Cathie Wood has returned to the investing spotlight after reshaping ARK Invest’s (ARKK) position in Palantir Technologies (PLTR). She sold 354,955 shares worth $57 million, yet her funds still retain a substantial $503.8 million stake. As usual, her move stirred a fresh wave of speculation across the market.

Wood’s decision aligns with her well-known strategy: lock in profits, trim positions after explosive runs, and redeploy capital into areas of sharper upside. Her recent tilt toward Alphabet (GOOG) (GOOGL) and crypto-aligned plays reflects that evolving conviction. Still, Palantir’s valuation and volatility are keeping investors second-guessing their next step.

Now, with Wood paring down ARK’s Palantir exposure, let us explore if other investors should follow her lead or stay the course.

About Palantir Stock

Headquartered in Denver, Palantir develops advanced data integration and artificial intelligence (AI) systems that help organizations convert sprawling information into usable intelligence. Its platforms, Gotham, Foundry, and AIP, support governments, global enterprises, and security agencies by uncovering insights, improving workflows, and powering AI-driven decision-making across sectors.

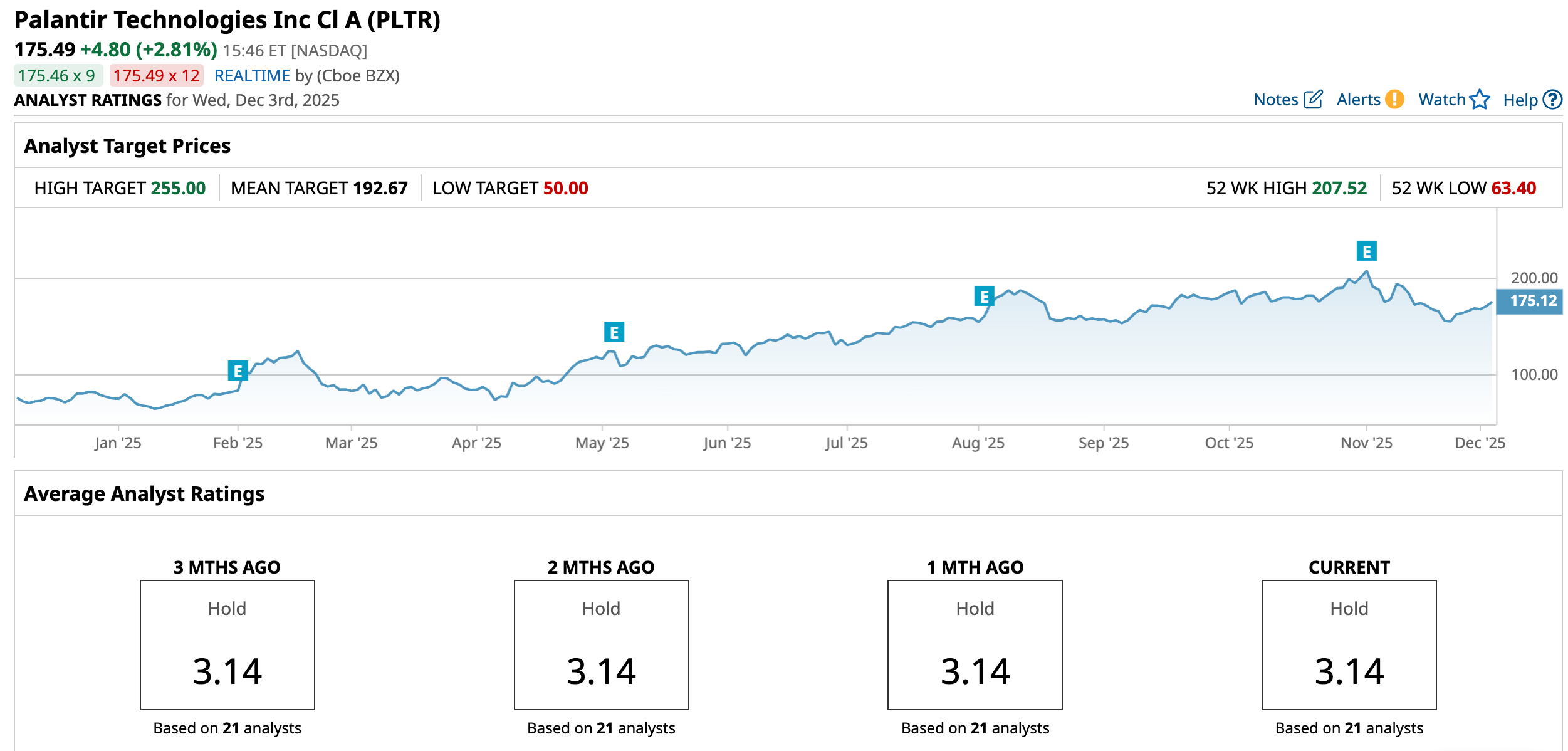

The company now commands a market cap brushing $406.8 billion, reflecting massive enthusiasm for its role in the AI economy. Over the past 52 weeks, PLTR shares surged 146.25%, and the past six months alone added another 31.21%. Both gains handily outpaced the tech-heavy Nasdaq 100 Index ($IUXX) of 20.68% and 18.26% respective returns.

However, the stock’s momentum has recently cooled. Shares currently trade about 17.8% below their early-November 52-week high of $207.52 and have slid 15.7% in the past month.

PLTR currently trades at 235.80 times forward adjusted earnings and 92.33 times sales. The multiples sit far above industry norms and well beyond its own five-year averages, underscoring the substantial premium investors are willing to pay.

Palantir Surpasses Q3 Earnings

Palantir posted an impressive Q3 fiscal 2025 earnings report on Nov. 3, comfortably surpassing Wall Street expectations on both top and bottom lines. Revenue rose 62.8% year-over-year (YOY) to $1.18 billion, outperforming analyst estimates of $1.09 billion. Adjusted EPS reached $0.21, ahead of Street's estimate of $0.17.

Growth in the U.S. business accelerated to nearly 77% YOY, while U.S. commercial revenue expanded almost 121% YOY, underscoring strong domestic enterprise demand.

Moreover, during the quarter, Palantir closed 204 deals worth at least $1 million, 91 deals worth at least $5 million, and 53 deals worth at least $10 million. The company also posted a record $2.76 billion in total contract value (TCV), marking a 151% YOY increase.

Adjusted income from operations rose 118% from the year-ago period to $600.5 million, while adjusted free cash flow increased 24.2% YOY to $539.9 million.

Despite delivering one of its strongest quarters to date, valuation concerns triggered a post-earnings pullback. Worries about the stock’s elevated trading multiples, combined with a large bearish options bet disclosed shortly after the print, drove PLTR shares lower by 7.9% in the following session.

However, the management remains unfazed. Palantir’s upgraded outlook is anchored in continued enterprise AI adoption. For Q4 2025, management projects revenue between $1.327–$1.331 billion and adjusted income from operations between $695–$699 million.

Meanwhile, for the full-year 2025, Palantir’s management has raised its revenue outlook to $4.396–$4.400 billion and sees adjusted income from operations between $2.151–$2.155 billion.

On the other hand, analysts expect fiscal Q4 2025 EPS to surge 1,800% YOY to $0.17. For the full fiscal year 2025, the bottom line is projected to climb 550% to $0.52, with fiscal 2026 EPS forecasted to increase 51.9% to $0.79.

What Do Analysts Expect for Palantir Stock?

Given its premium pricing, Wall Street currently assigns PLTR an overall “Hold” rating. Out of 21 analysts, four recommend “Strong Buy,” 14 advise “Hold,” one leans toward “Moderate Sell,” and two call for “Strong Sell.”

Even so, analysts acknowledge Palantir’s long-term potential remains intact. The company’s expanding commercial footprint and accelerating AI adoption leave room for meaningful future gains.

Nevertheless, the average price target of $192.67 indicates upside of 9.7%. Meanwhile, the Street-high target of $255 implies nearly 45.4% potential appreciation from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ford Just Reported an Absolute Collapse in Its EV Sales. That Could Be a Key Warning for Tesla Stock.

- Cathie Wood Is Selling Palantir Stock. Should You?

- Netflix Stock Breaks Below 20-Day Moving Average Amid Selloff. Should You Buy the Dip?

- Michael Burry Says Tesla Is ‘Ridiculously Overvalued.’ Should You Ditch TSLA Stock Here?