Apple, Inc. (AAPL) stock has held up well over the last month despite a tech sell-off. Based on its strong free cash flow (FCF) and FCF margins, AAPL could still be worth 17% more. Moreover, selling short out-of-the-money (OTM) put options over the last month has worked well.

AAPL stock is at $277.90 in morning trading on Monday, Dec. 1, 2025. That is up slightly (+2.785%) from a month ago, when it closed at $270.37 on Oct. 31.

I discussed Apple's price target in a Nov. 2 Barchart article after its fiscal year-end (Sept. 27) earnings release on Oct. 30. The article ("Apple's Free Cash Flow Surges, Implying AAPL Stock Could Be 20% Too Cheap") showed that AAPL stock could be worth $325 per share.

Strong FCF Possible

That was based on its strong free cash flow. Its FCF margin in Q4 was 25.85% of sales, even after a huge increase in capex spending. And for the full fiscal year, Apple's FCF margin was 23.74%. The average of these two FCF margins is almost 25% (24.795%).

Now, since analysts are forecasting $452.93 billion in revenue for fiscal 2026 and $481.18 billion for the following year. Weighting the former by 75% (for three quarters), the next 12 months (NTM) revenue forecast is $460 billion.

So, applying an average 25% FCF margin to this NTM revenue forecast shows that Apple could potentially generate $115 billion in FCF:

$460 billion NTM sales x 0.25 = $115 billion FCF

So, how will the market value this?

AAPL Price Target

One way to value its FCF is to divide it by the market cap. That portrays an FCF yield - as if 100% of the FCF were to be paid out to shareholders like a dividend yield.

For example, given Apple's market cap today of $4.144 trillion (i.e., $4,144 billion), its FCF yield, given its trailing 12-month (TTM) FCF of $98.767 billion, is 2.383%:

$98.767b / $4,144 billion market cap = 0.02383

In other words, over the last 12 months, if Apple had paid out 100% of its FCF to shareholders, the dividend yield would be 2.383%.

So, let's apply that to the forecasted NTM FCF:

$115b / 0.02393 = $4,825.85 billion market value

The market value might be expected to rise by +16.5% from $4,144 billion today.

Moreover, with the company's huge stock buybacks, one might expect at least another 0.5% increase in the stock price to a 17.0% gain:

$277.90 x 1.17 = $325.14 per share

That is how I derived a $325 price target for AAPL stock over the next year. It's based on reasonable assumptions about FCF, FCF margins, revenue forecasts, and FCF yield metrics.

One way to play this, as shown in my last article, is to sell short out-of-the-money (OTM) puts.

Shorting OTM Puts

For example, last month I suggested selling short the $260 put option that expires this Friday, Dec. 5, 2025. The premium received was $3.53 at the midpoint for the $260 strike price, which was 3.84% below (or out-of-the-money) the trading price at the time.

This provided a 1.358% yield (i.e., $3.53/$260.00) to the short seller for one month.

The premium is now just 8 cents. So, now most of the money has been made shorting these puts.

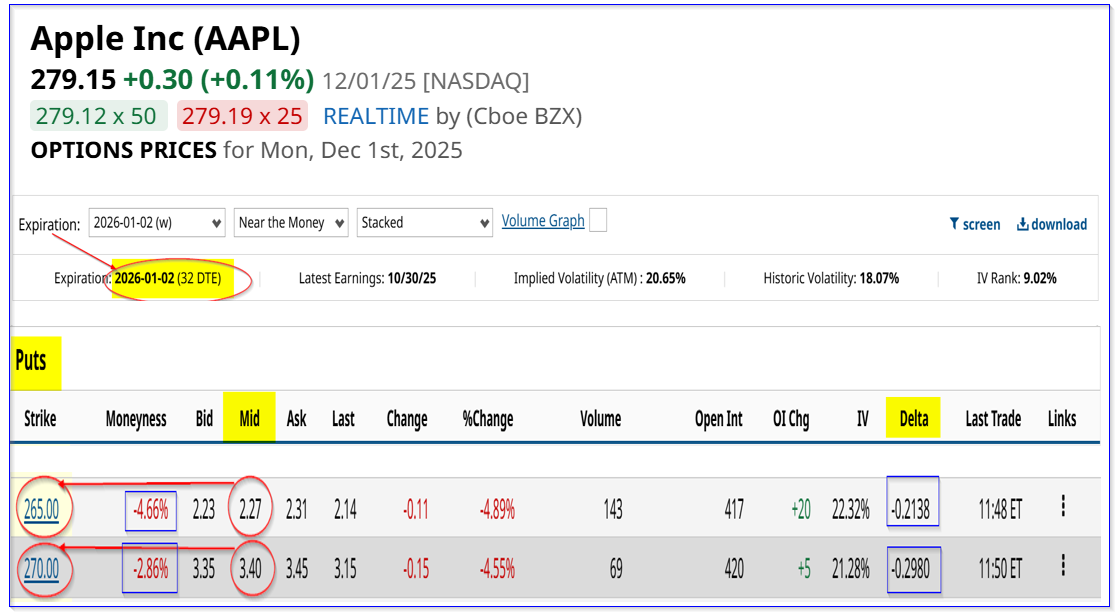

This can now be repeated for the next month. For example, the Jan. 2, 2026, expiry period shows that the $265 put option has a midpoint premium of $2.27, and the $270 put has a $3.40 premium.

That means the short-put yield is 0.8566% for the $265 put and 1.259% for the $270 strike price put. So, an investor who does both would make an average yield of 1.0578%.

This is for an average out-of-the-money (OTM) distance of -3.76% below the trading price.

That allows an investor to set a potentially lower buy-in point, if AAPL stock falls to between $265 and $270.00. This could provide a better upside for the investor while also making income.

The bottom line is that this is one way to play AAPL stock, which looks 17% undervalued here.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Did Wall Street Accidentally Hide This Arbitrage Trade for NetApp (NTAP) Stock?

- Apple Stock Looks Cheap Here Based on Strong FCF - Shorting OTM Put Options Has Worked

- Copper Bull Case 2026: Fundamentals, Trend, Correlation, and a Proven Nov-Feb Seasonal Play

- Bitcoin Slump Hits Strategy Hard, But This MSTR Options Play Pays You