Alphabet (GOOGL) remains in focus on Dec. 1 following new that famed investor Cathie Wood has loaded up on 174,293 shares of the technology company.

Wood’s purchase, which was split across four of her flagship exchange-traded funds (ETFs), comes as GOOGL looks on track to achieving a coveted $4.0 trillion valuation.

Google stock has been in a sharp uptrend over the past eight months. At the time of writing, it’s up a staggering 126% versus its April low.

Why Did Cathie Wood Buy Google Stock?

Wood has loaded up on GOOGL stock shortly after reports emerged that Meta Platforms (META) plans on switching to its tensor processing units (TPUs) to power its data centers by 2027.

Such a seismic shift would put Alphabet in direct competition with the likes of Nvidia (NVDA) – while unlocking the next leg of artificial intelligence (AI)-enabled growth for the Nasdaq-listed firm.

Sure, Jensen Huang has already confirmed that Nvidia’s chips are a generation ahead of Google’s, but hyperscalers choosing its TPUs to diversify their AI supply chains would still mean a massive new revenue stream for Alphabet.

It’s likely this upside that Cathie Wood is trying to play with a sizable position in Google.

GOOGL Shares Have an Edge Over AI Peers

Plexo Capital’s founding managing partner Lo Toney shares Wood’s optimism on GOOGL shares.

In a recent interview with CNBC, Toney recommended sticking with the California-based company as “the AI narrative is shifting toward Google.”

According to him, Alphabet is the only hyperscaler that has “vertically integrated” across all three layers of artificial intelligence – infrastructure, models, and applications – and that will continue to drive its shares higher in 2026.

What’s also worth mentioning is that even after its massive rally, Google is trading at roughly 30x forward earnings, which remains attractive compared to some of the other best-of-breed AI stocks.

Nvidia, for example, is going for more than 40x at the time of writing.

What’s the Consensus Rating on Alphabet?

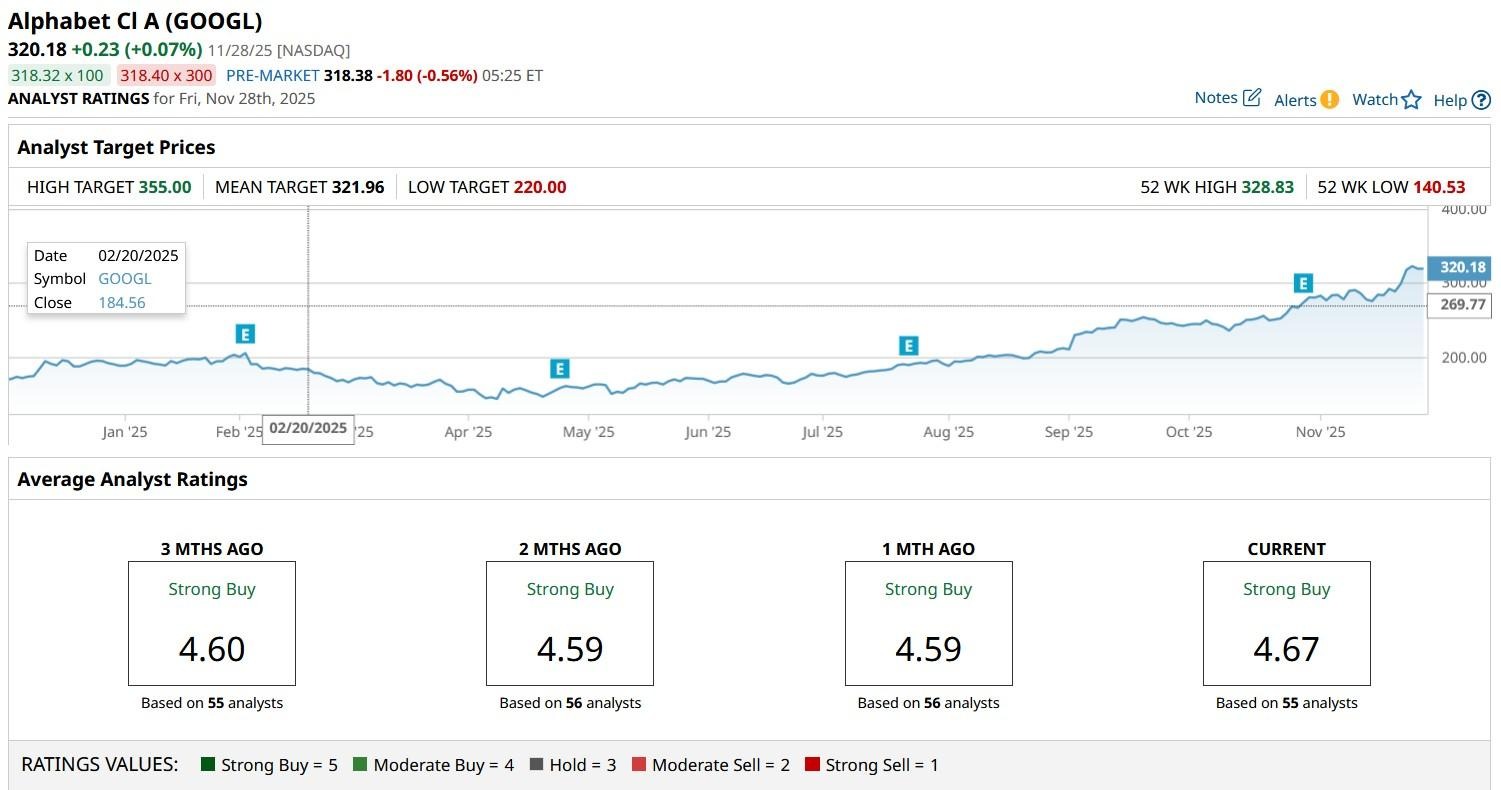

Wall Street analysts also recommend owning Google shares heading into 2026.

The consensus rating on GOOGL stock remains at “Strong Buy” with price targets going as high as $355 indicating potential upside of another 10% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Apple Stock Looks Cheap Here Based on Strong FCF - Shorting OTM Put Options Has Worked

- As Robinhood Dives Into the Prediction Markets, Should You Buy, Sell, or Hold HOOD Stock?

- Morgan Stanley Just Named This Stock a Top Semiconductor Pick. Should You Buy Shares Now?

- AMD Stock Drops 15% in a Month: Should You Buy, Sell, or Hold?