In biotech, success often begins in the lab — and for CRISPR pioneers, every clinical trial feels like a moonshot. Gene-editing is not just science but rewriting life itself. For clinical-stage companies, one successful trial can mean validation, funding, and survival, while one failure can send years of research crashing down overnight.

That’s exactly what happened with Intellia Therapeutics (NTLA). Once a rising star in CRISPR innovation, the company’s story took a tragic turn when an elderly patient in the firm's MAGNITUDE Phase III trial passed away following severe liver complications. The patient, dosed with Intellia’s therapy candidate nexiguran ziclumeran (nex-z), showed elevated enzyme levels weeks after treatment. The U.S. Food and Drug Administration (FDA) swiftly imposed a full clinical hold, halting both MAGNITUDE studies and shaking confidence across the gene-editing world.

NTLA stock plunged after Intellia paused dosing over safety concerns, and just days later, regulators made it official, imposing a clinical hold that hinted at a longer freeze ahead. Then the patient at the center of the trial lost their life, prompting analysts to swiftly cut targets. Consequently, sentiments soured, and optimism faded into doubt.

To that end, should you buy the dip in NTLA stock? Or wait for the dust to settle?

About Intellia Therapeutics Stock

Intellia Therapeutics is a trailblazer in CRISPR/Cas9 gene editing, engineering next-gen therapies. Its in vivo programs target disorders and diseases like hereditary angioedema and transthyretin amyloidosis by delivering gene editors directly into the body, while ex vivo efforts reprogram cells outside it to combat cancer and autoimmune disorders. With a $1.1 billion market capitalization, Intellia’s scalable tech platform drives its mission to turn gene editing into lasting, curative medicine.

Over the past year, NTLA stock has been volatile. Flying high at $28.25 in late October, NTLA has since nosedived 66% from that peak, marking a 43% drop over the past 52 weeks and a 19% decline year-to-date (YTD).

The free fall came when Intellia voluntarily halted dosing and enrollment in its Phase 3 trials of nex-z after a patient experienced a “grade 4” liver toxicity event — an alarming spike in enzymes and bilirubin that led to hospitalization. Days later, the FDA compounded the setback by officially placing both late-stage trials on hold. When news broke on Nov. 6 that the affected patient had passed away, shares sank another 23% on Nov. 7, deepening investor unease and stoking fears over the safety of Intellia’s in vivo CRISPR platform.

Technically, the chart mirrors the sentiment. The yellow MACD line has slid sharply below the blue signal line, reinforcing bearish momentum, while widening negative histogram bars confirm strong downside pressure. The 14-day RSI sits near 33, hovering around oversold territory — a sign that selling may be overextended but not yet exhausted.

In terms of valuation, NTLA stock is not cheap, trading at about 19.5 times forward sales, and carrying a premium next to most biotech peers. Yet, interestingly, it now sits below its own historical median, hinting that investors have dialed down expectations. For a gene-editing pioneer, that might just be the calm before the next spark.

A Snapshot of Intellia Therapeutics’ Mixed Q3 Results

Intellia unveiled its third-quarter earnings report. For the biotech company, the quarter was supposed to mark steady progress. Instead, it turned into a test of resilience. Intellia reported revenues of $13.8 million, a 51% jump year-over-year (YOY) but still shy of Wall Street’s mark. The gains came largely from cost reimbursements tied to its collaboration with Regeneron (REGN), one of the few bright spots in an otherwise turbulent quarter.

Losses narrowed to $0.92 per share, better than expected. R&D spending also dropped 23% annually to $94.7 million, signaling tighter cost control as the biotech juggles risk and reality. General and administrative expenses of $30.5 million were flat YOY.

Then came the storm. Just as investors digested the earnings, Intellia’s flagship gene-editing therapy, nex-z, ran into serious trouble in the form of a fatal patient case and an FDA-imposed clinical hold. The pause now leaves hundreds of patients waiting, and optimism for a quick recovery looks thin.

The regulatory blow has also clouded the future of lonvoguran ziclumeran (lonvo-z), Intellia’s other late-stage bet targeting hereditary angioedema. The company completed enrollment in its pivotal HAELO Phase III study in September and expects top-line data by mid-2026 — results that could now define Intellia’s near-term fate.

Still, there is some breathing room. With $669.9 million in cash and marketable securities, Intellia is funded through mid-2027. That's enough runway to regroup and refocus. CEO John Leonard noted the company is tightening patient monitoring and working closely with regulators to resolve the setback.

The tone from management was steady but cautious, a mix of scientific resolve and damage control. For now, Intellia’s story stands at a crossroads — one misstep from doubt, one breakthrough away from redemption.

Wall Street still sees a flicker of optimism in Intellia’s story. Analysts expect the company to trim its red ink, with per-share losses projected to narrow 19% annually this year to $4, followed by a further 10% YOY improvement to a loss of $3.61 in 2026. That’s a slow but steady climb back from the biotech bruising.

What Do Analysts Think About Intellia Therapeutics Stock?

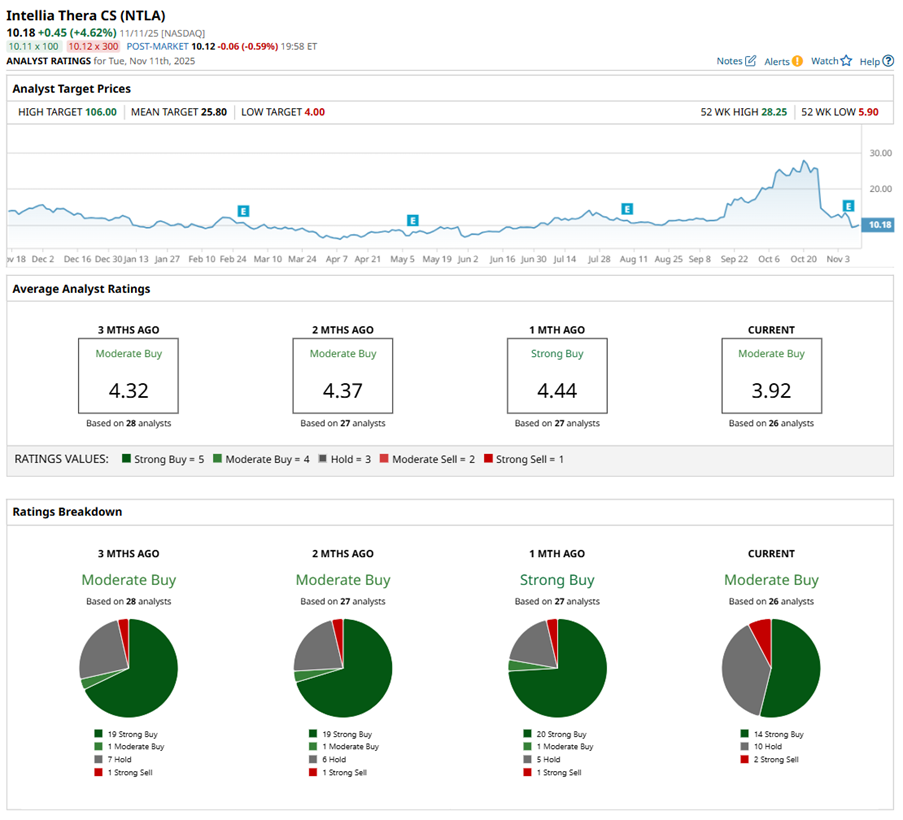

Intellia Therapeutics’ story has taken a sharp turn, shaking both Wall Street and the gene-editing world. The biotech now faces scrutiny after the patient fatality and clinical hold, news which has already triggered a wave of analyst downgrades and price cuts.

Citizens JMP trimmed the price target on NTLA stock to $21 from $29, but kept an “Outperform” rating. The firm also removed the ATTR program from its model, noting that the fatality and the regulatory hold raised near-term uncertainty.

Truist Securities held on to its “Buy” rating but lowered its target sharply to $14 from $25. Analyst Joon Lee emphasized that, despite the loss of a patient, nex-z could still move forward given the patient’s complex medical history and advanced age.

Jones Trading, once bullish, stepped back with a downgrade to “Hold” from “Buy" after NTLA stock tumbled by double digits in a week. The brokerage firm said that while Intellia’s therapies have shown durable efficacy in new follow-up data, the uncertainty around safety is overshadowing progress. Following discussions with medical experts, Jones concluded that the balance of risk and market sentiment warranted a more cautious stance.

Evercore ISI downgraded NTLA stock from “Outperform” to “In Line”, cutting its target to $8 from $17. The firm cited uncertainty around the ATTR program’s timeline, despite acknowledging “very promising efficacy updates.” Evercore noted that there’s a “path to value" — albeit a narrower, riskier one — and said that clarity could come with the HAELO results expected next spring.

While still overall bullish, Wall Street’s tone has softened a little. NTLA stock has a consensus “Moderate Buy” rating overall. Of the 26 analysts rating the stock, 11 analysts recommend a “Strong Buy” rating, 13 are cautious with a “Hold” rating, and two analysts are outright skeptical with a “Strong Sell” rating.

The consensus price target of $22.07 represents 132% potential upside from current levels. The Street-high price target of $106 implies that NTLA could rise 1,016% from here.

Conclusion

The biotech world has long-known that breakthroughs come with bruises — and Intellia’s tragedy is the latest reminder of that truth. The company now stands at the crossroads of promise and peril after a patient fatality derailed its lead CRISPR program, triggering an FDA hold and rattling investor confidence. Analysts, once bullish, have swiftly cut price targets and trimmed their expectations, acknowledging both the uncertainty around nex-z and the pressure it places on lonvo-z, Intellia’s next big hope.

Despite strong science and nearly $670 million in cash, Intellia remains a loss-making company, navigating through a storm where even one misstep can erase years of progress. Clinical setbacks like these aren’t new to gene therapy — giants like Sarepta (SRPT) and Pfizer (PFE) have faced similar hardships — yet each incident chips away at market faith.

Whether NTLA’s dip after the tragedy is a buying opportunity or a cautionary tale will depend on which side investors choose — the fear of failure, or the faith that tomorrow’s cure is on the horizon.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- United Airlines (UAL): Hidden Behind the Shutdown Deal is a Secret Informational Arbitrage Opportunity

- Penn Entertainment Is Breaking up With ESPN in Sports Betting Deal. Should You Sell PENN Stock Here?

- Loop Capital Says This Semiconductor Stock Is Poised for Big Gains Ahead in 2026

- Should You Buy the Dip in Intellia Therapeutics Stock?