In a sea of Cyber Monday promotions, Livent Corporation (NYSE: LTHM) stock may be one of the best deals around.

With the broad U.S. equity market donning its Santa rally cap, the Philadelphia-based lithium pure play has finished lower for six consecutive weeks — and is trading more than 60% off its September 2022 record high. Given the company’s opportunity to ride shotgun in the electric vehicle (EV) growth journey, it’s a sale long term investors won’t want to miss.

Livent is a fully integrated provider of a wide range of lithium products. It is commonly linked to the EV market because its primary offering is battery-grade lithium hydroxide. As the transportation sector transitions to cleaner fuel resources, lithium hydroxide and high-purity lithium metal are expected to power many long-lasting, energy-dense EV batteries.

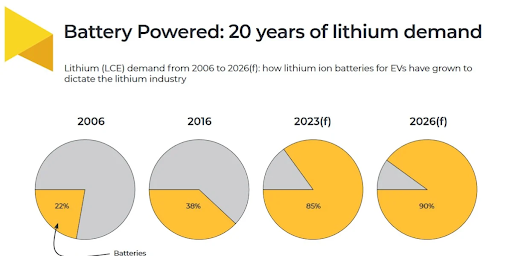

Mainly due to electric passenger car sales, automotive lithium-ion battery demand increased 65% last year according to the International Energy Agency (IEA). Worldwide demand for ‘performance lithium’ compounds is expected to grow exponentially over the next several years. Minerals research group Benchmark forecasts that battery-grade lithium will make up 90% of total lithium demand by 2026 after accounting for only 22% of it in 2006.

The prediction makes sense. Within a few years, 1 of every 4 cars sold in the U.S. are projected to be electric. Granted, not every EV battery will contain lithium.

There is a growing list of lithium-ion alternatives, including lithium-sulfur, sodium-ion and hydrogen fuel cells. Researchers are even developing glass batteries and hemp batteries. Each of these technologies have their merits but, for the most part, remain in their infancy.

Lithium-ion batteries, on the other hand, have been around for decades. From handheld games to smartphones to industrial tools, ‘li-on’ technology has long powered a lot of our electronic devices. Like an iPhone battery, a lithium-based EV battery can be easily charged and recharged. Manufacturers and consumers alike have a comfort level with the technology.

The marriage between lithium and EVs, however, isn’t a perfect one. The chemical itself is known to be highly reactive and, therefore prone to overheating and catching fire. Plus, as with smartphones, EV batteries don’t last forever and need to be replaced. Lithium has also been the subject of sustainability concerns. A great deal of lithium mining happens in developing countries that have yet to establish ethical mining practices. Ironically, these mines can create unnecessary greenhouse gas emissions.

Considering these shortcomings, it’s easy to see why companies are scrambling to build a better mouse trap for EV batteries. Lithium technology isn’t perfect — but at least for now, it's the best game in town.

Is scarcity a positive+ or a negative-?

Lithium plays a unique role in our daily lives. The problem is that there is a limited amount of it on the planet.

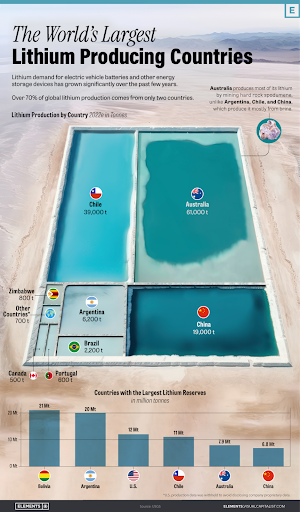

The U.S. Geological Survey estimates that there are 98 million metric tons of lithium resources worldwide. More than half are in the “lithium triangle” of Bolivia, Chile and Argentina. Only about one-fourth of the total are proven reserves, meaning lithium is confirmed as commercially viable to extract.

A critical distinction should be made between lithium reserves and lithium production. While the U.S. boasts the world’s third largest lithium reserves at approximately 12 million tons, it accounts for just 1% of global lithium production. With only one active lithium mine in the country, the Biden administration is scrambling to promote domestic production to reduce our dependence on foreign lands. As the EV revolution unfolds fast, lithium, a.k.a. ‘white gold,’ is quickly becoming the new oil.

Australia is responsible for the majority of global lithium production. Together with Chile, the two countries produce more than 70% of the world’s lithium. The key wrinkle? Almost all of Australia’s lithium gets shipped to China. Makes sense — approximately 3 of every 5 EVs are sold there.

This means that China has tremendous influence over the global lithium market. With China EV sales disappointing as of late, it’s no surprise that lithium has come crashing back down to Earth. On Friday, the price of lithium carbonate slipped to 130,500 Chinese yuan per ton, its lowest level since August 2021. Note: it was only a year ago that lithium prices were hovering around 600,000.

Lithium’s stunning plunge is not all about China. Recent U.S. EV sales have also fallen short of expectations with consumers pumping the brakes on high auto loan rates. There have also been signs of lithium supply stabilization. Mineral Resources, one of the world’s largest lithium producers, recently announced plans to double its Western Australian production next year.

Given the 77% plunge in lithium over the last 12 months, companies like Livent must be delivering some dreadful financial results.

Not exactly.

Offsetting price weakness with cost strength

On Halloween, Livent reported third quarter numbers that weren’t all that scary. Adjusted earnings per share (EPS) came in at $0.44, up 7% year-over-year. This missed Wall Street’s forecast by $0.02, but our two cents is that the performance was quite good, all things considered.

Despite the unfavorable pricing environment, profits went up because raw material and operating expenses went down. This more than made up for flat sales volumes and lower realized prices during the period. It highlights the company’s ability to manage costs when prices move against it. This bodes well for stronger profit growth as lithium prices improve.

Although management lowered its full-year guidance due to production delays across several new facilities, there’s reason to be optimistic about 2024. Domestic demand for EV could pick up as 1) automakers continue to compete on price in an inflationary economy and 2) new car loan rates moderate, making EV purchases more attractive.

China, of course, will be the wildcard in the demand equation. If the government can successfully stimulate economic growth as desired, a boost in consumer confidence would be highly beneficial to the local EV industry — and lithium prices.

All-in on Allkem

In anticipation of healthy ongoing demand from battery manufacturers, Livent is moving ahead with capacity expansion plans. Later this year, a 5,000 ton lithium hydroxide plant in North Carolina is slated to begin commercial delivery. Lithium capacity is also being increased in Argentina.

A major piece of Livent’s expansion push is its pending $10.6 billion merger with Argentine lithium company Allkem. Last week, Livent announced that a special meeting to vote on the proposed combination is scheduled for December 19th. If shareholders approve, the deal will create the world’s third largest lithium producer with assets spanning North America, South America, Europe and Australia.

The companies plan to rebrand as Arcadium Lithium plc and trade on the NYSE under the ALTM symbol.

The valuation on this miner can’t get much finer

This means investors may have limited time to buy LTHM before merger approval headlines give the stock a boost — and its financial prospects take a significant turn for the better. A Livent-Allkem merger is projected to create $325 million in cost synergies within the first 12 months of closing thanks to the companies’ respective Canadian and Argentine assets being located in close proximity. Aided by a rebounding lithium price backdrop, this could lead to some positive earnings surprises in the quarters to come.

The consensus estimate for 2024 EPS is currently $1.81. Chances are upward earnings revisions will start pouring in once the Allkem deal goes through. As it stands now, though, the stock is already well undervalued.

LTHM is trading at 8x trailing earnings, which is about a 50% discount to the average stock in the materials sector. It is a sector exposed to a wide range of commodities, many of which have inferior growth prospects compared to lithium and EVs.

Out of 36 mid to large cap specialty chemicals stocks, only Albemarle (P/E ratio 4x) is cheaper. But with Albemarle generating about 25% of revenue from bromine and other chemicals, LTHM is the cheapest lithium pure-play available.

As the stock gets clobbered by near-sighted investors, Wall Street research firms continue to stand by it. Since the third quarter earnings release, three have taken bullish positions and three have stayed neutral. The average price target among the six analysts is roughly $25. Even the most cautious target (Piper Sandler’s $18) implies over 30% upside over the next 12 months.

Bottom Line

Philly is known for its Eagles and cheesesteaks, but Livent is putting itself on the map too. On the brink of becoming one of the world’s top lithium producers, the well-managed company is in the driver’s seat for a long EV battery growth ride. Plenty of near-term challenges and China uncertainty remain, but as EVs go mainstream, look for LTHM (or ALTM) to be an increasingly important part of the global EV supply chain. About to hit a five-month losing streak, this stock’s skid is bound to reverse in 2024.