Lockheed Martin Corporation (LMT), based in Bethesda, Maryland, operates as a prominent force in aerospace, defense, and security. Its groundbreaking work includes designing and producing advanced technologies across multiple sectors, from aeronautics and space systems to missile and fire control systems.

Through innovation and global partnerships, the corporation ensures security and scientific advancement. With a market capitalization of $108.94 billion, Lockheed Martin’s reach extends worldwide, and its diverse portfolio underscores its commitment to developing superior solutions for government and commercial clients worldwide.

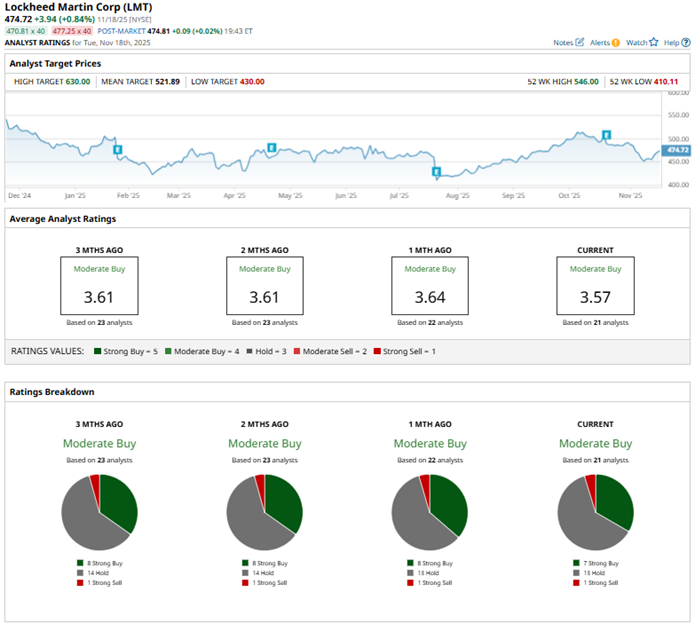

Lockheed’s stock has come under pressure over the past year due to significant program losses. There has also been uncertainty surrounding U.S. defense budgets. Over the past 52 weeks, the stock has been down 10.6%, while it has gained by a modest 1.4% over the past six months. Lockheed’s shares had reached a 52-week low of $410.11 in July, but are up 15.8% from that level.

On the other hand, the broader S&P 500 Index ($SPX) has gained 12.3% and 11.1% over the same periods, respectively, indicating that the stock has underperformed the broader market. The same trend can be observed when comparing the stock's performance with that of the industrial sector. The Industrial Select Sector SPDR Fund (XLI) has gained 7.9% over the past 52 weeks and 4.2% over the past six months.

On Oct. 21, Lockheed Martin reported its third-quarter results for fiscal 2025. The company’s revenue increased 8.8% year-over-year (YOY) to $18.61 billion, beating the $18.56 billion Wall Street analysts had expected. EPS for the quarter was $6.95, up 2.2% from the prior year’s period and higher than the $6.33 that Wall Street analysts had expected. The company also highlighted its record $179 billion backlog, which equates to more than 2.5 years of sales.

Lockheed Martin also raised its outlook for the current year following its Q3 results. On top of that, recently, President Trump confirmed that the U.S. will sell F-35 fighter jets to Saudi Arabia.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Lockheed Martin’s EPS to decline 1.6% YOY to $28.01 on a diluted basis. However, EPS is expected to increase 6% annually to $29.69 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

Among the 21 Wall Street analysts covering Lockheed’s stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, 13 “Holds,” and one “Strong Sell.” The ratings configuration is less bullish than it was a month ago, with seven “Strong Buy” ratings now, down from eight previously.

Last month, UBS analyst Gavin Parsons maintained a “Neutral” rating on Lockheed Martin, but lowered the price target from $514 to $513. On the other hand, Morgan Stanley analyst Kristine Liwag maintained an “Overweight” rating and raised the price target from $530 to a Street-high $630.

Lockheed Martin’s mean price target of $521.89 indicates a 9.9% upside over current market prices. The Street-high price target of $630 implies a potential upside of 32.7%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Elon Musk Just Teased Tesla’s ‘Most Memorable Product Unveil Ever’ with Roadster in Development and New ‘Electric Flying Car’

- Netflix Stock Is Now More Accessible After a 10-for-1 Split, But Is NFLX a Buy?

- This ‘Strong Buy’ Jet Engine Stock Is Partnering Up with Palantir. Should You Buy Shares Here?

- High-Probability AMZN Iron Condor with 13% Return Potential