Thanks to the criticality of the rare-earth materials that undergird myriad advanced technologies, mining and processing specialist MP Materials (MP) stands on unique geopolitical ground. As the only operating rare earth mining facility in the U.S., MP’s success carries significant economic and national security interests. For that reason alone, any dips in its equity should be researched as potential discounted entries.

Sure enough, the performance of MP stock has been nothing short of extraordinary. Since the beginning of this year, MP stock gained nearly 276%. That means at the start of 2025, shares could have been purchased for under $20. While it’s unlikely that such prices will materialize again anytime soon, those who missed the boat previously may have another shot on their hands.

In the trailing month, MP stock has witnessed a valuation hemorrhage, with the equity giving up almost 35%. Further, the performance last week was also poor, with the security losing about 5%. Some of the bearishness could have been tied to options flow, which focuses exclusively on big block transactions likely placed by institutional investors.

On Nov. 11, net trade sentiment slipped more than $1.36 million below parity. In the next session, this metric landed at $395,500 below the zero line, suggesting rising skepticism against MP stock.

However, circumstances appear to have improved heading into last weekend, with net trade sentiment rising to $763,300 on Friday. Moreover, in the open market session on the same day, MP stock gained close to 2%, with extended hours taking the security up almost another percentage point.

To be sure, the volatility that has rippled against the mining specialist has been frightening. At the same time, there’s no indication that rare earths will become less of a political tinderbox. If anything, tensions over their supply chains are escalating.

By logical deduction, then, MP should be viewed as an upside prospect — not a name to be avoided.

Market Correction Hysteria Hides a Potential Discount in MP Stock

Granted, many of the concerns tied to MP stock at this juncture is likely related to broader correction fears. Simply stated, many experts — from talking heads on CNBC to YouTube finance gurus — have warned about a potential crash in the tech ecosystem. While such a harbinger isn’t out of the question, it also brings up the obvious question: what’s the pressure point that forces people to sell their shares?

For a panic to happen, people generally need to be driven out of their position. With relatively low unemployment and credit markets still relatively loose, the environment really isn’t conducive for a crash. Plus, with seemingly everybody prepared for a catastrophic downturn, a downturn would be the last thing that would likely catch the market by surprise.

Another point to consider that almost no one in finance articulates is that the strength of heuristics imposes an inverse relationship to the underlying methodology’s efficacy. For example, tic-tac-toe is not a rigorous game in part because of its powerful heuristics, such as always taking the center if starting a move.

This is to say that if simply identifying MP stock as having a “high multiple” is considered evidence for a methodology’s effectiveness, that methodology is probably not effective.

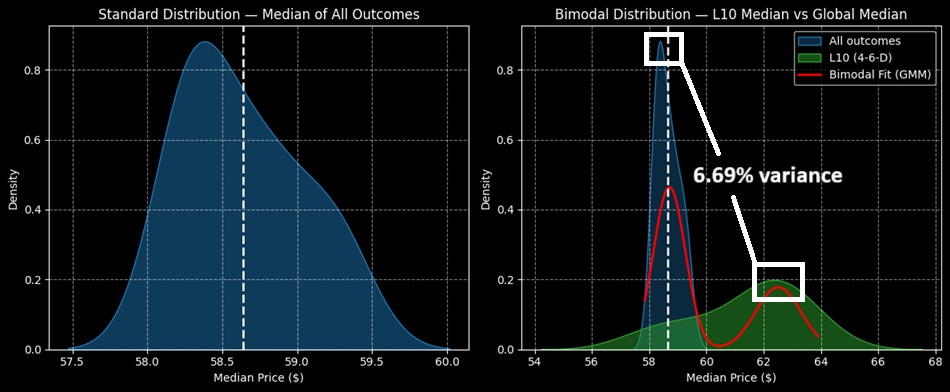

What might be at least mathematically instructive are Kolmogorov-Markov frameworks layered with kernel density estimations. Using such an approach, the forward 10-week median returns of MP stock can be arranged as a distributive curve, with outcomes ranging between $57.50 and $60 (assuming an anchor price of $58.64, Friday’s close). Further, price clustering would likely be predominant at $58.30. This translates to a neutral to slightly negative bias.

The above assessment aggregates sequences or trial attempts, if you will, going back to the company’s IPO in June 2020. However, the current behavioral pattern is not in a homeostatic or baseline state but is rather structured in a distributive 4-6-D formation; that is, in the past 10 weeks, MP stock printed four up weeks and six down weeks, with an overall downward slope.

Under this specific setup, the observed forward 10-week outcomes shift quite dramatically from the aggregate state, with prices ranging between $54 and $68. Further, price clustering would likely occur at $62.20.

Using the Informational Arbitrage to Bet on MP Materials

One of the reasons why I have gravitated toward quantitative analysis and away from technical analysis is the very informational arbitrage that was demonstrated above. Essentially, under 4-6-D conditions, MP stock would be expected to cluster around $62 as opposed to $58.30, which would be its normal tendency.

To be sure, conducting this informational arbitrage calculation doesn’t guarantee that MP stock will land there. As I demonstrated, the distribution of outcomes following a 4-6-D is wider than the baseline. However, given enough attempts, there should be an observed density that’s greater around $62 than at other price points.

So, if you’re betting on MP stock, it simply makes sense to go where the distribution is the densest. In technical analysis, the concept of density variance doesn’t even exist. This should raise alarm bells. If a methodology is completely blind to the variance that defines relative value, how can that methodology consistently find relative value?

In other words, how is a methodology that is structurally incapable of finding alpha able to find alpha? If somebody has an answer, please let me know.

Getting back to MP stock, one idea that stands out is the 60/65 bull call spread expiring Jan. 16, 2026. This trade is attractive because the breakeven price sits at $62, which again is where the clustering should be predominant. However, the $65 strike price is still within the realistic range of distributional outcomes. If MP gets there, you’re looking at a 150% payout.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why MP Materials’ (MP) Implosion Presents a Rare Upside Opportunity for Quants

- Make a 3.5% Yield In One Month By Shorting Cash-Secured OTM Palantir Put Options

- Get Paid to Buy Stocks With These Pro Tips for Selling Naked Put Options Successfully

- Option Volatility and Earnings Report for November 17 - 21