Germantown, Tennessee-based Mid-America Apartment Communities, Inc. (MAA) is a real estate investment trust (REIT) that owns, acquires, develops, manages and redevelops multifamily apartment communities. Valued at a market cap of $15.3 billion, the company targets high-growth Sunbelt markets and emphasizes a full-cycle, technology-enabled operating platform.

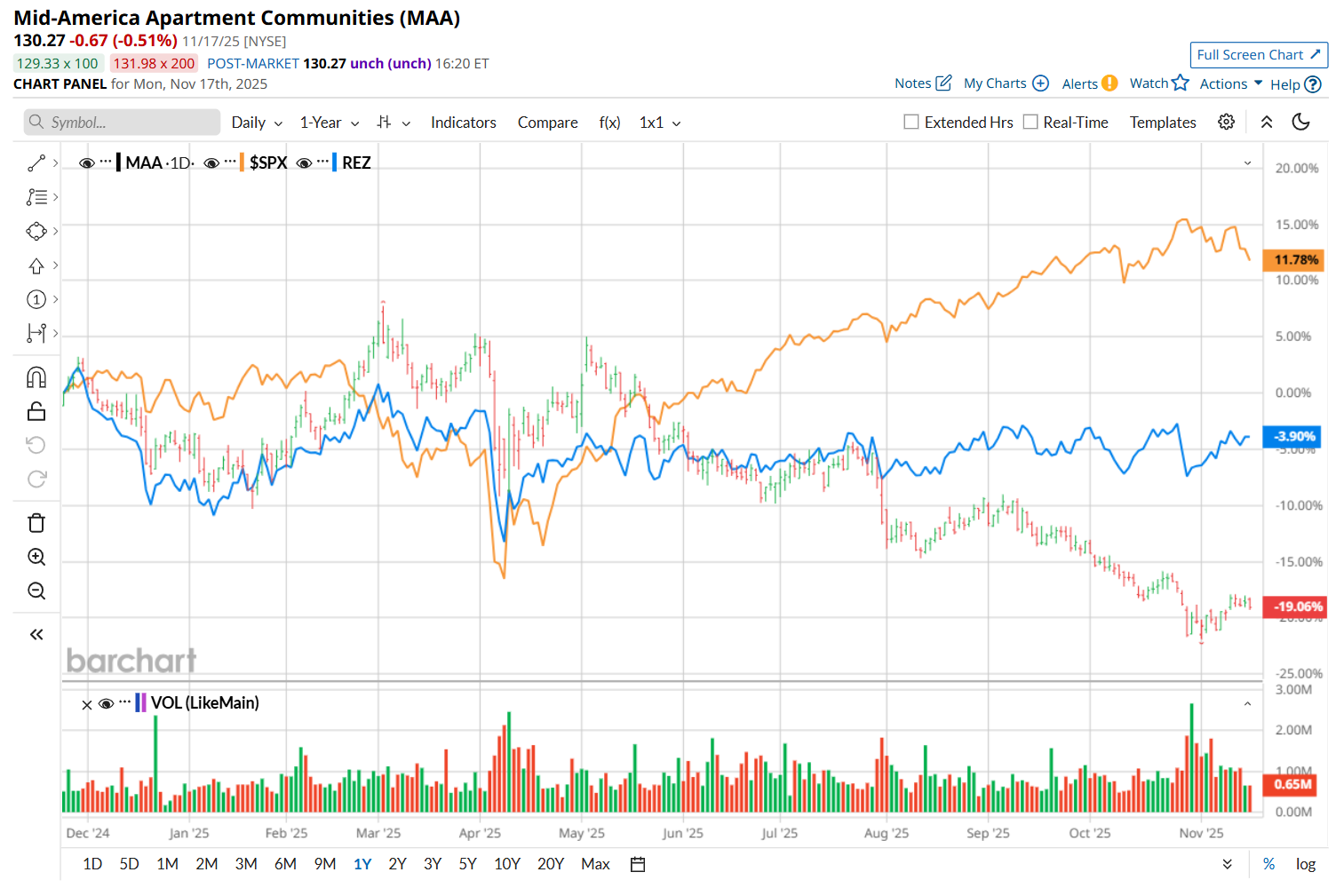

This residential REIT has considerably underperformed the broader market over the past 52 weeks. Shares of MAA have declined 17.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.7%. Moreover, on a YTD basis, the stock is down 15.7%, compared to SPX’s 13.4% uptick.

Narrowing the focus, MAA has also lagged behind the iShares Residential and Multisector Real Estate ETF’s (REZ) 2.6% drop over the past 52 weeks and 4.1% YTD rise.

MAA posted weaker-than-expected Q3 results on Oct. 29, and its shares plunged 3.4%. The company's rental and other property revenue grew marginally year-over-year to $554.4 million, missing consensus estimates by a slight margin. Meanwhile, its core FFO of $2.16 fell 2.3% from the year-ago quarter, falling short of Wall Street estimates by a penny. Additionally, its same-store revenue also slightly declined from the same period last year, while its same-store Net Operating Income (NOI) slid 1.8%.

For the current fiscal year, ending in December, analysts expect MAA’s FFO to decline 1.6% year over year to $8.74. The company’s FFO surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while missing on two other occasions.

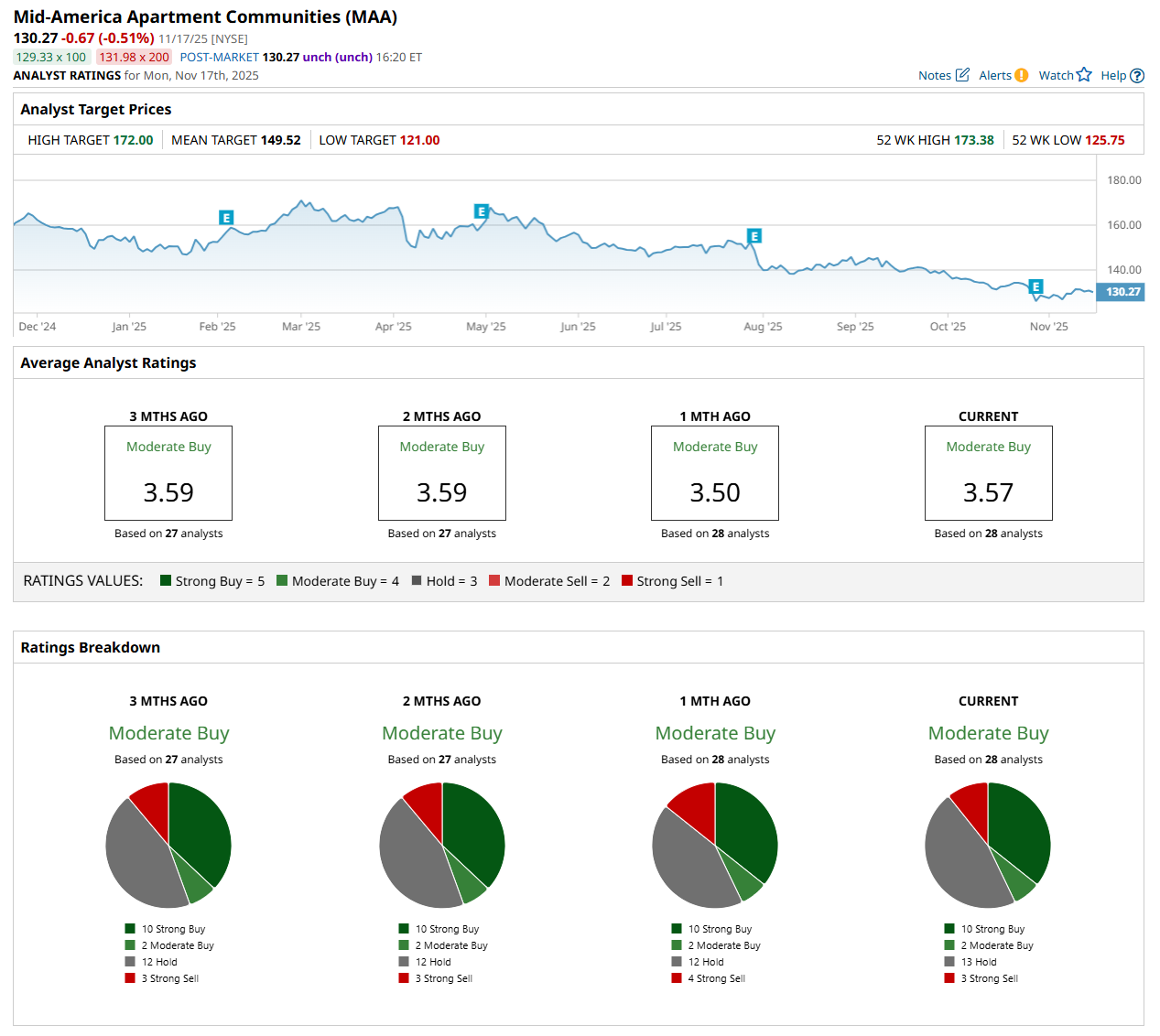

Among the 28 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 10 “Strong Buy,” two "Moderate Buy,” 13 "Hold,” and three “Strong Sell” ratings.

This configuration is slightly more bullish than a month ago, with four analysts suggesting a “Strong Sell” rating.

On Nov. 13, Morgan Stanley (MS) maintained an "Overweight" rating on MAA but lowered its price target to $164, indicating a 25.9% potential upside from the current levels.

The mean price target of $149.52 represents a 14.8% premium from MAA’s current price levels, while the Street-high price target of $172 suggests a 32% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Think AI Stocks Are Overvalued? Invest in These Data Center Power Trades for the Next Growth Phase.

- This High-Yield Dividend Stock Is Beaten Down, But Wall Street Still Loves It

- Unusual Options Activity Shows 71,000 Calls Hit the Tape for Applied Digital Stock – How You Should Play APLD Here

- AMD Is Powering the New Steam Machine. Will It Move the Needle for AMD Stock?