Founded 170 years ago and currently headquartered in New York, Pfizer Inc. (PFE) is a global biopharmaceutical powerhouse with a presence in over 125 countries. At its core, Pfizer researches, develops, manufactures and markets medicines and vaccines across a wide spectrum: from oncology to immunology, internal medicine, rare diseases, and preventive vaccines.

With a market capitalization of roughly $146 billion, Pfizer slots squarely into the “large-cap” league, a category typically defined as companies worth about $10 billion or more. And while the post-pandemic drop in COVID-19 product demand has challenged the company, the pharmaceutical giant is powering ahead with a refreshed lineup of innovative medicines and vaccines.

Its expanding pipeline showcases a company that isn’t slowing down, but rather doubling down on delivering breakthrough treatments and broadening its impact across global healthcare. But despite the company’s strengths, its stock has struggled to capture investors' attention.

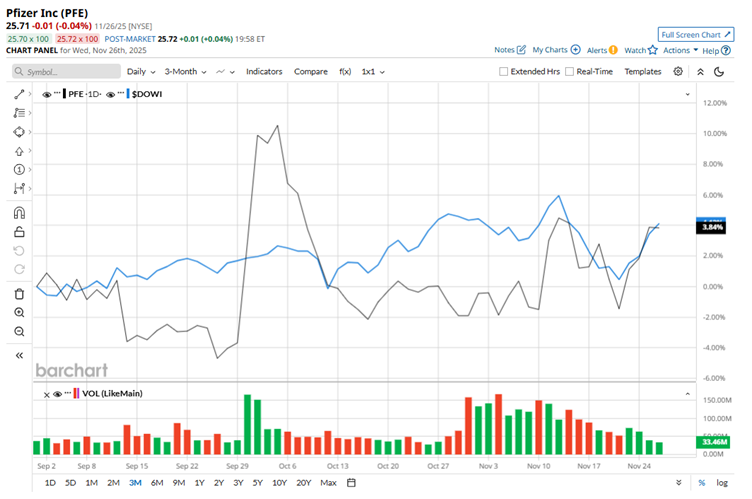

Over the past three months, PFE stock has been up about 3.2%, slightly lagging behind the broader Dow Jones Industrial Average’s ($DOWI) 4.4% return during the same stretch. After hitting a fresh 52-week high of $27.69, the pharma stock has tanked about 7.2% from that peak.

Things aren’t looking much brighter over the longer haul either. Over the past 12 months, Pfizer has only been slightly down, and in 2025 alone, shares have fallen about 3.1%. Meanwhile, the Dow Jones Industrial Average has sprinted ahead, jumping roughly 5.7% over the past year and chalking up an impressive 11.5% gain so far in 2025.

On a brighter note, Pfizer’s shares have been holding above their 50-day and 200-day moving averages since the start of the month, a bullish signal that momentum may finally be shifting in the company’s favor.

Pfizer’s shares have been under pressure this year, as investors worry about upcoming patent expirations for blockbuster medications like Eliquis and Ibrance, a challenge that could dent future revenue. Adding to the drag, COVID-19 product sales continue to fade. But there’s finally a spark of good news. The stock jumped nearly 2.6% on Nov. 21 after the FDA approved Pfizer’s PADCEV plus Keytruda combination for the treatment of certain bladder cancer patients.

Pfizer’s underperformance stands out even more next to rival Amgen Inc. (AMGN). While Pfizer has struggled to gain traction, Amgen has surged, climbing 23.1% over the past year and an impressive 32.2% year-to-date, leaving Pfizer trailing far behind.

Even though stock performance has been disappointing over the long term, Wall Street isn’t ready to write it off. The consensus rating from 23 analysts is a “Moderate Buy”, and with the average price target sitting at $28.43, the stock still carries about 10.6% potential upside from current levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This AI Dividend Stock Is a Buy Even as the S&P 500’s Yield Falls to Dot-Com Lows

- Have You Heard of the ‘Wheel’ Strategy? These 3 Unusually Active Stocks to Buy Can Get You Started

- 3 Buy-Rated Dividend Aristocrats Easily Beating Inflation

- ‘Insatiable’ Demand Is Powering This ‘Picks and Shovels’ AI Stock up 245%. Should You Buy It Here?