Most stock call option contracts lose money upon expiration. They expire worthless. If you buy an out-of-the-money (OTM) call option because you believe a stock will rise in value, chances are high that you will lose most or all of your investment by options expiration. Options players that take directional trades tend to go all or nothing by holding the calls until expiration.

Unfortunately, worthless options usually seal their fate. However, if you are looking for a way to pay less for your call options and lose less than your whole investment on expiration, then implementing a bull call debit spread may be your strategy. This trade works on any stock with options in any stock sector. A bull call debit spread strategy requires options approval from your broker. It may require a higher level than covered calls for income but less than selling puts to buy the dips.

What is intrinsic value?

Taking directional calls with a higher strike price is exciting. There is speculation and even some gambling in these types of trades. Everyone loves an underdog. However, more often than not, the calls usually end up worthless.

Buying OTM options means the intrinsic value is zero. The intrinsic value is how much the real value of the option is worth if it were to be exercised today. In other words, everything is just premium until the stock can rise above the strike price and have intrinsic value.

The option's premium is the extrinsic value

The extrinsic value of an option is the extra value beyond the intrinsic value. If you buy a $25 XYZ call option and XYZ is trading at $24, then the call option has zero intrinsic value. If you were to exercise the call, you would be down $1.

Why would you do that?

You wouldn't.

If XYZ were trading at $25.50, the intrinsic value would be 50 cents. Anytime an option trading under the strike price has value, that's considered premium or extrinsic value. It's the fat, while the intrinsic value is the meat. Premium derives from the time value until expiration (theta) and volatility.

The mechanics of a bull call debit spread strategy

They say necessity is the mother of invention. Suppose you are considering buying an OTM call option because the stock will rise.

However, the cost of the option is what's stopping you. You don't want to lose the full amount you paid for the OTM call. That would cause more pain than you're willing to take. A bull call debit spread can work.

You buy the OTM call option and then sell the call option at a higher strike price with the same expiration date. Since you're initiating positions, you are opening them as in "buy to open the call" and "sell to open the call." Most broker platforms will have debit spread functions that will automatically open and close both legs, so you don't have to time the execution manually.

You would have to select the width of the spread, strike prices and expiration date.

Maximum loss potential and maximum gain potential

You limit both losses and gains by taking a call debit spread. Most importantly, you also reduce the cost of the option trade. Your maximum loss would be the trade cost, or the spread between the price you paid for the call minus the price you sold the higher strike call. Your maximum gain will occur if the stock closes above the strike price for your sold/short call. The maximum gain is the difference between the strikes minus the cost of the spread trade.

Do your technical analysis.

Before putting on any trade, doing a technical analysis on the charts always pays.

Be sure to mark the stock's price support levels and resistance levels. Resistance levels will be important to mark your strike prices. Be sure to identify any chart patterns that form in your analysis. Let's use a trade example with Las Vegas Sands Co. (NYSE: LVS).

The daily candlestick chart on LVS indicates resistance at the $50 price level, with $50.46 as the recent swing high. The daily 200-period moving average resistance sits at $53.48. The daily relative strength index (RSI) is choppy but trending higher towards the 70-band. The pullback support levels are $40.52, $39.19, $37.53 and $36.26.

Select your buy-call strike price and expiration date

Let's say that today is December 20, 2023.

The stock is trading at $48.67.

