Inflation may not be as high as it was in 2022, but at 3.2%, it sure quietly eats up returns. In times like this, high dividend yields alone don’t cut it. Investors need companies that consistently raise dividends faster than prices rise.

That is why I look for Dividend Aristocrats. These S&P 500 listed companies have consistently increased their dividends for over 25 years, highlighting their resilience. The goal is not only to beat inflation, but to overtake it by a huge gap year after year.

How I came up with the following stocks

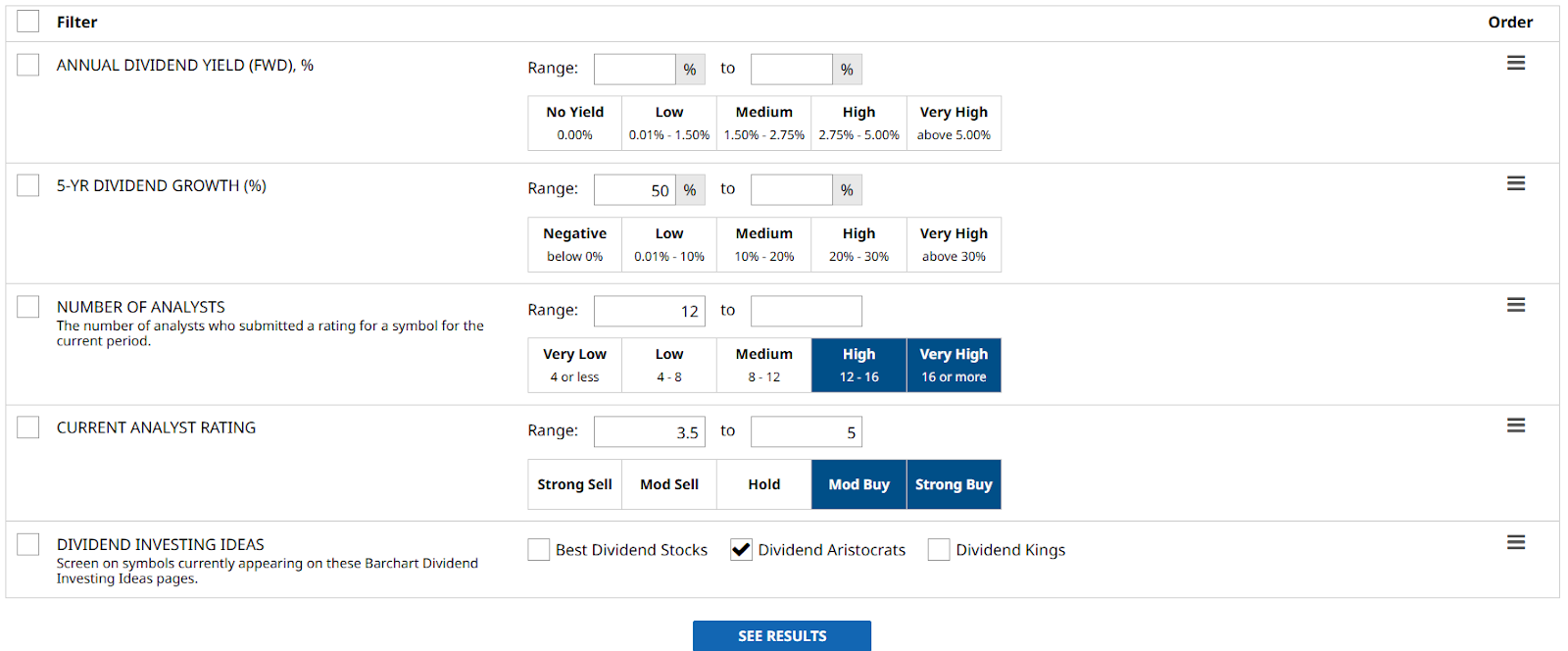

I used Barchart’s Stock Screener to find the highest-yielding companies on my watchlist.

- 5-YR Dividend Growth (%): 50% or higher for companies that comfortably beat inflation over the last five years

- Number of Analysts: 12 or more. The higher the number of analysts, the stronger the confidence of the call.

- Current Analyst Rating: 3.5 – 5. Companies that are “Moderate” to “Strong Buy”, expected by Wall Street to perform well over the next 12 months.

- Annual Dividend Yield (FWD), %: Added (out of habit) for quick reference

- Dividend Investing Ideas: Dividend Aristocrats.

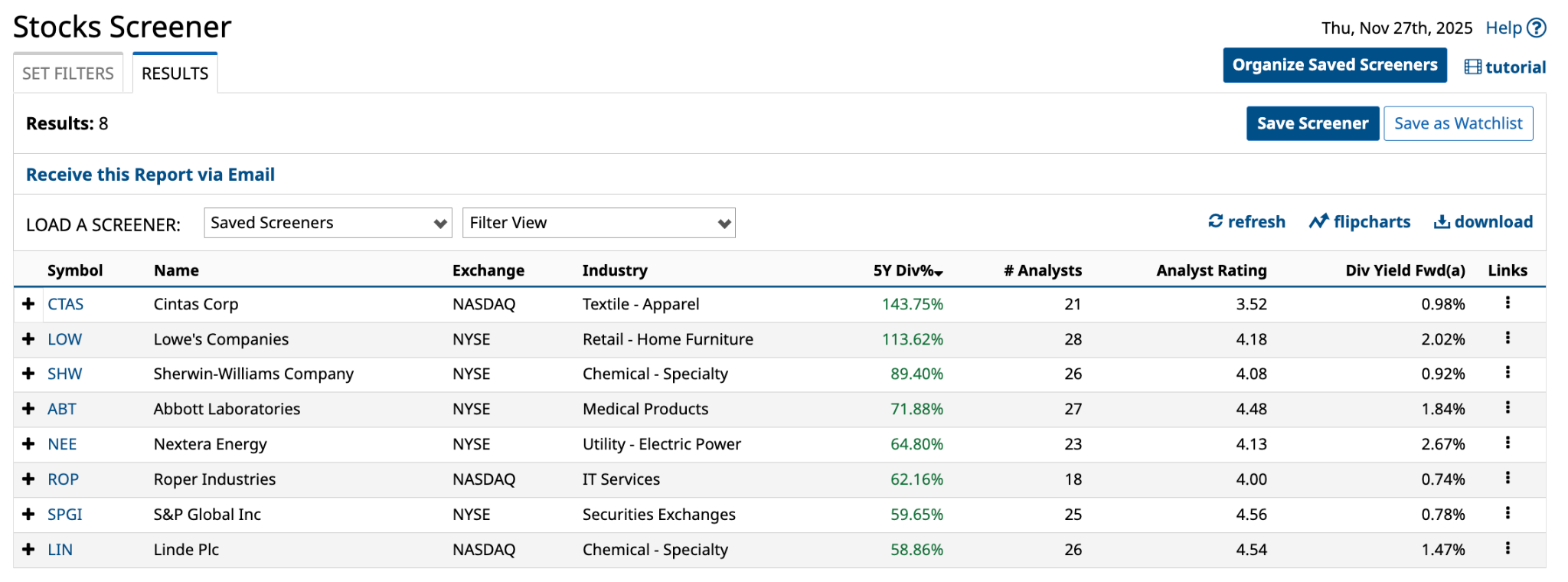

Eight companies matched the screen, and I’ll cover the top three, starting from the company with the highest five-year dividend growth to buy now.

Let’s kick off this list, starting with the first Dividend Aristocrat:

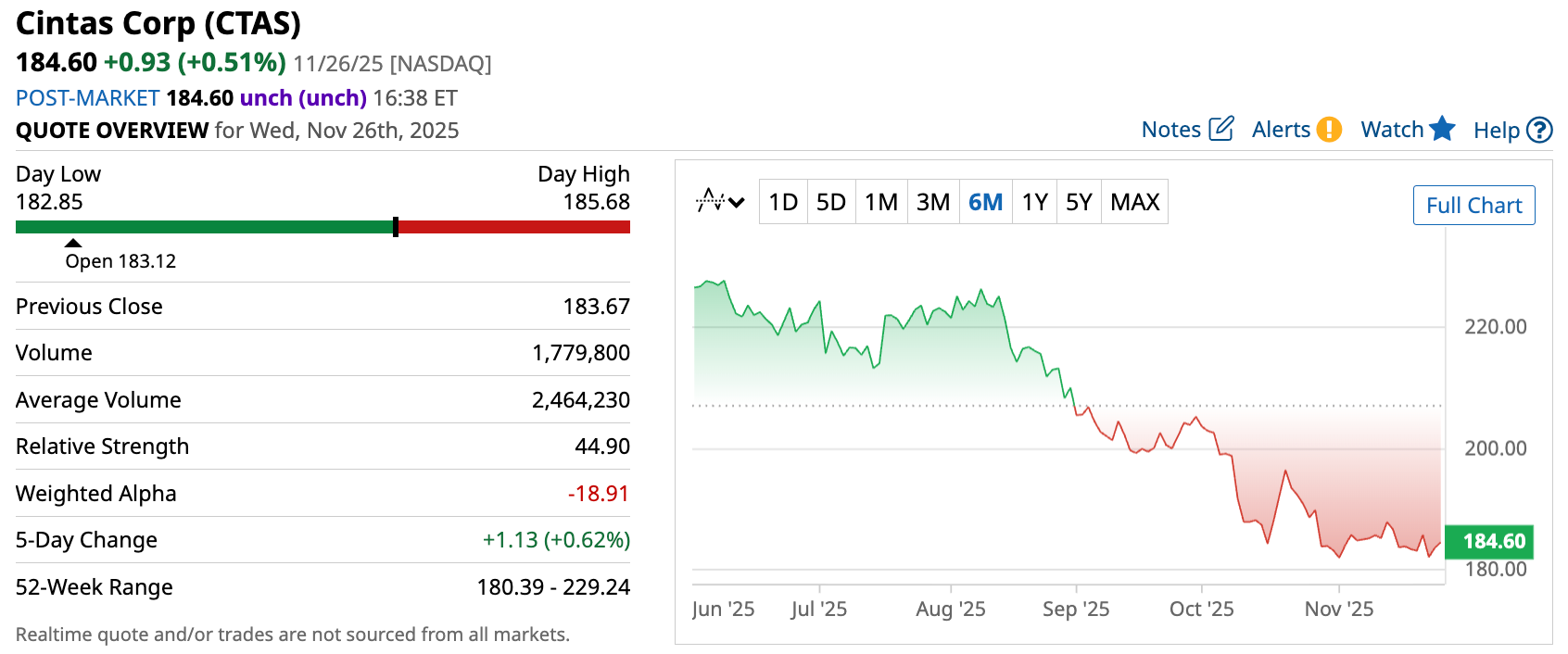

Cintas Corp (CTAS)

Cintas Corporation helps different businesses across different industries to maintain a clean, safe, and professional environment through supplying uniforms and restroom necessities for fire protection and safety training. Founded in 1968, Cintas is now serving over one million customers.

Recently, Cintas landed on Newsweek's World's Most Trustworthy Companies, a first for the company. It signals a momentum in brand strength and reinforces long-term confidence in Cintas' business model

In its recent financials, the company reported that sales rose approximately 9% YOY to $2.7 billion while its net income also increased at the same clip, to $491 million. Aside from that, Cintas pays a forward annual dividend of $1.40, translating to a yield of around 0.75%. It may not be the highest out there, but the company has an outstanding 5-year dividend growth of 143.75%, beating inflation by a huge margin.

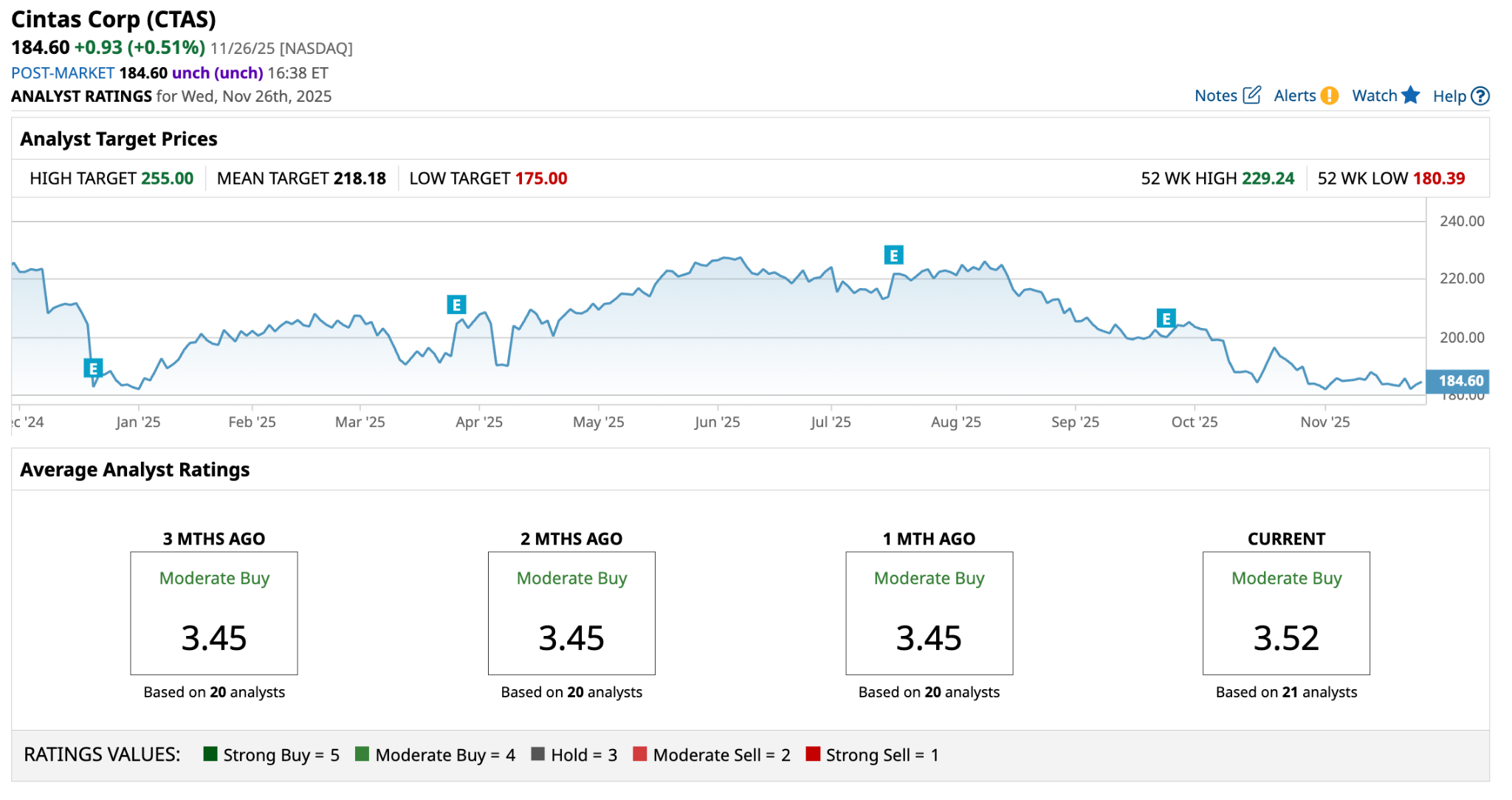

With that, a consensus among 21 analysts rate the stock a “Moderate Buy”, a sentiment consistent over the past three months. The high target price of $255 suggests as much as ~38%.

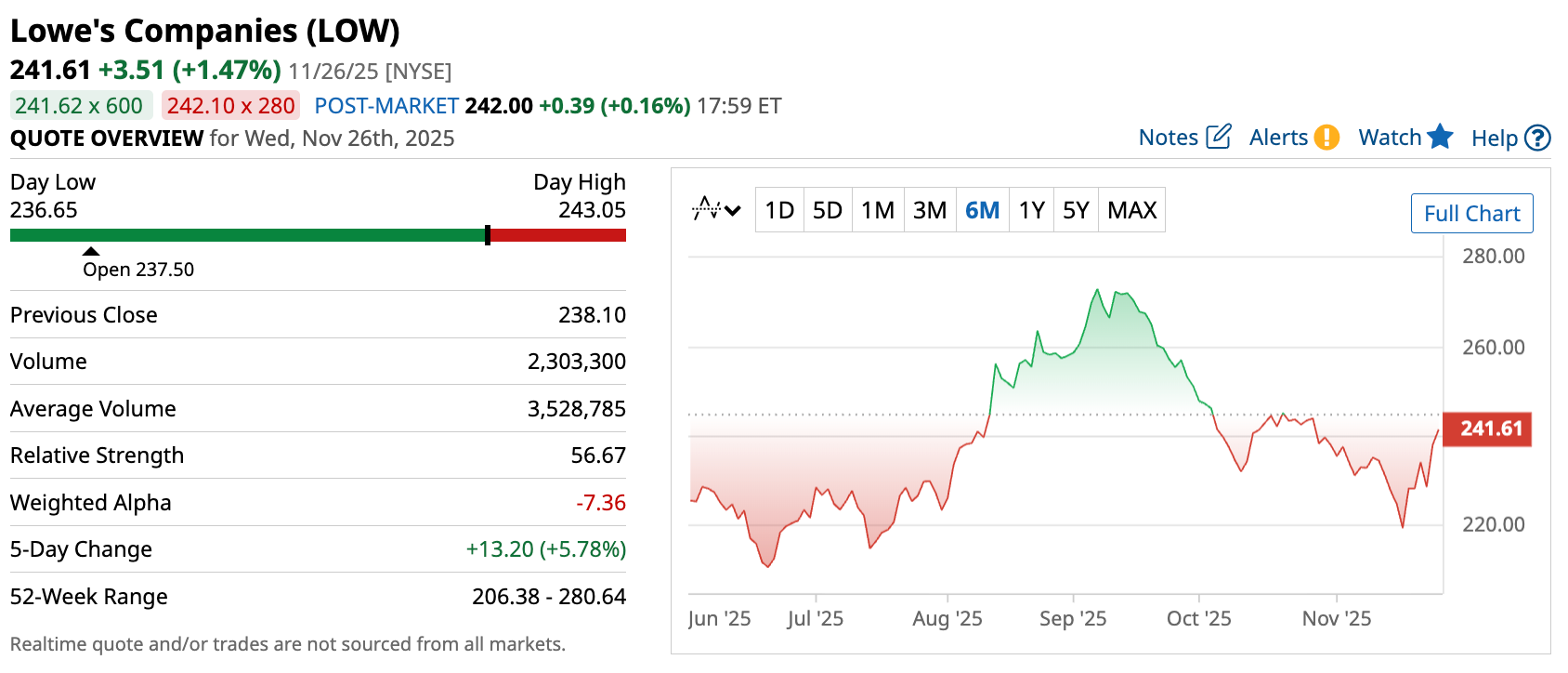

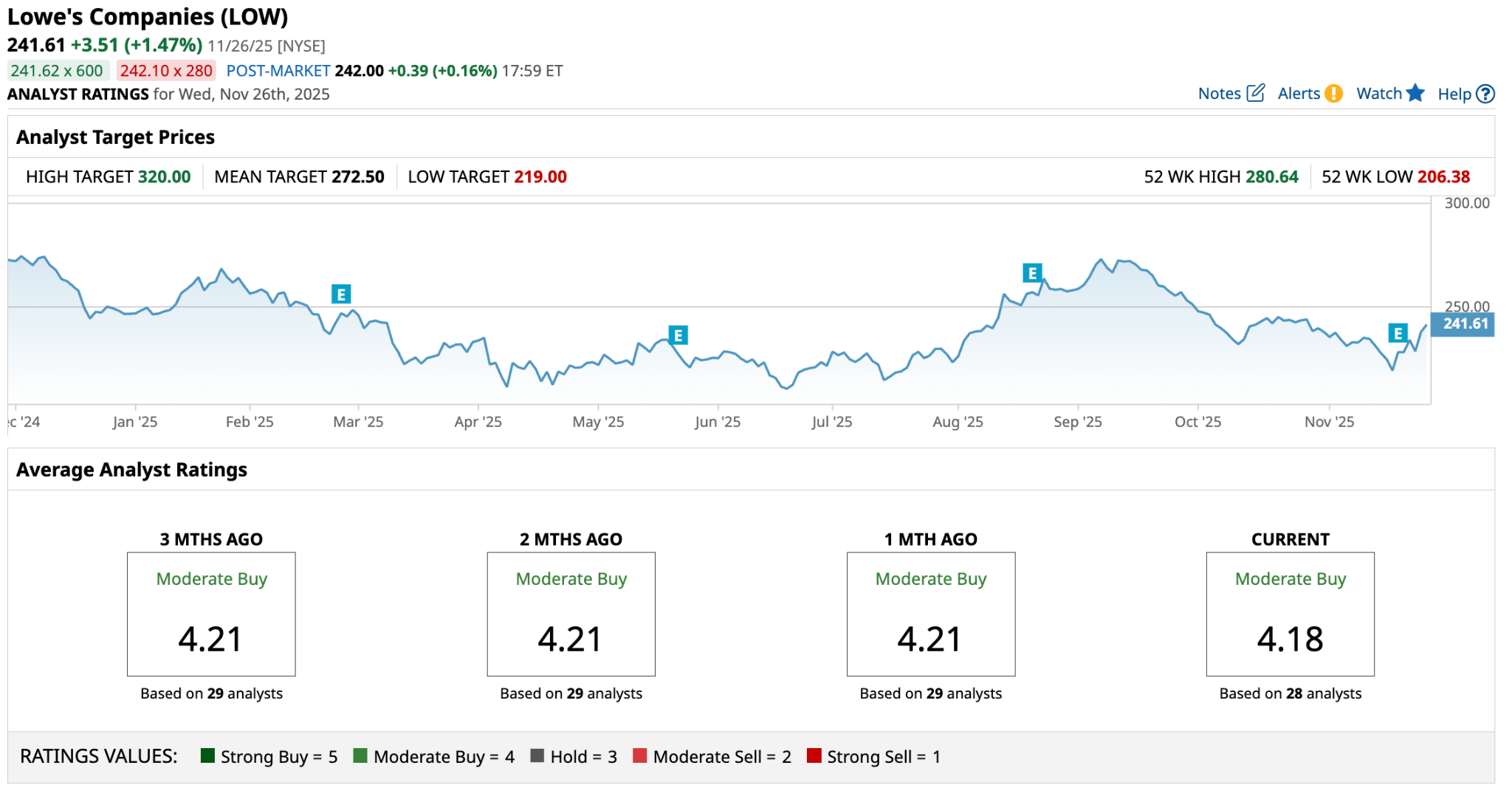

Lowe’s Companies (LOW)

The second Dividend Aristocrat on my list is Lowe’s Companies, a home furnishings retailer. There’s a good chance that you have come across them, as Lowe sells approximately 40,000 different products in a typical store. Founded in 1921, Lowe's has various products, including appliances, building supplies, and even garden-related items.

Recently, Lowe has closed its acquisition of Foundation Building Materials, which immediately boosts its Pro capabilities with a deeper presence in key and major markets.

In its recent financials, the company reported that sales grew 1.6% YOY to around $24 billion, while its net income rose around 1% to $2.4 billion. The company also pays a forward annual dividend of $4.80, translating to a yield of around 2%. However, Lowe’s 5-year dividend growth is 113.62%, highlighting its ability to grow the payout over the years.

A consensus among 28 analysts rates the stock a “Moderate Buy”, a sentiment that is stable, though declining a touch over the past three months. The stock also has upside potential of around 35% if it hits the high target price of $320.

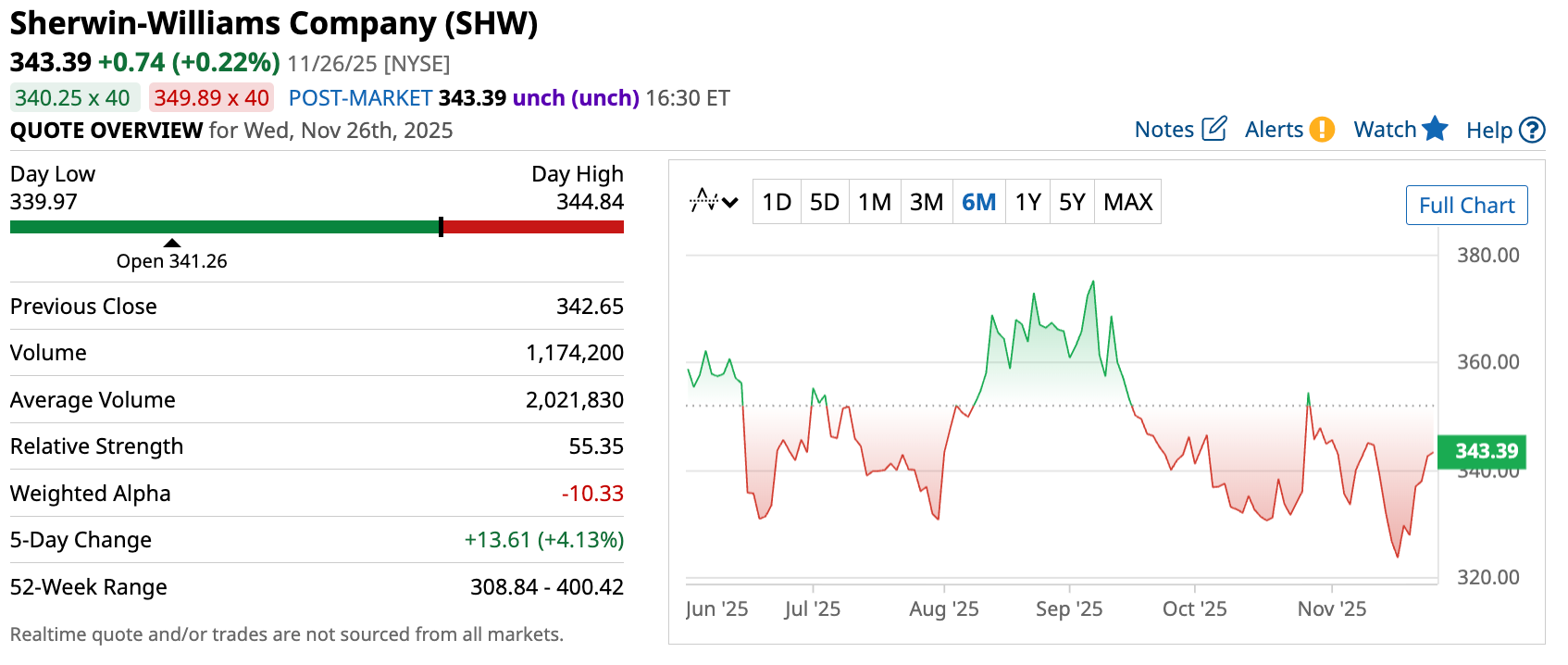

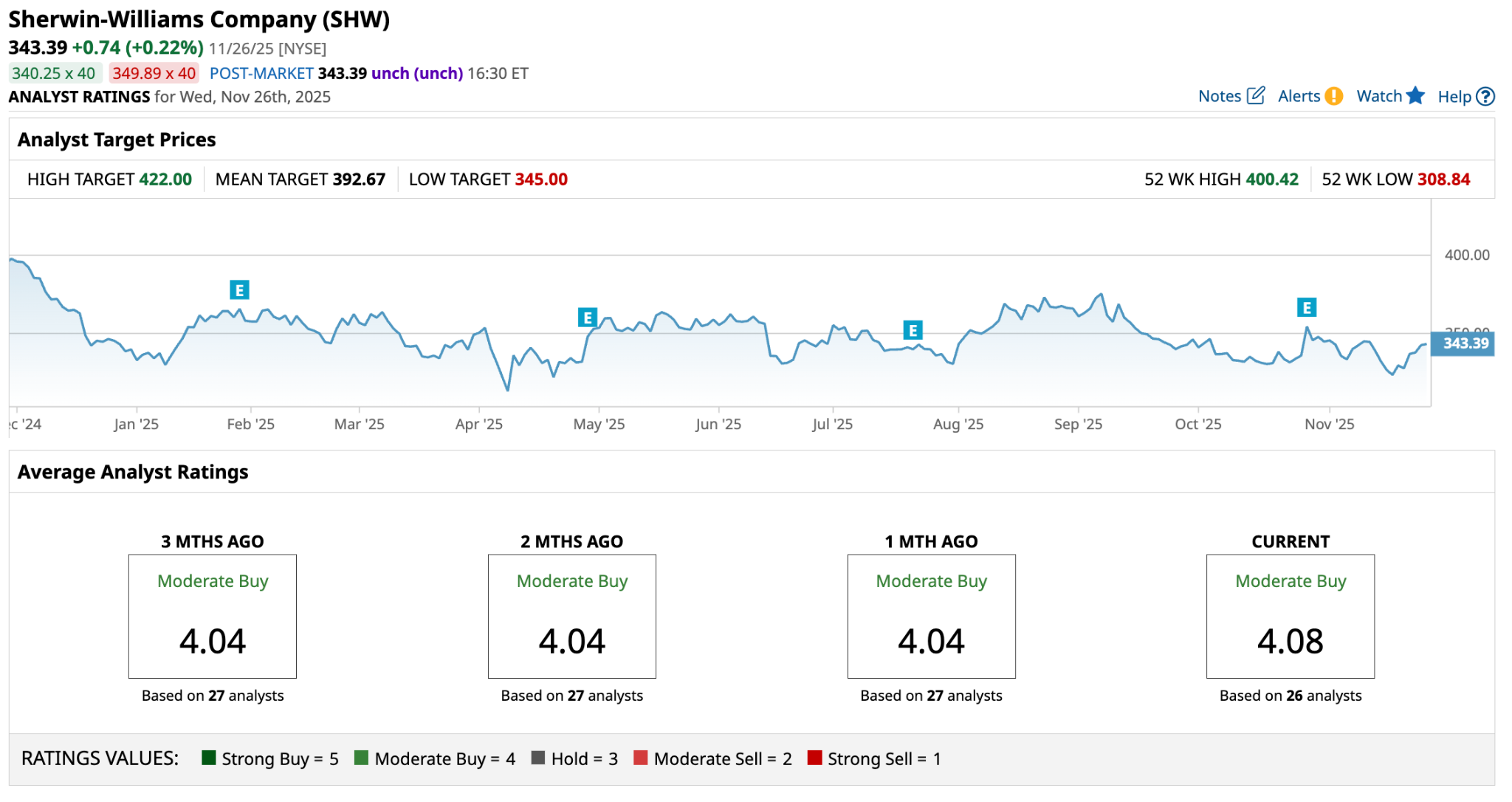

Sherwin-Williams Company (SHW)

The third and final Dividend Aristocrat on my list is Sherwin-Williams, a company that manufactures and commercializes paint and paint-related products. Founded in 1866, it is now the largest paint and coating company in terms of revenue and has a global reach of 120 countries.

Just last month, Sherwin-Williams completed the acquisition of Suvinil, a paint business in Brazil. This expands its presence in Latin America, bringing $525 million in sales.

Speaking of sales, in its recent financials, the company reported that sales rose over 3% YOY to $6.4 billion. Its net income also grew by the same percentage to $833 million. Sherwin-Williams also pays a forward annual dividend of $3.16, translating to a yield of around 0.92%. It is not the highest out there, but it has an outstanding 5-year dividend growth of 89.4%.

That said, a consensus among 26 analysts rates the stock a “Moderate Buy”, a rating consistent over the past three months. The high target price is $422, suggesting as much as 23% upside from today's prices.

Final thoughts

So, high yields may get the attention, but it is dividend growth that builds long-lasting wealth, and these three Dividend Aristocrats prove they hit the marks. With their inflation-beating dividend growth, steady earnings, and stability, they’ve earned their place on this list. If you are looking for dividend growth stocks to protect purchasing power over the long haul, any of these companies could be a great addition to your portfolio.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart