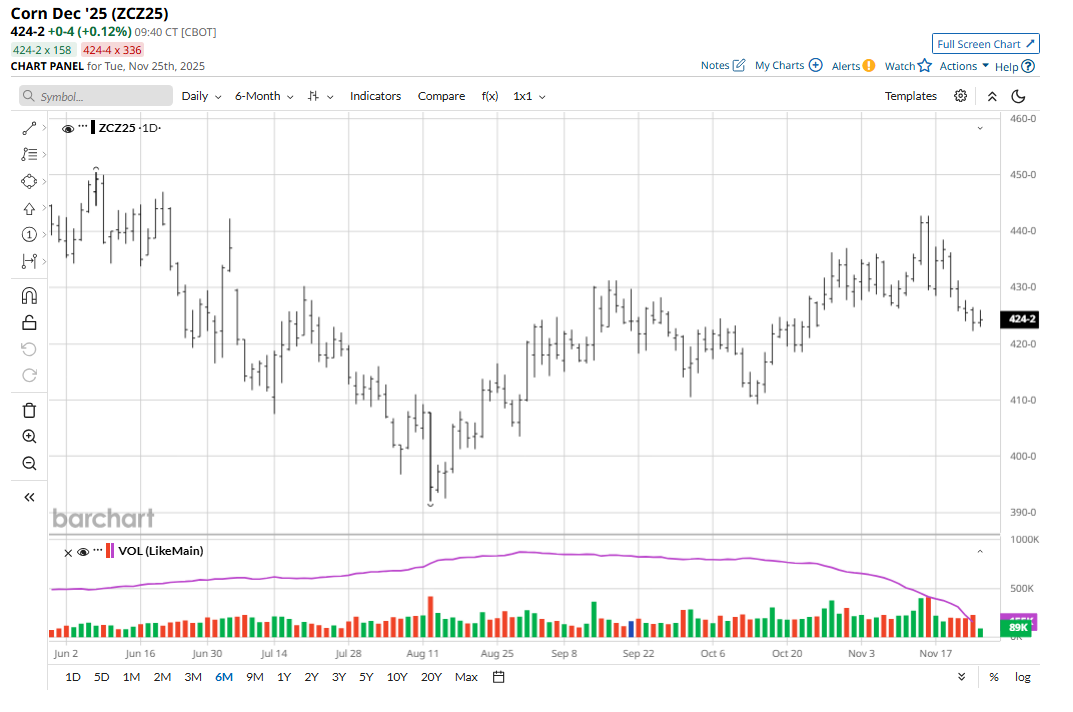

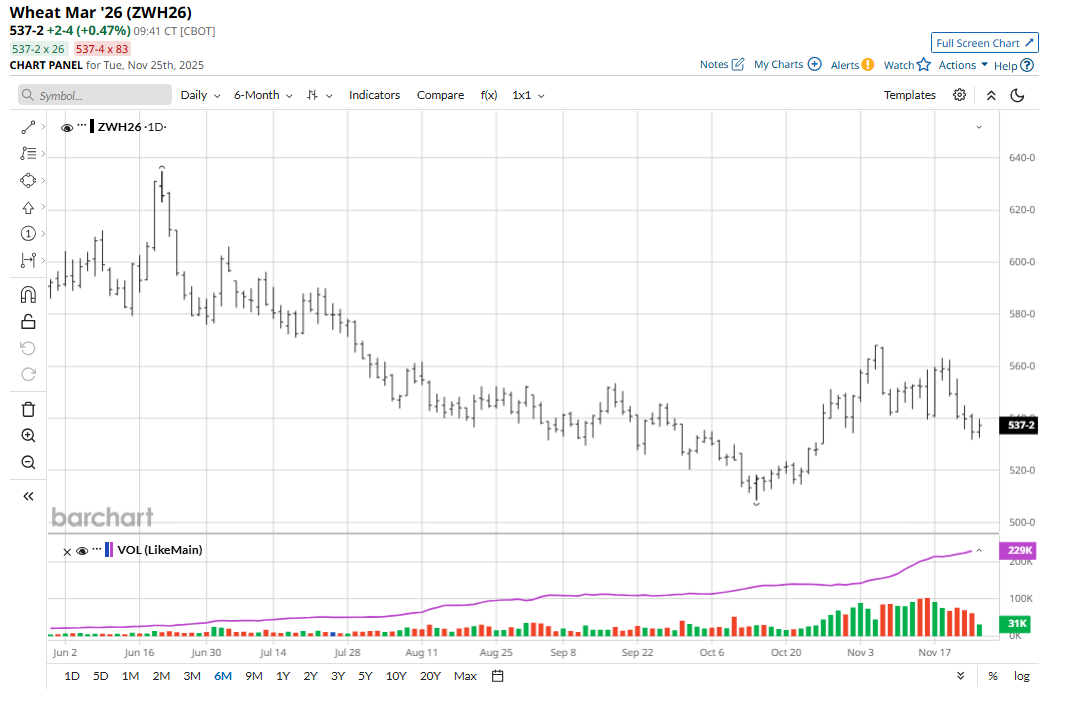

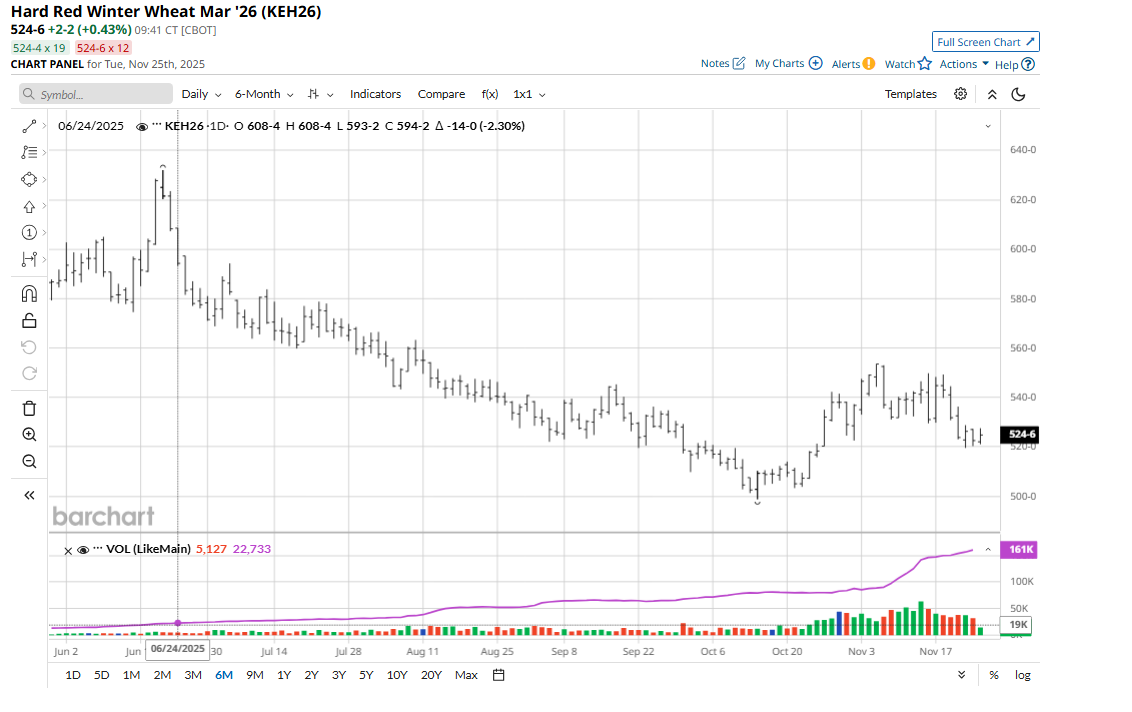

March corn (ZCZ25) futures hit a four-week low on Monday. January soybeans (ZSF26) have backed well down from their November high, while March winter wheat futures (ZWH26) (KEH26) have just hit four-week lows and are starting to trend down. The past week has seen the air come out of the bullish grain markets balloon.

