With a market cap of around $51 billion, United Rentals, Inc. (URI) is a leading equipment rental company operating through its General Rentals and Specialty segments across the United States, Canada, Europe, Australia, and New Zealand. Its offerings range from construction and industrial equipment to trench safety, power and HVAC, fluid solutions, and modular storage.

Companies valued $10 billion or more are generally classified as “large-cap” stocks, and United Rentals fits this criterion perfectly. The company also sells new and used equipment and provides repair and maintenance services.

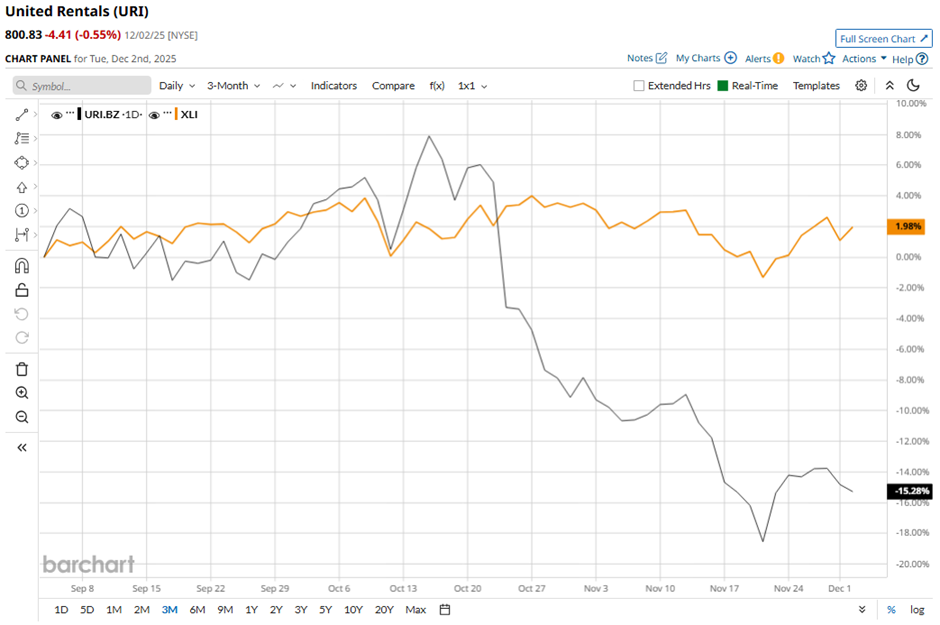

URI stock has dropped 21.7% from its 52-week high of $1,021.47. Shares of the equipment rental company have fallen 15.4% over the past three months, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 2.1% rise over the same time frame.

In the longer term, URI stock is up 13.6% on a YTD basis, lagging behind XLI’s 16.1% increase. Moreover, shares of United Rentals have declined 7.9% over the past 52 weeks, compared to XLI’s 7.7% return over the same time frame.

The stock has been trading below its 50-day average since late October. Yet, it has moved above its 200-day moving average since late June.

Despite reporting better-than-expected Q3 2025 revenue of $4.23 billion on Oct. 22, shares of URI tumbled 7.8% the next day as the company posted adjusted EPS of $11.70 missed expectations. Investor sentiment weakened further as inflation, elevated interest rates, and rising operating costs squeezed margins and reduced profitability.

Moreover, URI stock has underperformed compared to its rival, AerCap Holdings N.V. (AER). Shares of AerCap have surged 41% over the past 52 weeks and 43.2% on a YTD basis.

Despite URI’s weak performance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 22 analysts covering the stock, and the mean price target of $991.32 is a premium of 23.8% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Small-Cap Investment Firm Slumps to 52-Week Low: Opportunity or Red Flag?

- IonQ Wants to Bring Quantum Computing to Medicine. Should You Buy IONQ Stock Here?

- Jamie Dimon Once Called Bitcoin a ‘Fraud.’ Now, JPMorgan Is Quietly Making Blockchain History and Betting This ‘Crypto Winter’ Will Be Short-Lived.

- Down 41% From Its Highs, Should You Buy the Dip in MP Materials Stock?