Valued at a market cap of $48 billion, Roper Technologies, Inc. (ROP) designs and develops vertical software and technology-enabled products. The Sarasota, Florida-based company provides software and engineering solutions to healthcare, industrial, transportation, and niche enterprise end markets.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and ROP fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the software - application industry. The company’s business model is driven by disciplined capital allocation and strategic acquisitions, enabling it to continually expand its portfolio into data- and software-centric segments with durable demand.

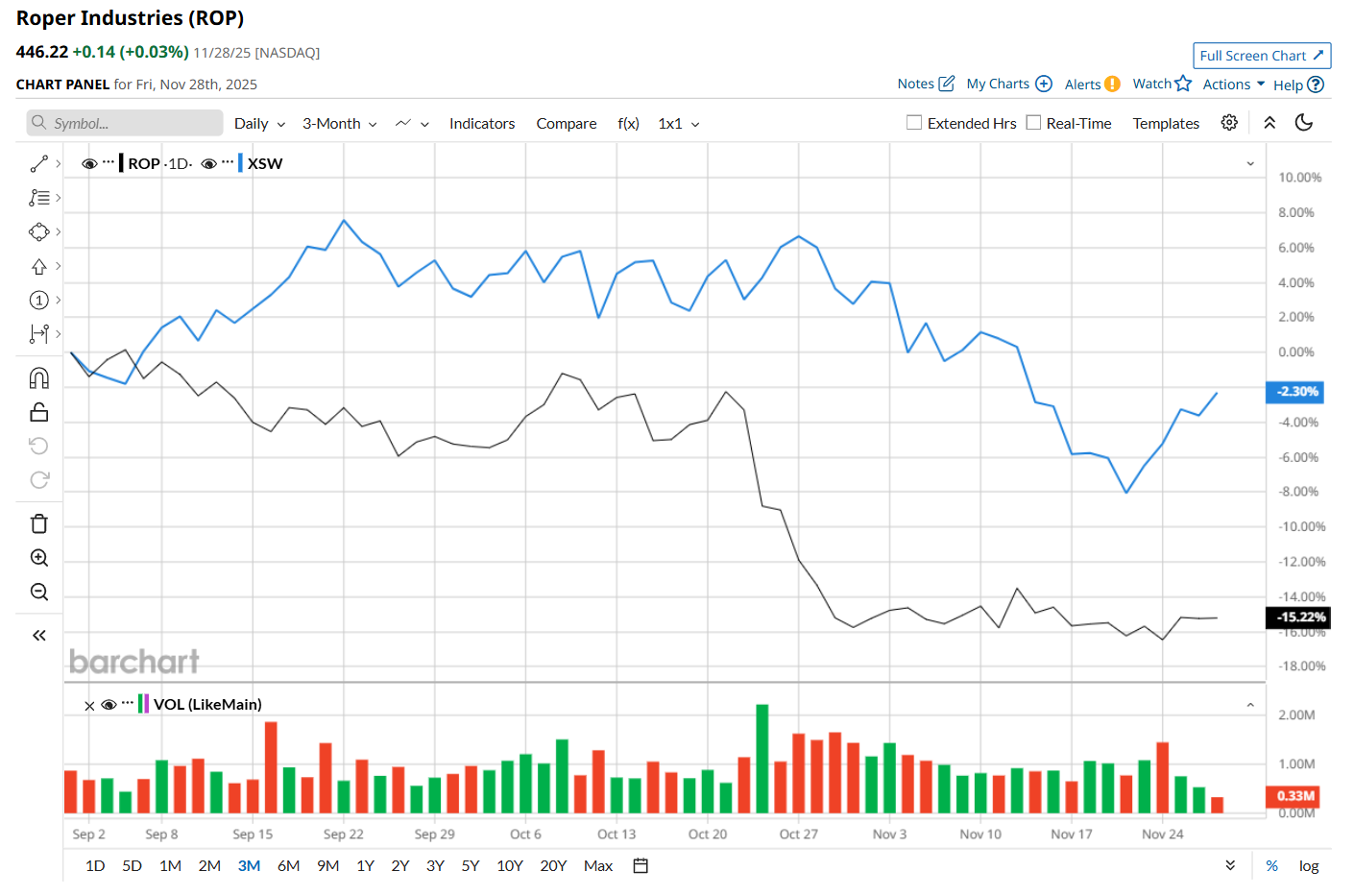

This software company has slipped 25% from its 52-week high of $595.17, reached on Mar. 5. Shares of ROP have declined 15.3% over the past three months, lagging behind the SPDR S&P Software & Services ETF’s (XSW) 2.3% drop during the same time frame.

In the longer term, ROP has fallen 20.9% over the past 52 weeks, notably underperforming XSW's 3.9% downtick over the same time period. Moreover, on a YTD basis, shares of ROP are down 14.2%, compared to XSW’s 1.4% loss.

To confirm its bearish trend, ROP has been trading below its 200-day moving average since late July, and has remained below its 50-day moving average since early July.

On Oct. 23, shares of ROP plunged 5.7% after its Q3 earnings release, despite beating Wall Street’s earnings estimates by a slight margin. The company posted adjusted EPS of $5.14, up 11.3% from the year-ago quarter and marginally ahead of analyst estimates. Meanwhile, its revenue also improved 14.3% year-over-year to $2 billion, meeting consensus expectations. However, ROP lowered its fiscal 2025 adjusted EPS guidance range to $19.90 to $19.95, down from the previous range of $19.90 to $20.05, which might have made investors jittery.

Nonetheless, ROP has outperformed its rival, Tyler Technologies, Inc. (TYL), which declined 25.5% over the past 52 weeks and 18.6% on a YTD basis

Despite ROP’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 18 analysts covering it, and the mean price target of $575.93 suggests a 29.1% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart