Meta Platforms (META) has seen its stock drop roughly 15% this month as investors digest the company's aggressive spending plans. However, Wedbush Securities remains bullish on META stock with a $920 price target, indicating an upside potential of 50% from current levels.

The investment firm added Meta to its “Best Ideas” list, arguing the recent selloff has created an attractive entry point despite near-term concerns about rising expenses and capital expenditures. Valued at a market capitalization of $1.54 trillion, META stock has increased by 445% over the last three years. Despite these outsized gains, it trades 23% below all-time highs.

The pullback follows Meta's third-quarter earnings report, which showed revenue climbing 26% year-over-year (YoY) and beating analyst expectations. However, operating costs surged even faster at 32%, raising questions about the margin trajectory. Meta also warned that capital spending will be substantially higher next year as it accelerates its investments in artificial intelligence and expands its data center infrastructure.

The social media giant raised the lower end of its 2025 capital expenditure guidance to a range of $70 billion to $72 billion, up from the previous $66 billion to $72 billion. Quarterly profit took a significant hit from a roughly $16 billion one-time charge related to President Trump's tax legislation.

Wedbush analysts emphasize that Meta's heavy spending has been justified, citing meaningful improvements across its advertising systems and content recommendation engines resulting from AI integration.

The firm highlighted robust growth in Meta's core advertising business, positive developments around Meta AI and Superintelligence Labs, and momentum from new AI-driven hardware launches as key reasons for optimism.

Is Meta a Good Buy Right Now?

Meta Platforms is positioning itself at the forefront of artificial intelligence development through its newly formed Superintelligence Labs, which CEO Mark Zuckerberg claims has achieved the highest talent density in the industry.

The company is aggressively front-loading infrastructure capacity to prepare for potential breakthroughs in superintelligence, as it expects the upside to justify the investment risk even if the technology takes longer to materialize.

Meta revealed plans for its first gigawatt-plus data center cluster launching next year under the code name Prometheus. The company has another five-gigawatt project in development that could scale to that capacity if needed.

The AI strategy centers on delivering deeply personalized experiences across Meta's family of apps. The company's recommendation systems are already showing strong results, increasing the time spent on Facebook by 5% and on Threads by 10% during the third quarter. Video content continues to drive engagement, with Instagram video time up over 30% YoY. Notably, Reels alone generates over $50 billion in annual revenue run rate.

Meta's advertising business continues to benefit from AI improvements in ranking systems. The company has unified different models into simpler, more general systems that deliver better performance and efficiency.

Revenue running through completely end-to-end AI-powered advertising tools has surpassed $60 billion annually. The long-term vision involves combining three major AI systems that currently run Facebook, Instagram, and advertising recommendations into a single unified system.

Business AI represents another major opportunity, with people engaging in over 1 billion active messaging threads daily with business accounts across Meta's platforms. Improved models will enable tens of millions of businesses to scale customer conversations and drive sales more efficiently at lower costs, creating a substantial revenue opportunity as the technology matures.

What Is the META Stock Price Target?

Analysts forecast that Meta's sales will increase from $164.5 billion in 2024 to $347.58 billion in 2029, indicating an annual growth rate of 16%. During this period, adjusted earnings per share are forecast to increase by 10% annually, from $23.86 per share to $38.26 per share.

Over the last 10 years, META stock has traded at an average price-to-earnings multiple of 24.5 times, with an annual earnings growth rate of 22%. If we assume META stock to trade at 15x earnings, it should be priced at $575 in late 2028, which is below the current trading price of $619.

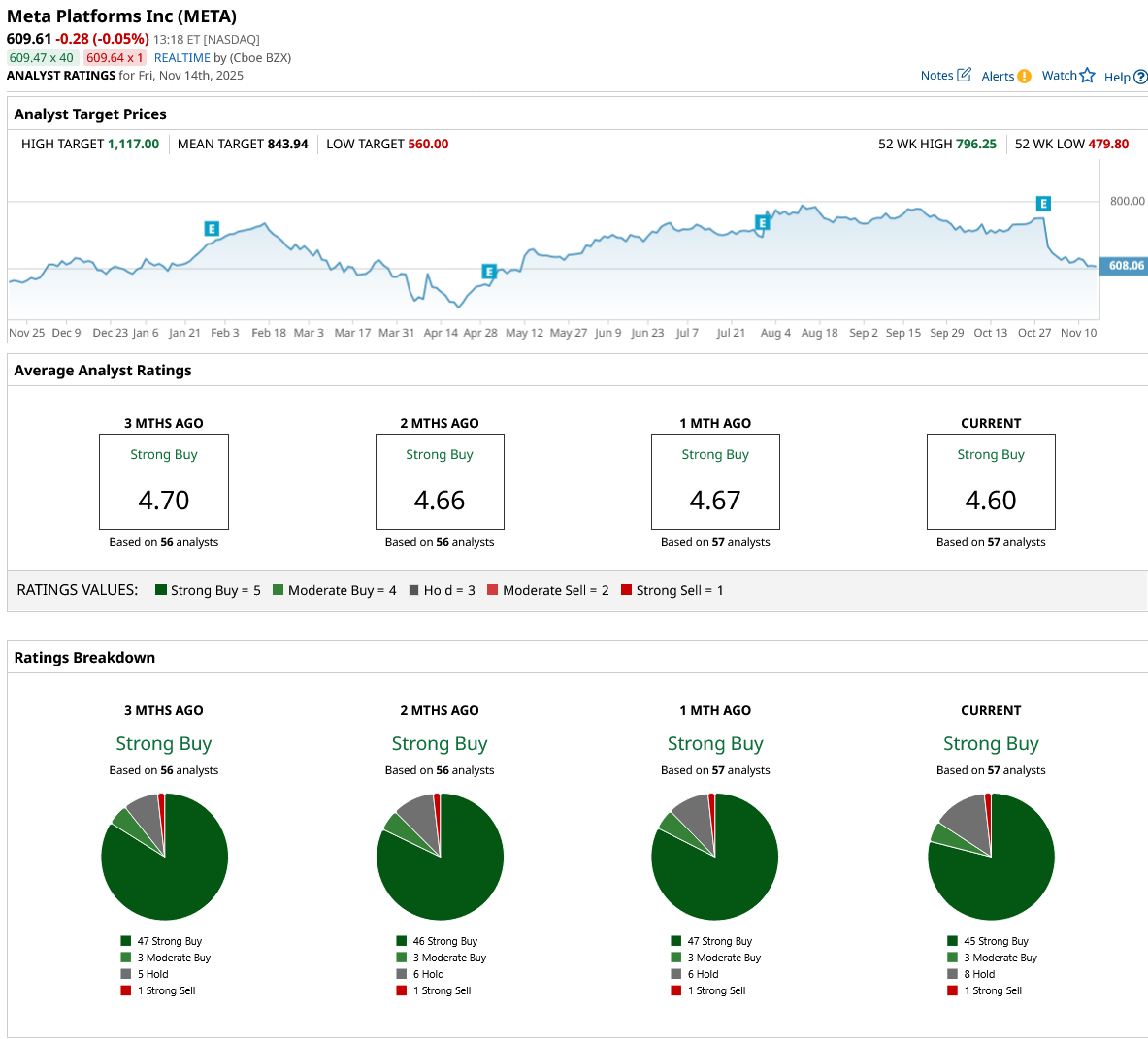

Out of the 57 analysts covering META stock, 45 recommend “Strong Buy,” three recommend “Moderate Buy,” eight recommend “Hold,” and one recommends “Strong Sell.” The average META stock price target is $843.94, indicating a potential upside of almost 40%.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Michael Burry Warned That the AI Bubble Is About to Burst. If You Agree, Use Options to Bet Against These 2 Stocks.

- Cathie Wood Is Buying the Dip in Circle Stock. Should You?

- These 3 Unusually Active Puts Deep ITM Offer Strategic Plays for Both Bulls and Bears

- META Stock Has Fallen 15% This Month, but Wedbush Says It Can Soar 50% from Here