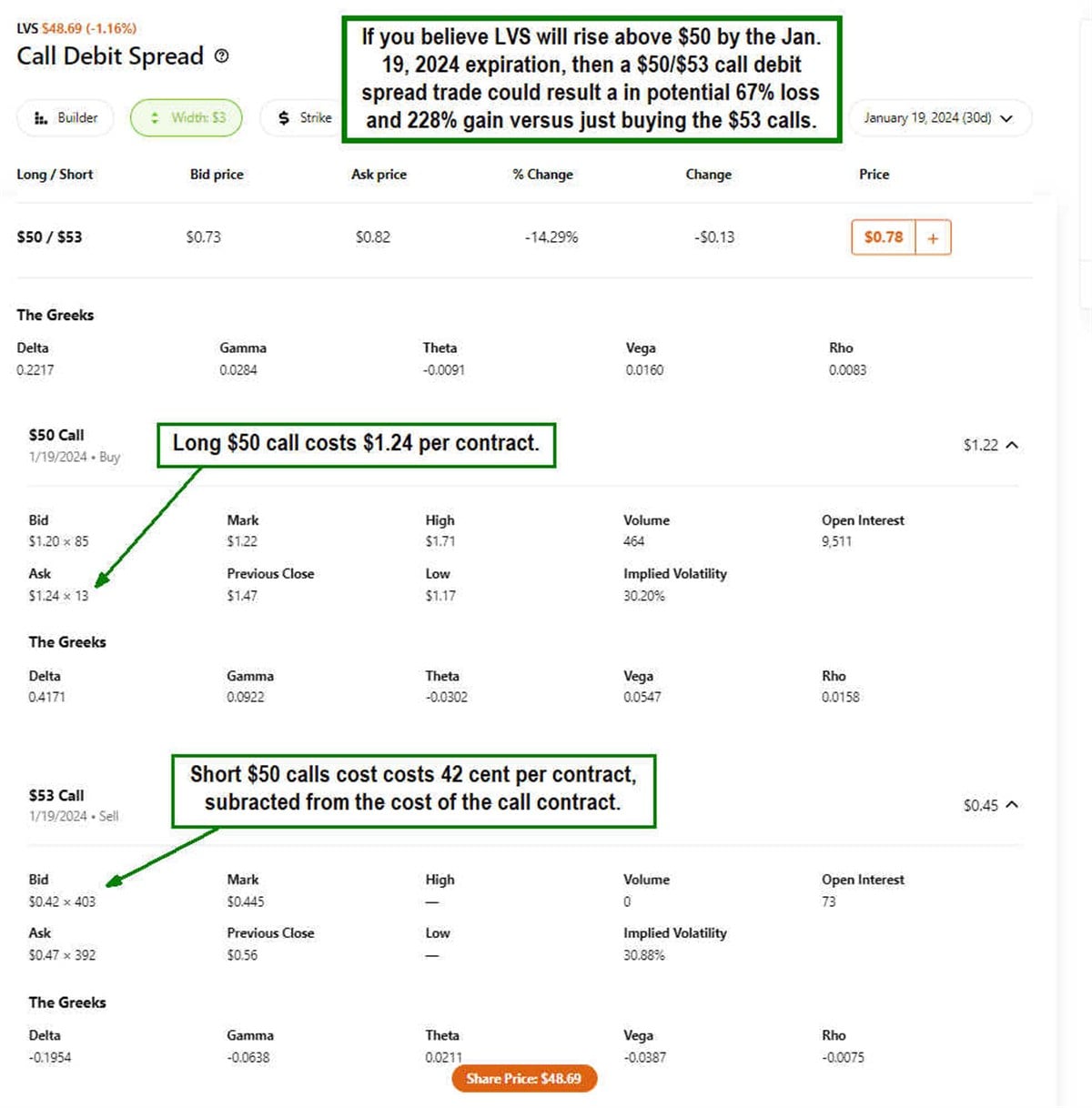

You believe it will rise through $50 within the next 30 days. If you were to buy a call option, the LVS $50 Call expiring on January 19, 2024, would cost you $1.24.

That is all premium as the intrinsic value is $0 since LVS is trading beneath the $50 strike price. Your option will be worthless if LVS doesn't close above $50 by expiration. You would need LVS to close at or above $51.24 to break even on the trade. This would be a one-leg, one-way, all-or-nothing directional call option trade where LVS must close above $50 for the option not to be worthless.

Putting on the trade: Select your spread width and sell a call strike price

Let’s add the other leg to make it a call debit spread. You need to select the width, which then selects the strike price to sell a call option.

Let's choose a $3 width, which brings the strike price to $53 to sell a call. This results in a bull call debit spread price of 78 cents, which is the difference between the cost of your long call at $1.24 minus the price of your short call at 42 cents and whatever fee your broker sneaks in. In this case, it's 78 cents, which is easier to swallow than a loss of $1.24 or a 37% discount.

Potential trade max loss and max profit, and breakeven price levels

If you hold the spread to expiration, and LVS closes under $50, your maximum loss would be the 78 cents you spent on the trade. If LVS closes above $53, your maximum profit would be the $3 intrinsic value of the $50 long call minus the 42-cent cost of the $53 short call for a total of $2.58 profit or 228% gain.

If LVS closed at $50.82, then you would be breakeven and profitable above there. Therefore, compared to a directional trade of just buying the $50 call on LVS and spending $1.24 per contract, a bull call debit spread would reap the potential for a 63% loss versus a 228% gain, or nearly a 4-to-1 risk reward ratio.

Final thoughts

You can consider the bull call debit spread strategy when bullish on a stock. It helps to lower the cost of the trade and the potential for loss while capping the profit potential.

Most brokers have the function of placing debit spread trades so the execution can be automatic, rather than trying to manually buy the long call first and sell the short call while trying to calculate the cost of the trade. Most brokers should provide the spread price you can view and use for the trade. The bull call debit spread may sound complicated, but it's a basic two-leg option strategy.