With a market cap of $120.6 billion, Honeywell International Inc. (HON) is a diversified technology and manufacturing company operating across aerospace, industrial automation, building automation, and energy and sustainability solutions worldwide. Its business spans advanced aircraft systems, automation technologies, building control software, and energy-efficient and sustainable solutions.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Honeywell fits this criterion perfectly. Honeywell delivers products and services that support industries from aviation to manufacturing and infrastructure.

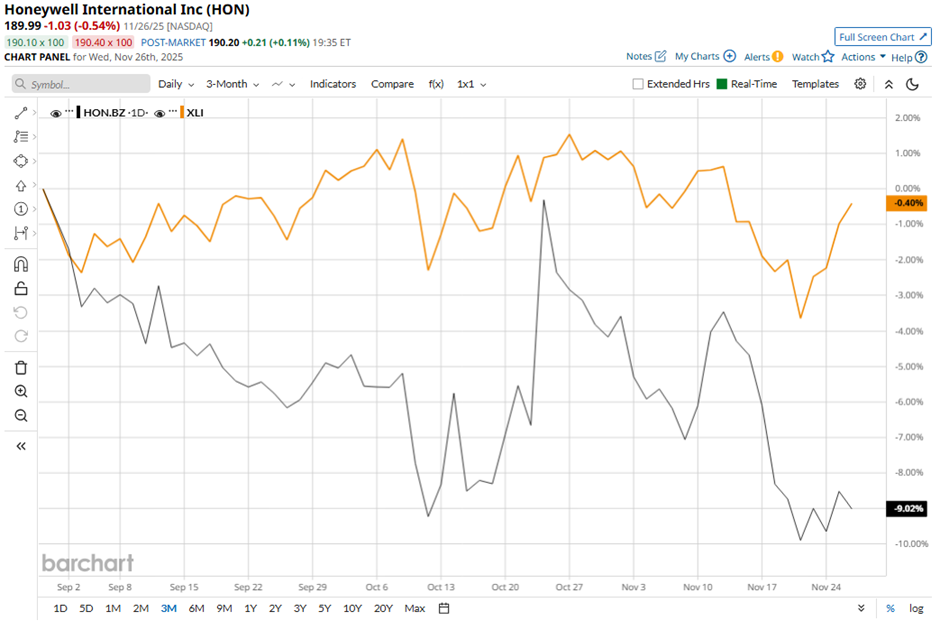

Shares of the Charlotte, North Carolina-based company have decreased 16.7% from its 52-week high of $228.04. Honeywell’s shares have fallen 9.5% over the past three months, a more pronounced decline than the Industrial Select Sector SPDR Fund’s (XLI) marginal drop over the same time frame.

In the longer term, HON stock is down 10.9% on a YTD basis, lagging behind XLI’s nearly 16% return. In addition, shares of the company have declined 12.6% over the past 52 weeks, compared to XLI’s 6.3% return over the same time frame.

Despite a few fluctuations, the stock has been trading below its 50-day moving average since late July.

Honeywell shares climbed 6.8% on Oct. 23 because the company beat the high end of guidance with Q3 2025 sales of $10.4 billion and adjusted EPS of $2.82. Investors also reacted positively to strong orders growth of 22%, record backlog, and Honeywell raising its full-year 2025 adjusted EPS guidance to $10.60 - $10.70 and organic growth outlook.

Confidence was further boosted by solid segment performance, especially 12% organic growth in Aerospace Technologies and margin expansion in Building Automation.

However, HON stock has lagged behind its rival GE Vernova Inc. (GEV). GE Vernova’s shares have surged 79.3% on a YTD basis and 74% over the past 52 weeks.

Despite the stock’s weak performance, analysts remain moderately optimistic about its prospects. HON stock has a consensus rating of “Moderate Buy” from 22 analysts' coverage, and the mean price target of $240.75 is a premium of 26.7% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Founder Ray Dalio Warns the Market Is in a Bubble, Bridgewater Associates Just Bought CoreWeave Stock

- Eli Lilly’s Stock Price Has Fattened Up Like a Thanksgiving Turkey. Time to (Options) Collar That Green!

- With a 6.7% Yield and 27 Years of Dividend Hikes, Is This Stock a Buy Today?

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip