Oil Flares Up Amid Middle East Crisis

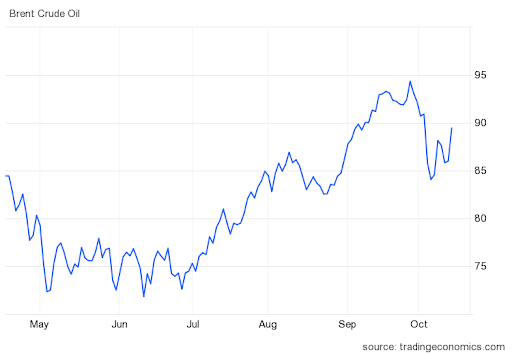

Tensions between Israel and Gaza are proving to be another catalyst for surging oil prices. With Brent crude futures closing back in on the $90 per barrel level on Friday — and no end in sight to the latest Middle East conflict — $100 oil may be back. The world’s largest energy resource has surged approximately 25% over the past four months, a move that began well before Gaza’s brazen attack on Israel.

Tight supply conditions drove oil higher this summer after OPEC+ members announced their intention to extend production cuts through 2024. Fast approaching the two-year anniversary of Russia’s invasion of Ukraine, the conflict there continues to influence oil. On Thursday, the U.S. imposed sanctions on tankers carrying Russian oil priced above the G7’s $60 cap to enforce punishment on Russia.

Despite record domestic crude exports in the first half of 2023 and ramped production since oil may remain in an uptrend as long as geopolitical tensions are elevated. This would be a welcome development for oil producers and the businesses that support them. Oilfield services companies, in particular, have much to gain from a potential return to $100 crude. When oil producers operate more rigs to capitalize on higher pricing, demand for oilfield products. oil stocks and services go up.

Earnings Review, Outlook

Enter Houston-based Halliburton (NYSE: HAL) — with a presence in over 70 countries, it is one of the world’s largest energy services companies. Its offerings span the oil lifecycle from exploration and well construction to production optimization and abandonment. The world’s major oil producers (including Exxon Mobil, Shell and Total) have relied on Halliburton for decades because it helps them get the most out of their reservoir assets.

The 123-year-old company is no stranger to the ups and downs of the commodity cycle. In the face of above-normal volatility and cost inflation, Halliburton has been turning in some amazingly steady financial performances. Its last three quarterly earnings per share (EPS) results are $0.72, $0.72 and $0.77. Wall Street’s projection for the next three quarters? $0.77, $0.79 and $0.77.

You wouldn’t know the oil market is in a period of unusual turbulence by looking at Halliburton’s bottom line. This is a testament to its leadership and financial strength. Through the first six months of 2023, it generated $11.5 billion in revenue, a 22% jump from 2022. Increased oil and gas drilling activity certainly helped, but so did equipment and services price hikes. Meanwhile, management efforts to control costs in an inflationary environment continue to be successful. Halliburton is on pace to deliver more than 40% profit growth this year — that’s nearly triple the profits it recorded in 2021.

Tapping Technology to Spur Industry Growth

A big reason for the recent success — technology. With all eyes on artificial intelligence (AI), tech has quietly played a major role in advancing the oil and gas industry. AI, machine learning, automation, data analytics and cloud computing are buzzwords that apply to more than just consumer electronics and retail. All of the above are being utilized by the energy sector to improve productivity and achieve decarbonization.

For the rest of the decade, digital transformation technologies that help oil producers manage volatility, cut costs and boost output may be the industry’s biggest growth driver. This is an area in which Halliburton excels.

Last week, the company announced a new collaboration with reservoir optimization specialist Core Laboratories. The pair will combine laboratory data with digital rock technologies to cut the output time of digital rock data software from months to weeks. The hookup will allow Halliburton customers to run rock simulations in tandem with physical lab experiments to gain faster, more accurate insights.

The promising Core Lab news follows Halliburton's appearance at the 2023 Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) held earlier this month. Management shared a host of recent and future innovations designed to improve oil drilling efficiency and stability. These included several new AI applications and recently launched products like:

- PulseStar - high-speed streaming of downhole geologic data that uses AI to maintain high data rates at extended depths.

- EquiFlow Density - an inflow control technology that magnifies density differences in reservoir fluids to self-adjust water and oil flow restrictions.

- Intelevate - a data science-driven digital platform that optimizes electrical submersible pump performance (ESP) monitoring systems.

Digging Out of a Financial Hole

Halliburton suffered a bigger revenue hit than industry peers during the pandemic in part because of its exposure to the Asia-Pacific region. On the bright side, this has led to a sharper recovery and a return to pre-Covid revenue levels. With the reset button effectively pressed, the company will now look to healthier oil and gas drilling activity and a reduced capital spending budget to drive top and bottom-line growth, respectively.

The market will get its next glimpse of the recovery when Halliburton reports third-quarter financials before the opening bell on October 24th. Not surprisingly, the consensus EPS estimate has been trending higher and currently sits at $0.77. Yet, considering the company has beaten analyst expectations for seven consecutive reports, the odds of outperformance are good.

This means that the Street’s earnings estimate for all of 2023 could get revised higher from the current $3.06. Even if it stays where it is, though, Halliburton shares are cheap. At 14x this year’s earnings, HAL looks undervalued relative to:

- the energy equipment & services industry average P/E ratio of 19x;

- large cap industry peers such as Baker Hughes (23x) and Schlumberger (20x); and

- the 42% earnings growth that Halliburton is forecast to record in 2023 — and expectations of further growth in 2024.

While Halliburton screams inexpensive from a valuation perspective, its dividend still leaves something to be desired. After lowering the annual cash payout to $0.18 per share in 2021 to survive the pandemic, the board of directors has been cautiously fattening it back up.

The board took a big step forward earlier this year when it raised the quarterly dividend by 33% to $0.16, or $0.64 annually. This gives the stock a 1.5% forward dividend yield that’s improved but well below the 4.2% energy sector average. The good news is that Halliburton’s payout ratio based on projected profits is less than 20%. This means that the current dividend is very sustainable and that there is a ton of room for dividend growth.

If customers continue to spend more on exploration and production (E&P) projects as expected, Halliburton’s cash flow and ability to raise the dividend will do the same. So will its ability to buy back its own stock. In the second quarter of 2023, the company bought back $248 million of HAL — and still has $4.7 billion left on the current repurchase authorization.

Wall Street Is Gushing About HAL

It’s not often that a group of 10 or more sell-side research groups agree on a stock, but that is exactly the case with Halliburton. The company is not only one of Wall Street's favorite energy investments but also one of its favorite U.S. large-cap names.

So far this month, four firms have expressed bullish views on HAL. On October 3rd, Citigroup commented on the company’s operational efficiency and earnings outlook. A couple of days prior, Jeffries reiterated its ‘Buy’ rating and increased its price target from $49 to $51. In total, 14 analysts have offered an opinion on HAL over the last three months. All 14 are bulls.

The group’s average target of $48 implies a 12% upside over the next 12 months, or 13.5%, including the dividend. Since the stock has already run from approximately $28 this summer to $43 currently (in conjunction with higher oil), much of the so-called ‘easy money’ has been made. But given the rapid climb in crude prices and room for P/E expansion, it wouldn’t be surprising to see HAL blow past the $43 resistance level — and the consensus target — en route to challenging its $74.33 pre-pandemic peak.

Bottom Line

The Israel-Gaza conflict has added risk to an already tenuous geopolitical landscape, prompting J.P. Morgan CEO Jamie Dimon to suggest we are living in “the most dangerous time the world has seen in decades.” On top of tight supply conditions, this could coincide with sustained oil price volatility and demand for oilfield services providers like Halliburton.

During the company’s Q3 update next week, it’ll be interesting to learn how the recent events are impacting the industry’s outlook. Halliburton’s commitment to technological innovation is a differentiator — and its undervalued stock is a potential opportunity for long-term investors.