Grain market bulls are working to stabilize prices early this week. However, price action the past week may be forming bearish pennant or flag patterns on the daily bar charts. Corn, soybean, soybean meal (ZMZ25), and winter wheat bulls need to step up and show fresh power this week because the confident, chart-based speculative bears are licking their chops.

Corn and soybean market bulls are hoping that now with the U.S. harvests virtually over, focus will be more on the stronger domestic and export demand picture for corn, as well as fresh purchases of U.S. soybeans from China, that should keep a floor under corn and soybean futures prices. The USDA reported on Monday a daily U.S. soybean sale of 123,000 metric tons to China during the 2025-26 marketing year.

The soybean complex futures have seen selling interest limited early this week as bulls were encouraged after President Donald Trump said on social media Monday that he had “a very good telephone call” with China’s President Xi Jinping. He said soybeans and “other farm products” were discussed. “We have done a good, and very important, deal for our great farmers — and it will only get better. Our relationship with China is extremely strong!” said Trump Monday.

Reports that progress has been made in recent days on a Ukraine-Russia peace deal are bearish for grains and especially for wheat futures, as any peace deal would likely mean more grains — namely wheat — being shipped out of the Black Sea region.

South American Corn and Soybean Weather Coming More into Focus

With the U.S. corn and soybean harvests virtually wrapped up, grain trader attention is turning more to growing weather in Brazil and Argentina. Don’t be surprised to see some degree of a weather-market scare develop for South American corn and soybeans crops in the next few months. Recent rains across northern Brazil, and more in the forecast, will improve growing conditions for developing crops. Central and southern Brazil will see more sunshine than rain the next two weeks, said weather forecasters. Meantime, in Argentina, some western crop areas see subsoil moisture still short.

The U.S. dollar index ($DXY) last week hit a nearly six-month high, which has added to the selling pressure in the grain futures markets lately. Most global grain trading is transacted in U.S. dollars. So, when the greenback appreciates, it makes that grain more expensive to purchase in non-U.S. currency. If the USDX continues to trend higher in the coming months, which may be likely given the recent more hawkish tone on U.S. monetary policy from the Federal Reserve, such would continue to be a weight on grain and soy prices.

(Place December U.S. dollar index daily chart here.)

Cotton Prices Continue to Trend Down, Establish New Contract Lows

March cotton futures last Friday scored a fresh contract low. The natural fiber’s solidly bearish near-term technical posture does not bode well for futures’ upside price potential in the near term. Cotton traders will look to the grain futures markets and the U.S. stock market for price direction in the coming weeks. The very recent rebounds in the U.S. stock indexes after hitting nine-week lows last week is a positive development for the cotton futures market.

Export demand prospects for U.S. cotton are dour as the U.S. harvest is in the late stages. Cotton traders are looking forward to getting a better look at weekly U.S. export sales data from the USDA now that the government has reopened. USDA today reported weekly export sales for the week ended Oct. 9 showed net U.S. cotton export sales of 159,500 running bales (RB), with China taking 16,695 RB for the 2025/26 marketing year.

The stronger U.S. dollar has also added to the selling pressure in the cotton futures market. If the USDX continues to trend higher in the coming months, such would continue to be a bearish weight on cotton futures prices.

At present, the path of least resistance for cotton futures prices remains sideways to lower.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cotton Is Under Serious Pressure and Corn Prices Just Hit a 4-Week Low. Grain Bulls Need to Step It Up.

- Argentina Beef Quota Just Opened — Why Your Grocery Bill Won't Budge, and Live Cattle Is Still Setting Up for a Monster Move

- Corn: Is the Tepid Rally Bearish?

- Learn How to Read These Smart Money Warning Signs as Commitments of Traders Data Comes Back Online