In my October 21, 2025, Barchart article on the grain and oilseed markets in the third quarter, I concluded with:

At the current levels, prices have limited downside potential, while the upside could be substantial. I favor long positions in the sector, leaving plenty of room to add on further declines over the coming months. The 2026 crop year and supply uncertainty are just around the corner in early 2026, which could ignite price recoveries.

CBOT wheat futures declined 3.92% in Q3 and were 7.89% lower over the first nine months of 2025, settling at $5.08 per bushel on September 30, 2025. While the CBOT wheat futures continued to decline during the first half of Q4, they may have reached a bottom in mid-October.

A recovery in the CBOT wheat futures

After reaching a low of $4.9225 per bushel on October 14, 2025, CBOT soft red winter wheat futures turned higher, rising to over the $5.60 level.

The daily December continuous contract CBOT wheat futures chart highlights that the futures rallied 14.4% since from the low of October 14 to the high of November 18.

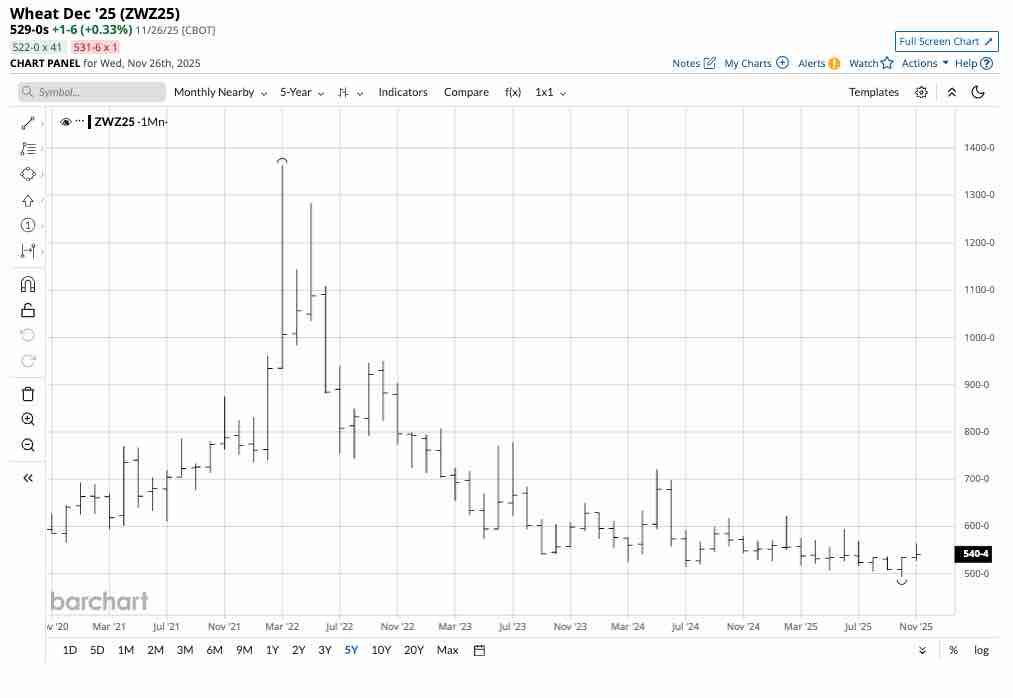

The long-term trend remains bearish

After reaching a record high of $13.6350 per bushel in March 2022, following Russia’s invasion of Ukraine, which raised supply concerns, the wheat futures have made lower highs and lower lows.

The monthly continuous CBOT wheat futures contract exhibits a bearish trend, with the price 63.9% lower from the March 2022 high to the low in October 2025.

Despite the recent price recovery, the CBOT wheat futures remain in a bearish long-term trend. Technical resistance is at the June 2025 high of $5.94, the February 2025 high of $6.2175, and the May 2024 peak of $7.20 per bushel. A rally that takes the price above the June 2025 high of $5.94 would mark the end of the long-term bearish trend.

Wheat turned higher with soybeans

While wheat futures had recovered 14.4% from the mid-October 2025 low and critical technical support level, soybean futures have done better on a percentage basis since their critical technical support level at the low from December 2024.

The monthly CBOT continuous soybean futures chart illustrates the 23.5% recovery rally from the December 2024 low of $9.47 to the November 2025 high of $11.6950 per bushel.

Soybeans have rallied after the summit between U.S. President Trump and Chinese President Xi, which could open the door for U.S. soybean exports to China. Wheat has followed soybeans higher over the past weeks.

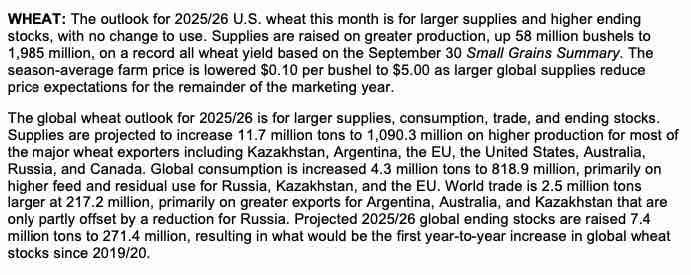

The November WASDE report was not bullish

The U.S. Department of Agriculture released its November World Agricultural Supply and Demand Estimates Report on Friday, November 14, after a one-month lapse due to the U.S. government shutdown. The USDA told the wheat market:

The November WASDE reported that U.S. wheat supplies and ending stocks increased. Moreover, global ending inventories rose by 7.4 million tons to 271.4 million tons, marking the first year-over-year increase in global wheat stocks since the 2019/2020 season. The bottom line is that the WASDE was bearish for wheat prices.

I reached out to Jake Hanely, the Managing Director of the Teucrium family of grain and oilseed ETFs, which includes the WEAT product. Jake’s comment on wheat was:

It’s hard to make a bull case for wheat. Supply is ample in the United States and abroad. Prices remain under pressure, and the trade has treated rallies as selling opportunities.

While the fundamentals remain bearish, CBOT wheat prices rose to their latest high on November 18, despite the WASDE report’s release.

WEAT is the ETF that tracks CBOT wheat prices- Commodity cyclicality and the weather in the leading growing regions are critical for prices in 2026

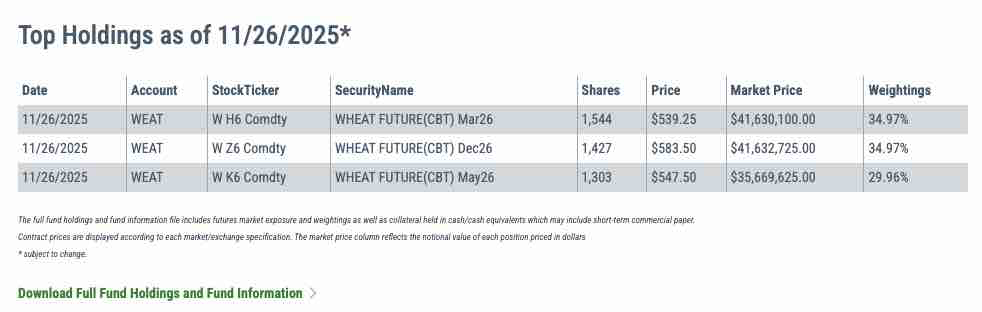

The Teucrium Wheat ETF product (WEAT) tracks the price of a portfolio of three actively traded CBOT soft red winter wheat futures contracts, excluding the nearby contract to mitigate roll risks. Since the most volatility occurs in the nearby contract, WEAT tends to underperform the nearby wheat futures during rallies and often outperforms during downside price action. At $20.96 per share, WEAT had over $119 million in assets under management. WEAT trades an average of over 134,000 shares daily and charges a management fee of 0.83%. The continuous CBOT wheat futures contract rallied 14.4% from the mid-October low to the high on November 18.

Over the same period, WEAT moved 9.8% higher from $19.95 to $21.90 per share. The WEAT ETF reached its most recent high on November 4 at $21.90 as the deferred contracts rallied to their highest levels on that day. WEAT experienced a 1:5 reverse split on November 25.

While WEAT underperformed the December CBOT wheat futures contract, the ETF does an excellent job tracking the portfolio of deferred CBOT wheat futures contracts. The ETF’s holdings on November 26 were:

The chart shows that while WEAT does not have exposure to the active month December 2025 CBOT futures contract, it holds virtually equal exposure to the March, May, and December 2026 CBOT wheat futures contracts, which display less price volatility than the nearby December 2025 contract.

As the wheat market heads towards the 2026 crop year, stocks and production remain bearish, but it will be the weather conditions in the critical growing regions that will determine the size of next year’s crop and the global inventories. Commodity cyclicality suggests that the CBOT’s wheat futures low in October 2025, which was the lowest price since August 2020, and could limit the downside potential of wheat futures. Prices below $5 do not incentivize producers as production costs have been increasing. A decrease in output in 2026 due to high stock levels and low prices could lead to a price recovery if demand remains at current levels or increases. In bear markets, such as wheat’s price action since the 2022 high, prices tend to decline to levels where production slows, inventories begin to decline, and consumption increases. Therefore, watch the WASDE reports over the coming months to see if inventories begin to decline, which could make the low from October 14, 2025, a critical price bottom. Meanwhile, the weather over the coming year will be the primary factor driving wheat prices higher or lower.

If wheat prices decline towards $5 per bushel, they could offer significant value as the downside risk is far less than the upside potential for the agricultural product that is the primary ingredient in bread and other products that feed the world. Wheat prices can continue to recover, but weather conditions and inventory levels will be crucial in 2026.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart