Leidos Holdings, Inc. (LDOS) is a technology and engineering firm specializing in national security, defense, health, and civil markets. Headquartered in Reston, Virginia, Leidos provides scientific, systems-integration, IT, and technical services to government and commercial clients. Its market capitalization stands at around $23.8 billion.

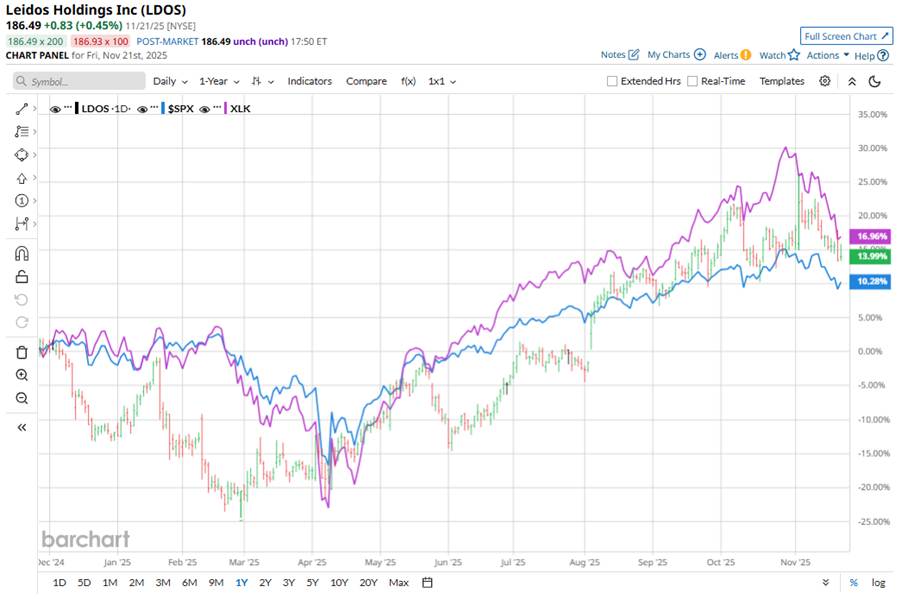

Shares of the defense contractor have outperformed the broader market. LDOS stock has gained 13.2% over the past 52 weeks and 29.5% on a year-to-date (YTD) basis, compared to the S&P 500 Index’s ($SPX) 11% gains over the past year and 12.3% uptick in 2025.

Narrowing the focus, LDOS has lagged behind the Technology Select Sector SPDR Fund’s (XLK) 17% surge over the past year, but significantly outpaced XLK’s 17.5% surge in 2025.

Leidos Holdings’ shares are rising in 2025 mainly because the company is delivering strong earnings and expanding its lucrative backlog. The defense and IT services provider unveiled its third-quarter results on Nov. 4, generating record revenues of $4.5 billion, up about 7% year over year (YoY), while non-GAAP EPS for the quarter was $3.05, up 4% annually. Its total backlog was up 5% YoY.

Meanwhile, its “NorthStar 2030” strategy, focused on growth areas like national security, mission software, and health services, is resonating well amid macro tailwinds.

For fiscal 2025, ending in December 2025, analysts expect Leidos Holdings to deliver a 14.8% YoY growth in EPS to $11.72. However, the company has a robust earnings surprise history. The company has surpassed the Street’s bottom-line projections in each of the past four quarters by solid margins.

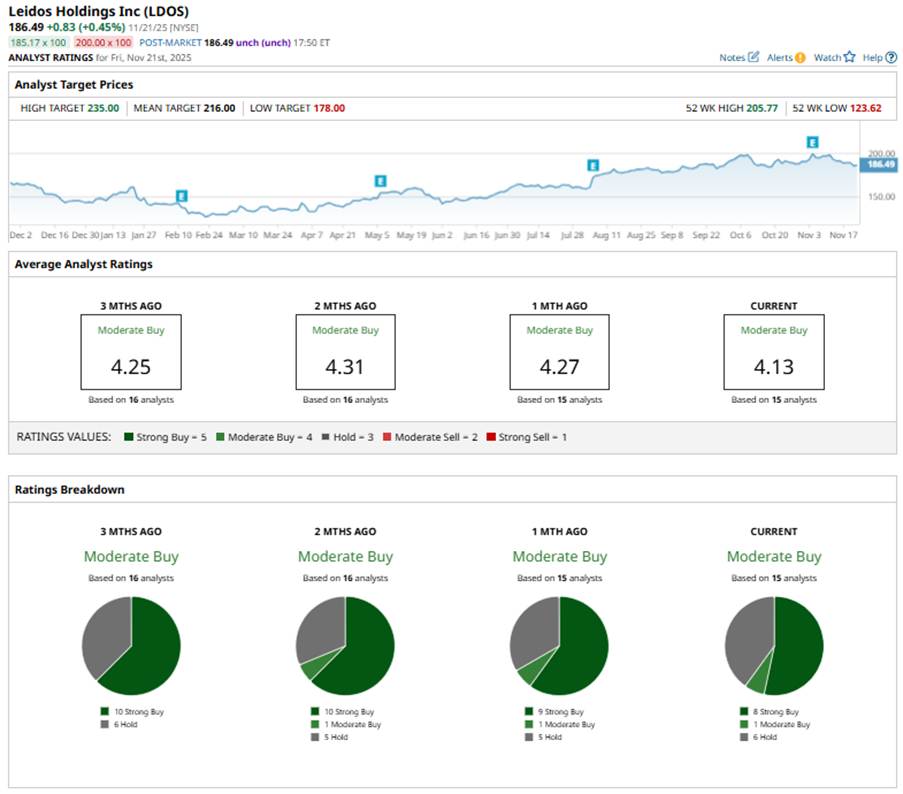

The stock has a consensus “Moderate Buy” rating overall. Of the 15 analysts covering the stock, eight suggest a “Strong Buy,” one has a “Moderate Buy,” and six analysts are playing it safe with a “Hold” rating.

This configuration is slightly less bullish than two months ago, when there were 10 “Strong Buy” ratings.

Earlier this month, Jefferies lifted its price target on LDOS to $230 from $215, reaffirming its “Buy” rating after what it called “another strong quarter.”

LDOS’ mean price target of $216 represents a notable 15.8% premium to current price levels. Meanwhile, the street-high target of $235 suggests a 26% potential upside.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart