With a market cap of $54.1 billion, SLB N.V. (SLB) is a global technology company serving the energy industry through four divisions focused on digital solutions, reservoir performance, well construction, and production systems. It delivers advanced technologies and services for field development, hydrocarbon production, and emerging areas like carbon management and energy system integration.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and SLB fits this criterion. The company offers a comprehensive portfolio ranging from drilling and reservoir evaluation to subsea systems and production optimization.

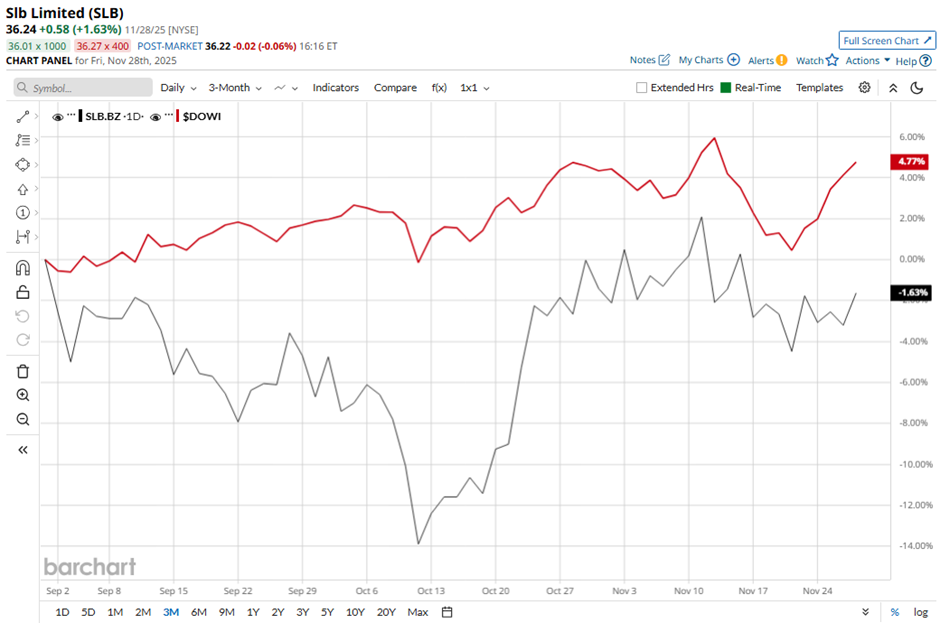

Shares of the Houston, Texas-based company have decreased 18.9% from its 52-week high of $44.66. Over the past three months, its shares have declined marginally, underperforming the broader Dow Jones Industrials Average's ($DOWI) 4.6% rise during the same period.

Longer term, SLB stock is down 5.5% on a YTD basis, lagging behind DOWI's 12.2% gain. Moreover, shares of the oilfield services giant have dropped 17% over the past 52 weeks, compared to DOWI’s 6.7% increase over the same time frame.

The stock has been trading below its 200-day moving average since last year. However, it has moved above its 50-day moving average since late October.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $0.69, SLB’s shares fell marginally on Oct. 17 as the management signaled no significant pickup in North American drilling activity, citing high production costs in some shale basins and an oversupplied oil market. Investors also reacted to operational softness, including a 7% drop in international revenue to $6.92 billion, disruptions in Ecuador, and a 9% global revenue decline when excluding the ChampionX acquisition.

In addition, SLB stock has performed weaker than its rival, Exxon Mobil Corporation (XOM). XOM stock has risen 7.8% YTD and dipped 1.5% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain bullish about its prospects. SLB stock has a consensus rating of “Strong Buy” from 24 analysts in coverage, and the mean price target of $47.08 is a premium of 29.9% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart