Alphabet’s (GOOGL) Google recently landed a deal with NATO that investors should watch closely. The military alliance picked Google Cloud to upgrade its digital systems. While the exact dollar amount remains under wraps, these government contracts can often stretch into hundreds of millions over time.

NATO will gain access to specialized cloud technology that runs entirely off-grid, which is essential for classified military information. Google calls this setup "air-gapped," and it's designed for the Joint Analysis, Training and Education Center to run artificial intelligence (AI) tools and data analysis without any security vulnerabilities.

The deal could provide Alphabet with long-term recurring revenue, as defense contracts are sticky. The technology involved is Google Distributed Cloud, which enables organizations to run AI and analytics on sensitive data while maintaining complete control and meeting strict security requirements.

NATO chose Google over competitors precisely because these systems can handle classified workloads while staying completely isolated from public networks. For investors, the deal validates Google's enterprise capabilities in high-stakes environments and opens the door to similar contracts with NATO member nations.

Google Stock Soars to New All-Time Highs

Valued at a market cap of more than $3.8 trillion, Alphabet stock has almost doubled in the past year due to its widening AI moat. The tech giant recently unveiled Gemini 3, its newest AI model that represents a major leap forward in the company's AI capabilities.

The new model shows substantial improvements over Gemini 2.5, which arrived less than a year ago. Users get better answers to complex questions without needing to provide as much context upfront. Google plans to integrate Gemini 3 across its search products, the Gemini app, and enterprise services. Early testing suggests the model performs exceptionally well against industry benchmarks.

ChatGPT still dominates, however, with 81% of the global chatbot market, while Gemini's share is quite low at 2.8%. Bank of America (BAC) analysts view Gemini 3 as a positive step toward closing any perceived performance gap with competitors, given the healthy adoption of AI Overviews.

Recent momentum in Alphabet shares extends beyond just AI developments. Warren Buffett's Berkshire Hathaway (BRK.B) revealed a surprising $4.3 billion stake in the company, making it Berkshire's tenth-largest holding. The investment is a notable shift for Buffett, who has traditionally avoided the tech sector. However, a few years back, the Oracle of Omaha admitted he “blew it” by not investing in Google earlier despite recognizing its massive advertising potential.

Alphabet also exceeded consensus estimates in Q3 with revenue of $102.3 billion and adjusted earnings per share of $2.87. Wall Street had forecast revenue of $99.9 billion and earnings of $2.33 per share in Q3.

Google Cloud ended Q3 with a backlog of $155 billion, and search revenue rose by 15% to $56.6 billion. The company also raised its AI infrastructure spending guidance to $92 million, up from $85 billion.

Is GOOGL Stock Still Undervalued?

Analysts tracking Alphabet stock forecast revenue to increase from $350 billion in 2024 to $630 billion in 2029. In this period, adjusted EPS is estimated to expand from $8.04 to $17.23.

If GOOGL stock is priced at 23x forward earnings, which is in line with its five-year average, it should trade around $400 in November 2028, indicating an upside potential of 26% from current levels.

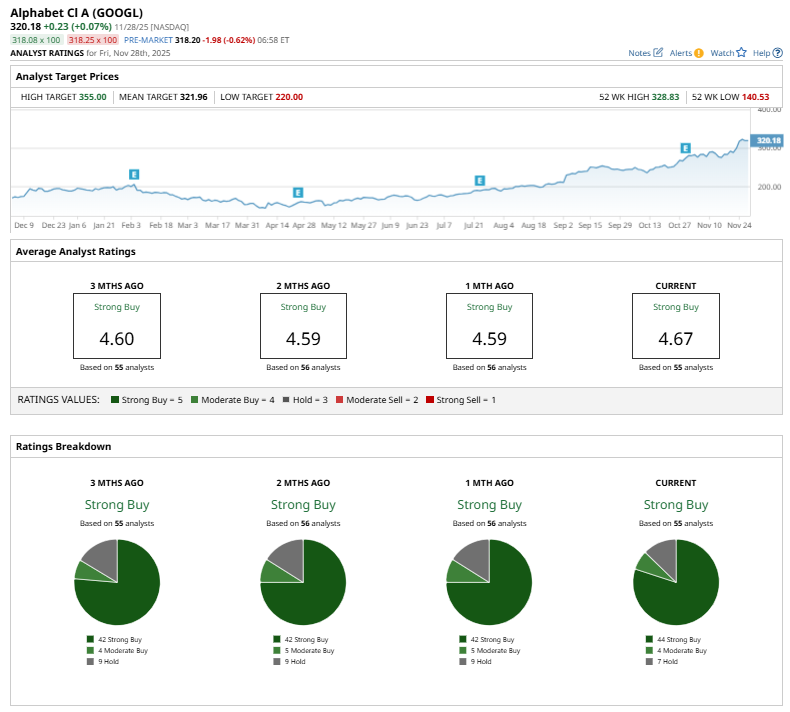

Out of the 55 analysts covering GOOGL stock, 44 recommend “Strong Buy”, four recommend “Moderate Buy,” and seven recommend “Hold." The average GOOGL stock price target is $321, which is similar to the current trading price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Morgan Stanley Just Named This Stock a Top Semiconductor Pick. Should You Buy Shares Now?

- AMD Stock Drops 15% in a Month: Should You Buy, Sell, or Hold?

- Is XPEV Stock a Buy for 2026 as XPeng Targets Breakeven and Pivots to Physical AI?

- Cathie Wood Is Buying GOOGL Stock as Alphabet Approaches $4 Trillion. Should You?