Netflix (NFLX) stock performed terrifically well in 2024. Its solid content, subscriber growth, and push into advertising boosted its top- and bottom-line growth, supporting its share price and strengthening its competitive positioning in the streaming space.

So far in 2025, the company’s operating momentum has remained solid. Viewers continue to engage with its expanding catalog, and the ad-supported tier is gaining traction. But despite its solid fundamentals, the stock hasn’t kept pace with the broader market’s climb. NFXL shares are up 8% this year, noticeably behind the S&P 500 Index’s ($SPX) nearly 16.7% advance. That lag suggests that while Netflix has maintained its growth, the rate of acceleration is not strong enough to boost its share price.

What’s adding further uncertainty is Netflix’s recently announced deal to acquire Warner Bros (WBD). The agreement introduces regulatory risk and execution challenges.

Netflix’s Warner Bros. Deal Adds Uncertainty

Netflix’s plan to acquire Warner Bros. marks one of the streaming industry’s largest deals. Valued at roughly $82.7 billion, the deal would bring Warner’s prized film and TV studios under Netflix’s umbrella, along with major assets like HBO and HBO Max. It’s a move designed to supercharge Netflix’s library and its global competitive edge.

But investors should weigh the uncertainty that comes with a transaction of this scale. Because the acquisition requires Warner Bros. Discovery to first spin off its Global Networks division into a new publicly traded company, the timeline has already been stretched, with completion now not expected until the third quarter of 2026.

Regulatory eyes are also likely to focus sharply on the deal. Concerns about monopoly and industry consolidation could delay approval, or, in the worst-case scenario, the deal may fail to go through. Plus, Paramount (PSKY) has announced a hostile bid for Warner Bros. as well.

There’s also the financial load to consider. Netflix reported total debt of about $14.5 billion at the end of the third quarter. Absorbing Warner Bros. Discovery’s operations would demand even more leverage. Increased debt may weigh on future earnings and limit flexibility in an already competitive streaming landscape.

In the long run, the deal could strengthen Netflix’s market power and unlock substantial growth. However, in the near term, regulatory roadblocks and balance sheet strain introduce a level of unpredictability that could limit NFLX stock’s upside.

Netflix Stock Isn’t Cheap

Netflix’s fundamentals remain strong, and the company is performing well. However, NFLX stock is not cheap. The company’s key performance indicators remain solid as its subscriber base continues to grow across its key operating markets, and its advertising strategy gains traction. The shift toward a growing ad-supported tier is creating a promising new source of earnings for Netflix, strengthening its competitive positioning.

Netflix’s edge lies in content. The company continues to deliver new seasons of popular shows and a steady rollout of fresh titles that keep viewers engaged and loyal, even as subscription prices rise. Subscription hikes have helped lift revenue without noticeably slowing new signups or prompting existing members to cancel. This gives the company room to continue investing heavily in premium content and the latest technology, strengthening its competitive positioning.

With a solid content pipeline, Netflix appears well-positioned to maintain momentum into 2026. Further, Netflix has also branched into live programming, including headline-grabbing sporting events. These significant events boost engagement and make the platform more attractive to advertisers eager to connect with massive, real-time audiences.

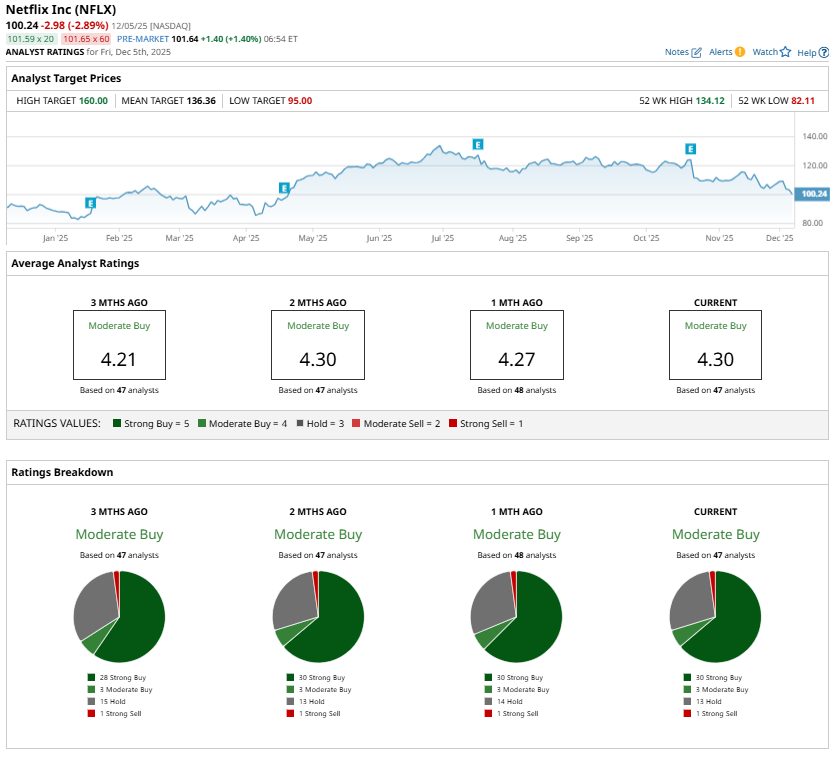

Thanks to the ongoing momentum in its business, analysts expect NFLX’s earnings to climb 26.1% in 2026. However, NFLX stock already trades at a premium, at about 40.9 times forward earnings, suggesting that much of this optimism is already baked into the share price. That valuation risk is one reason Wall Street’s consensus on Netflix is a “Moderate Buy” rather than a more enthusiastic endorsement.

Bottom Line

Overall, Netflix’s premium valuation and the heightened risk surrounding the Warner Bros. acquisition suggest that now may not be the ideal moment to jump into Netflix shares. While the company remains fundamentally strong, caution could be warranted until the regulatory picture becomes clearer and the market regains confidence in the stock’s upside potential.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $1.5 Billion Catalyst Just Rocked SoFi Stock. Should You Buy, Sell, or Hold Shares Here?

- Is a Global Margin Call Coming? How a Bank of Japan Rate Hike Could Trigger the Next Market Shock

- As Palantir Announces a TWG Partnership, Should You Buy, Sell, or Hold PLTR Stock?

- A Short Squeeze Could Send This Little-Known Biotech Stock Soaring