Broadcom (AVGO) is due to report earnings after the market close on December 11th and the market is pricing in a 10.1% move in either direction.

Implied volatility is 53.56% which gives AVGO an IV Percentile of 84% and an IV Rank of 47.52%.

Broadcom is a premier designer, developer and global supplier of a broad range of semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor (CMOS) based devices and analog III-V based products.

Headquartered in San Jose, CA, Broadcom's semiconductor solutions are used in end products such as enterprise and data center networking, home connectivity, set-top boxes, broadband access, telecommunication equipment, smartphones and base stations, data center servers and storage systems, factory automation, power generation and alternative energy systems, and electronic displays.

Broadcom's infrastructure software solutions enable customers to plan, develop, automate, manage, and secure applications across mainframe, distributed, mobile, and cloud platforms.

The company's Symantec cyber security solutions portfolio, include endpoint, network, information and identity security solutions.

Broadcom Earnings Iron Condor

Today, we’re going to look at an iron condor trade placed over earnings. These types of trades can be high risk, so make sure you understand how they work before attempting something like this.

Ideally, we would like to close it out before earnings.

An iron condor aims to profit from a drop in implied volatility, with the stock staying within an expected range.

When implied volatility is high, the wider the expected range becomes.

The maximum profit for an iron condor is limited to the premium received while the maximum potential loss is also capped. To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

Trade Setup

As a reminder, an iron condor is a combination of a bull put spread and a bear call spread.

The idea with the trade is to profit from time decay while expecting that the stock will not move too much in either direction.

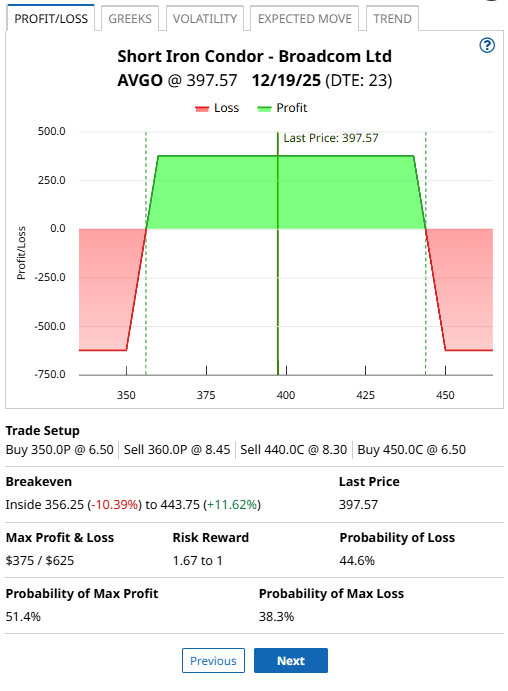

First, we take the bull put spread. Using the December 19th expiry, we could sell the $360 put and buy the $350 put. Then the call side could be placed by selling the $440 call and buying the $450 call.

In total, the iron condor will generate around $3.75 per contract or $375 of premium.

The profit zone ranges between $356.25 and $443.75. This can be calculated by taking the short strikes and adding or subtracting the premium received.

As both spreads are $10 wide, the maximum risk in the trade is 10 – 3.75 x 100 = $625.

Therefore, if we take the premium ($375) divided by the maximum risk ($625), this iron condor trade has the potential to return 60%.

If price action stabilizes, then iron condors will work well. However, if AVGO stock makes a bigger than expected move, the trade will suffer losses.

Trades held over earnings allow little room for adjusting, so they can be a bit hit or miss.

Conclusion And Risk Management

This iron condor on Broadcom offers a well-balanced, high-probability setup for options traders seeking steady income with defined risk. By targeting short strikes that sit outside key support and resistance levels, the trade benefits from time decay while maintaining a healthy risk/reward profile.

Remember to close before earnings if you do not want earnings risk.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AVGO Iron Condor Could See a 60% Return in 3 Weeks

- Have You Heard of the ‘Wheel’ Strategy? These 3 Unusually Active Stocks to Buy Can Get You Started

- Using Probability Density to Extract a Huge Payout from Microchip’s Potential Breakout

- Eli Lilly’s Stock Price Has Fattened Up Like a Thanksgiving Turkey. Time to (Options) Collar That Green!