Wells Fargo believes the next leg of the semiconductor rally is ahead and can still deliver significant gains. On Thursday, the firm upgraded KLA Corp (KLAC) and Lam Research (LRCX) from "Overweight" to “Equal Weight.” The market quickly reacted and bumped up both stocks. Wells Fargo's top pick is still Applied Materials (AMAT), and it also moved higher alongside these two stocks.

Wells Fargo acknowledged semi-cap equipment names have become a “consensus long” and have already outperformed year-to-date, but the firm still expects demand data points to point to tighter logic and memory supply/demand dynamics that support further wafer fab equipment (WFE) acceleration into 2027. That setup is also consistent with other Street outlooks.

For instance, Stifel expects WFE spending to rise 10% to 15% in 2026. That reflects a $10 billion to $15 billion increase year-over-year due to advanced foundry/logic and DRAM.

Let's take a look at each of these stocks in detail to find out why exactly Wells Fargo likes them, along with the price target on each stock.

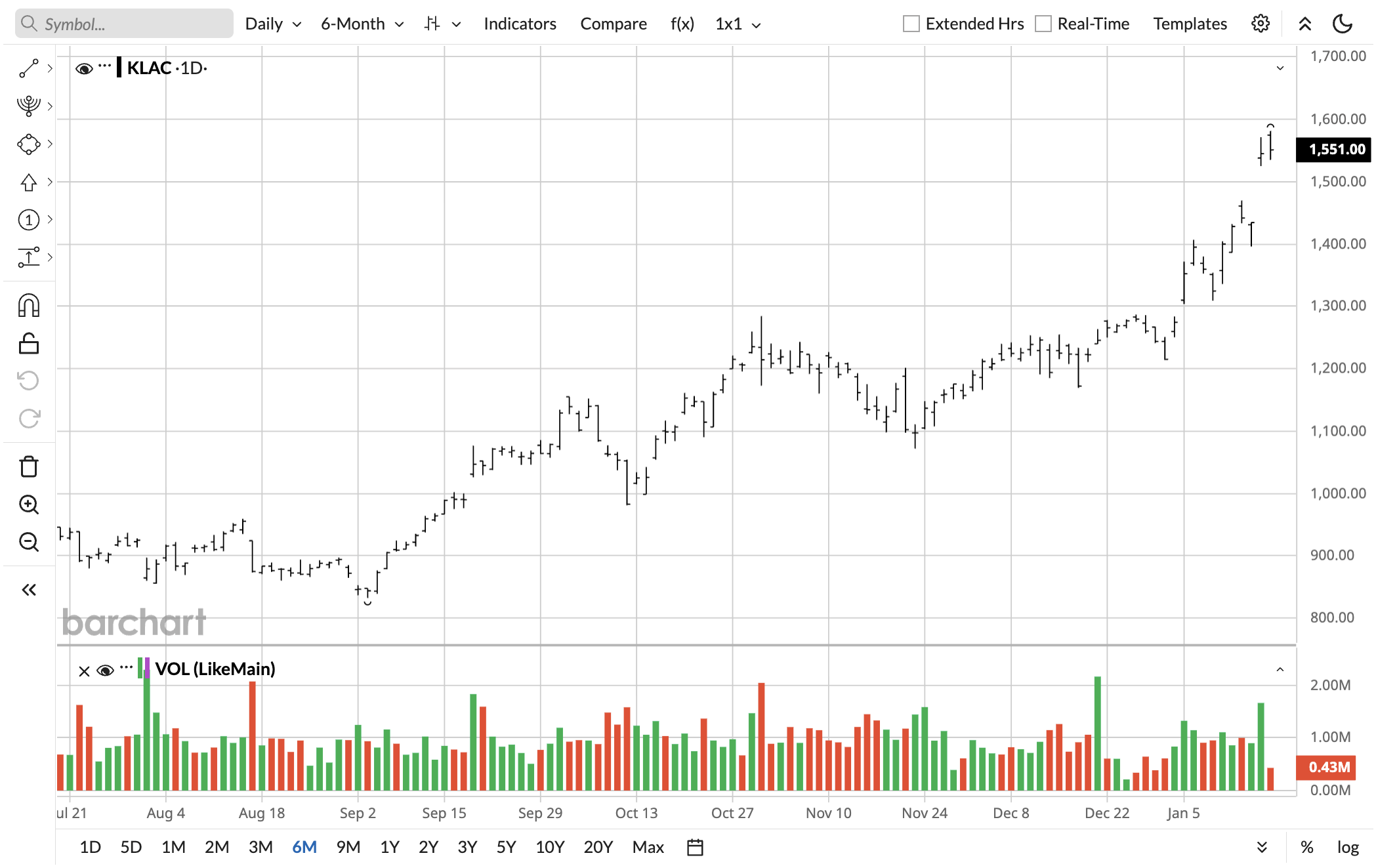

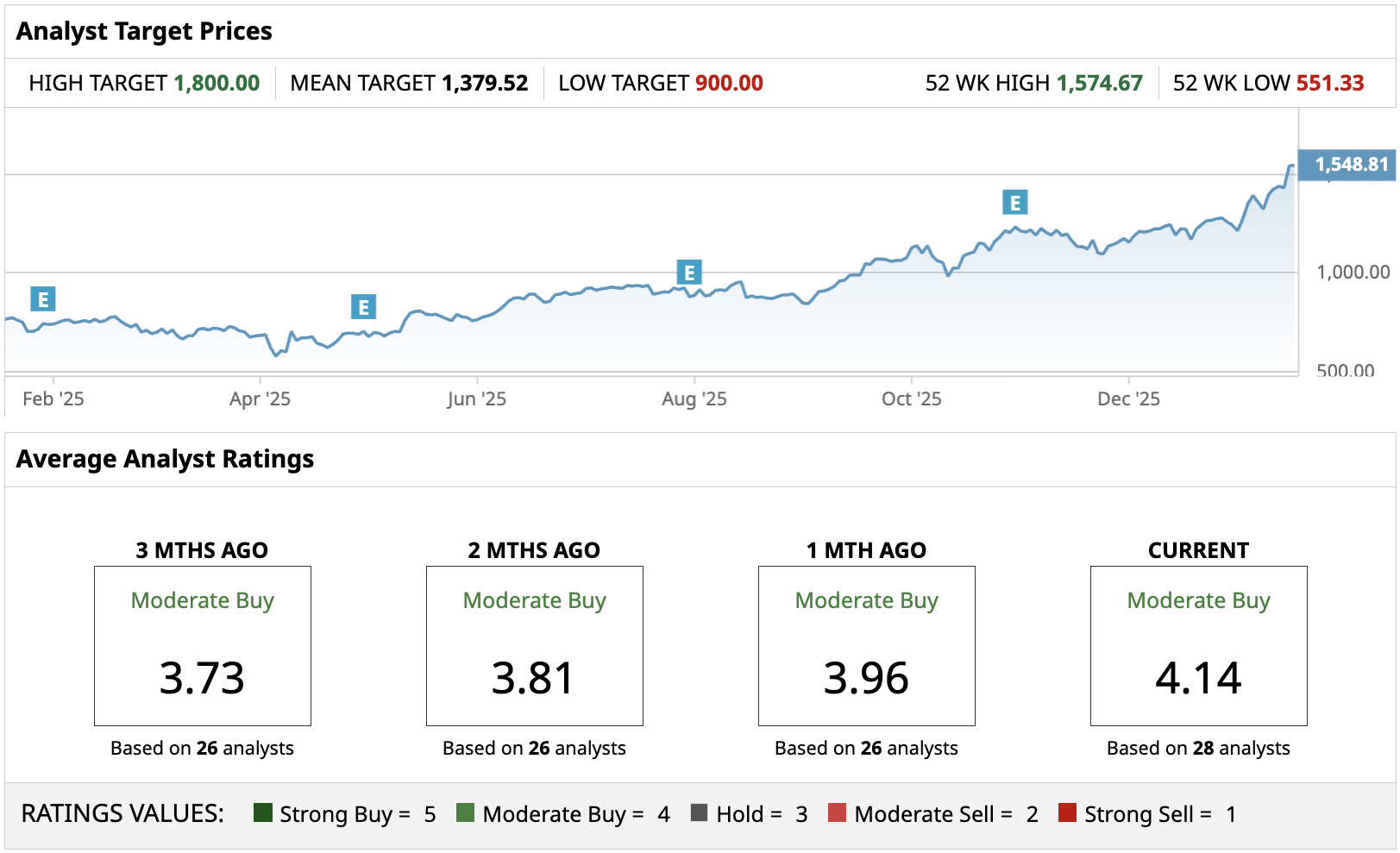

KLA (KLAC)

KLA Corp makes semiconductors and electronics. It makes integrated circuits, wafers, and printed circuit boards. All of these components are in high demand due to the artificial intelligence (AI) boom. The upgrade is a bet on rising process complexity. In the note, Wells Fargo said that it expects KLA to continue driving WFE outperformance tied to “2nm momentum.” Semiconductors are getting smaller, with two-nanometer transistors set for mass-production starting this year. Manufacturing chips this small requires extremely high levels of precision, and KLA's products are expected to be in demand. KLA can benefit not only from more tools going into fabs but also from customers leaning more into process-control intensity to improve yields.

Wells Fargo backed up the upgrade with a big price-target move, boosting KLA’s target to $1,600 from $1,250. More broadly, the firm said it increased its WFE estimate by an average of 10% and lifted its 2026 and 2027 forecasts to above Street expectations.

Analysts are still behind the curve, with the average price target at $1,379.52.

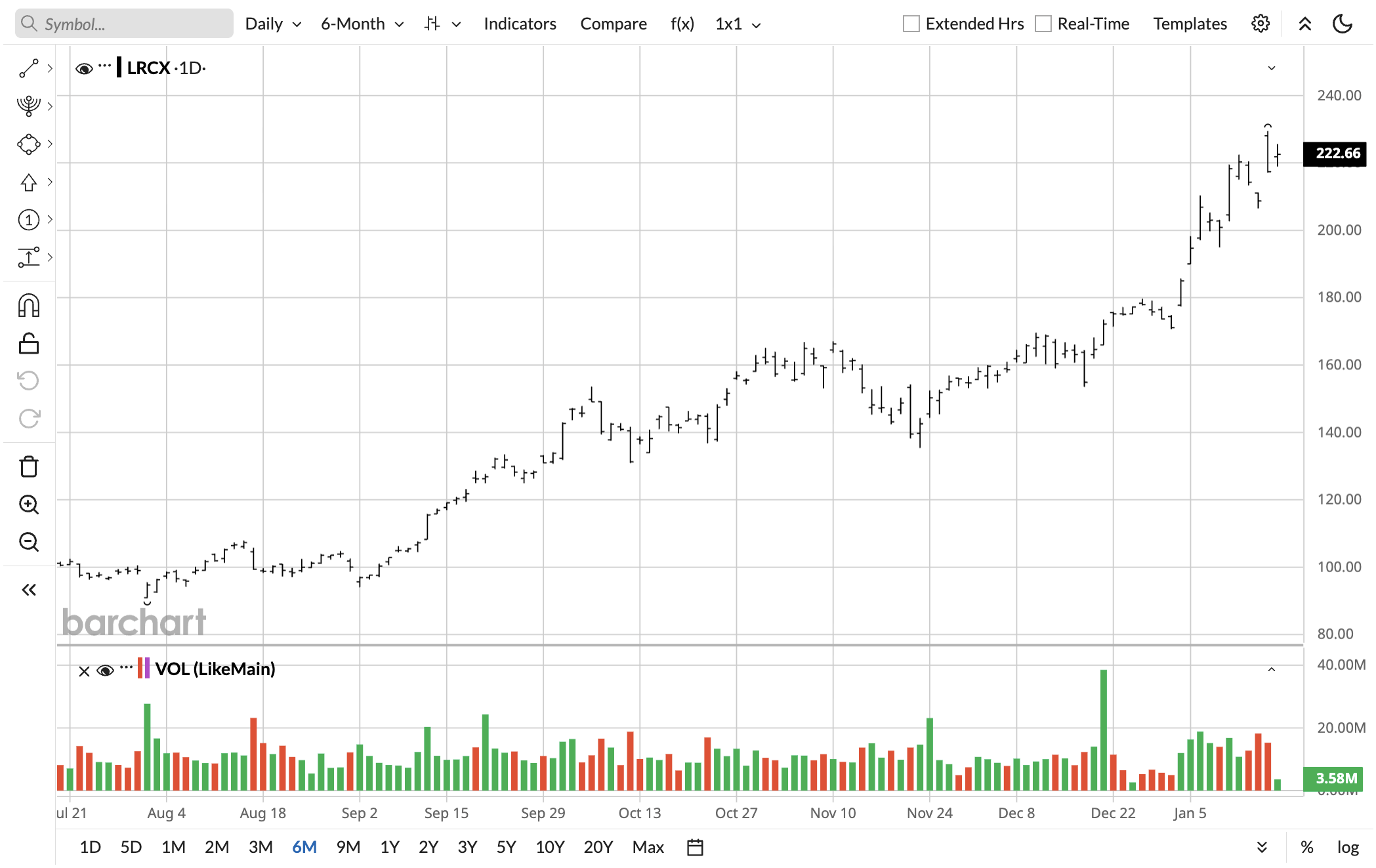

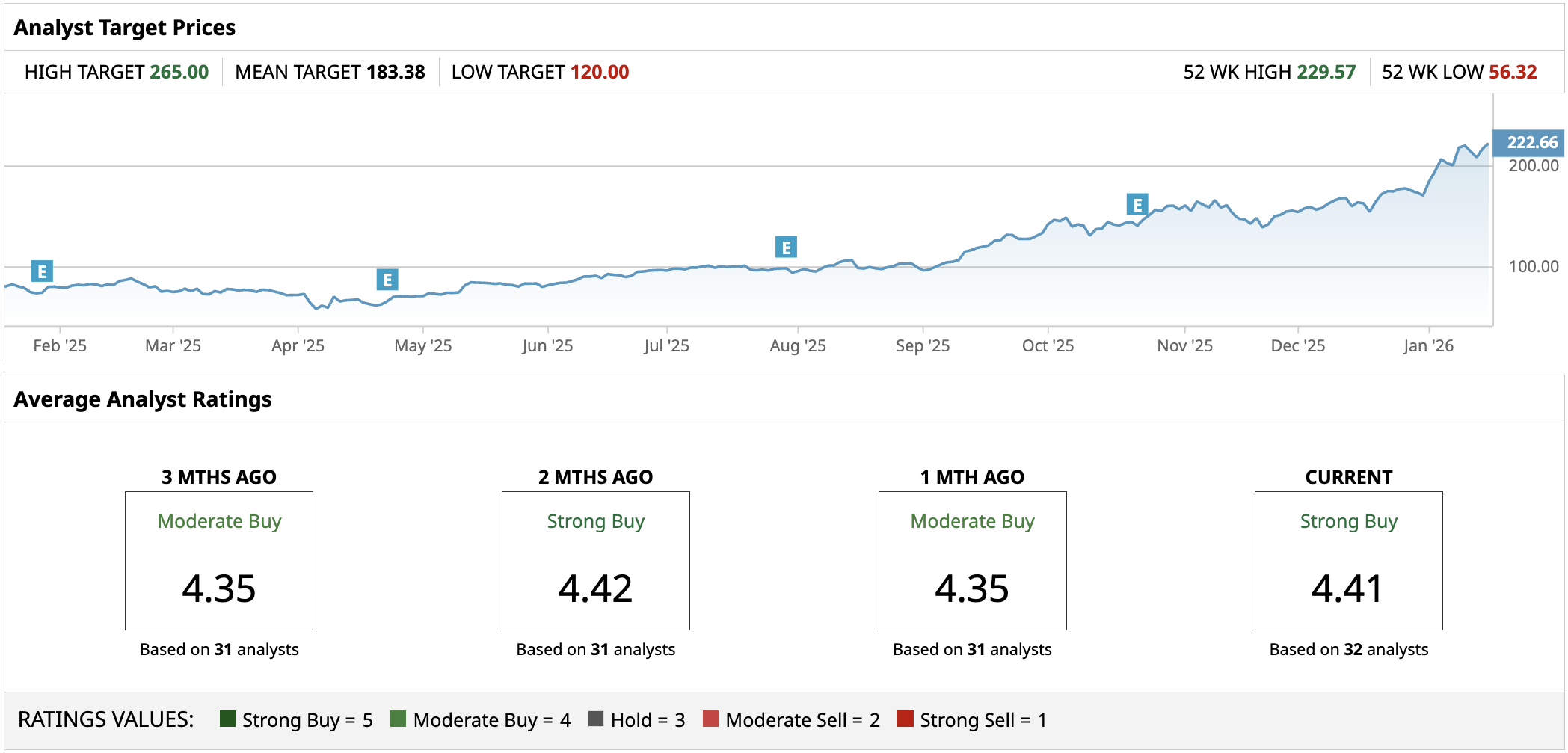

Lam Research (LRCX)

Lam Research supplies advanced water fabrication equipment for the semiconductor industry. It works with major memory producers to make memory cells and complex wiring, and that's mainly why Wells Fargo is bullish on the firm.

If you've kept tabs on consumer PC parts and their pricing, you're likely aware that memory prices have been skyrocketing. RAM prices have seen the biggest increases and have more than quadrupled in many cases.

Wells Fargo sees LRCX stock performing well as demand for memory is high and the shortage is expected to last through 2026. Tailwinds from NAND flash memory are also leading to sales increasing faster than expected.

Lam is a major supplier to the steps in chipmaking where process transitions and upgrades can drive tool demand, even when the industry isn’t building a wave of entirely new greenfield fabs. Put differently, if the next memory upcycle expresses itself through upgrades and technology transitions, Lam can still have a strong equipment opportunity.

Wells Fargo also sharply raised Lam’s price target to $250 from $145. The broader read-through is that Wells Fargo thinks equipment demand may be better than consensus models for the next couple of years.

Like KLAC, analysts remain much more pessimistic. The average price target is just $183.38.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Super Micro Computer Is One of the Most Shorted Stocks. Could a Squeeze Take It Higher in 2026?

- Intel Reports Earnings on January 22. Here Is Where Options Data Says INTC Stock Could Be Trading Next.

- Trump Just Took Aim at Health Insurance ‘Middlemen.’ What Does That Mean for UnitedHealth Stock?

- Dear Netflix Stock Fans, Mark Your Calendars for January 20