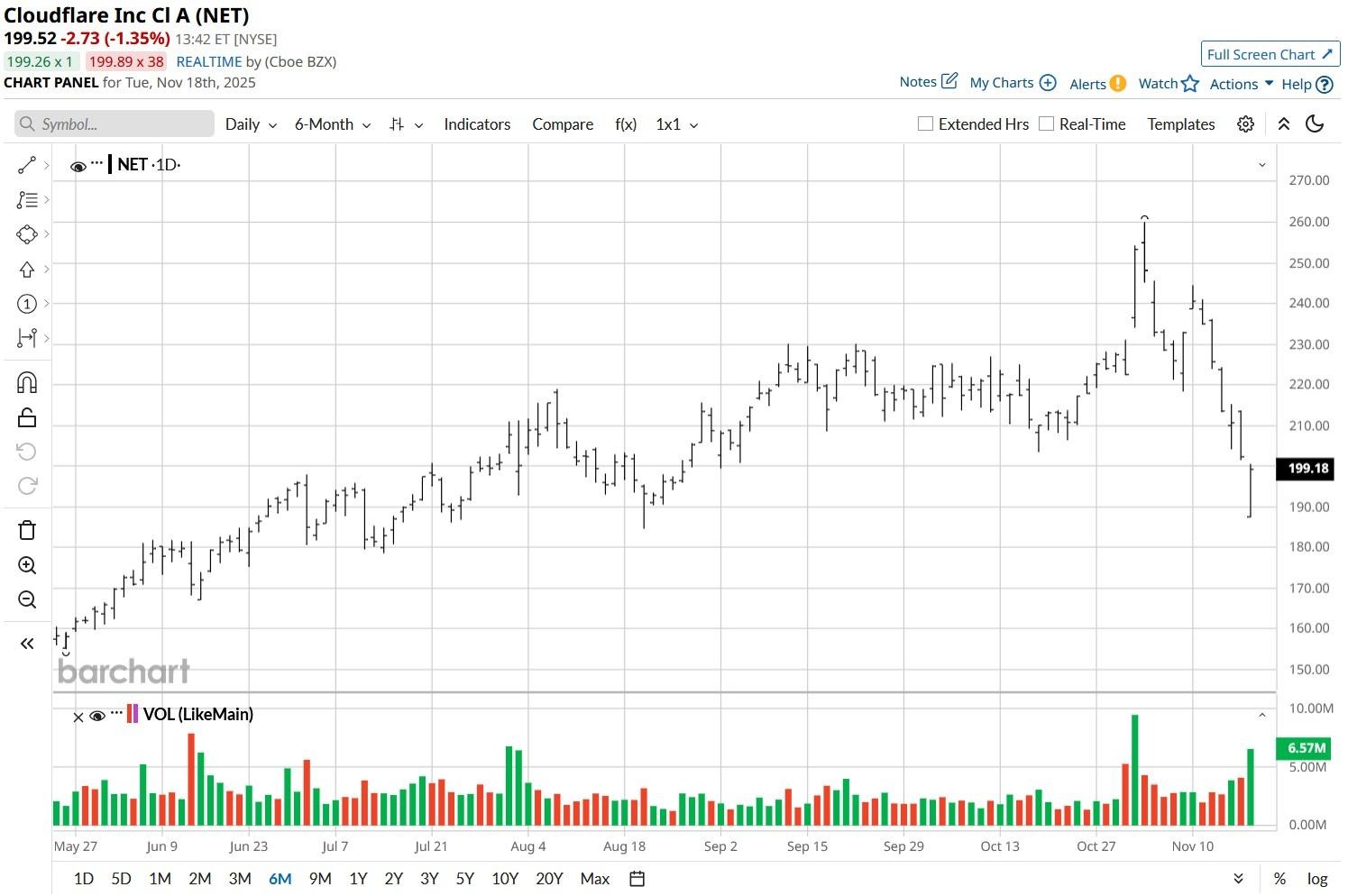

Cloudflare (NET) shares opened in the red on Tuesday, Nov. 18 as the internet services company suffered a global outage that triggered partial or complete downtime across services, including ChatGPT and PayPal (PYPL).

The selloff pushed NET stock decisively below its 100-day moving average (MA), a key support that, when breached, signals accelerated downward momentum ahead.

At its intraday low, Cloudflare stock was down about 25% versus its year-to-date high on Tuesday.

Is Cloudflare Stock Worth Buying on the Pullback?

Despite the 100-day MA indicating bearish momentum ahead, the post-incident dip in NET shares is worth buying given the aforementioned outage is unlikely to hurt the company’s financials.

Why? Because most of its clients are on long-term contracts or SLAs (Service Level Agreements), which typically allow for brief disruptions without major penalties.

What it means is that the loss of revenue from today’s outage will likely be limited only.

Meanwhile, Cloudflare’s rapid response, resolving the issue within hours, may contain reputational damage as well, further paving the way for its share price to recover heading into 2026.

TD Cowen Sees Massive Upside in NET Shares

TD Cowen analysts also seem to believe that the outage on Nov. 18 will likely prove a short-term hiccup for Cloudflare shares only, not a long-term setback.

In a research note on Tuesday, they reiterated their “Buy” rating on the California-based company, with a $265 price target indicating potential upside of nearly 40% from here.

Investors should consider investing in the cloud stock on recent weakness also because historically (over the past four years), it has gained more than 10% on average in November.

Wall Street Remains Bullish on Cloudflare

TD Cowen isn’t the only Wall Street firm that’s recommending sticking with Cloudflare stock for 2026.

According to Barchart, the consensus rating on NET shares remains at “Moderate Buy” with the mean target of about $250 indicating potential upside of more than 30% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.