In a surprising turn of events sending shockwaves through the betting world, Penn Entertainment (PENN) recently announced the end of its marquee partnership with ESPN, bringing its long-standing sportsbook deal to a close earlier than expected.

Penn and ESPN have mutually agreed to end their exclusive U.S. online sports betting partnership early, effective Dec. 1, 2025. The 10-year deal, launched in August 2023, gave the firm rights to the ESPN BET brand in exchange for $150 million annually and stock warrants. Despite user growth and product improvements, Penn Entertainemnt CEO Jay Snowden said both sides agreed to “wind down” amicably after missing market share goals.

Penn Entertainment will rebrand its U.S. sportsbook as theScore Bet, expanding from its successful Ontario operations and leveraging its 4-million-user media app. ESPN, which brought nearly 3 million users to Penn Entertainment’s platform, will now seek other betting partnerships while helping with the transition.

As Penn finally admits that the math doesn’t add up, is it time to hit the exit?

About Penn Entertainment Stock

Penn Entertainment is a gaming and entertainment company headquartered in Wyomissing, Pennsylvania. The company operates a portfolio of land-based casino and racetrack properties across multiple states, alongside significant digital gaming and sports-betting platforms. Penn’s market capitalization is around $2 billion.

Over the past 52 weeks, PENN stock's share price has declined by 29%, reflecting heightened investor caution amid shifts in the gaming and sports-betting space. PENN stock is currently trading down by 34% from its 52-week high of $23.08.

On a year-to-date (YTD) basis, the stock is down roughly 23%, with a 6.5% decline in just the past five days, marked by pressure as strategic moves such as the early termination of its ESPN sports-betting deal weigh on sentiment.

With that said, PENN stock is trading at a discount to its industry peers at 0.32 times forward sales.

Mixed Q3 Performance

Penn Entertainment released its third-quarter 2025 earnings on Nov. 6, revealing a mixed performance that underscores both the strength of its land-based casino operations and the headwinds facing its digital segment.

Total revenue came in at about $1.7 billion, a 4.8% increase year-over-year (YOY) but just shy of analyst expectations. While the retail casino business maintained favorable metrics with revenues of $1.4 billion and segment adjusted EBITDAR of $465.8 million with a margin of 32.8%, the interactive (online betting and iCasino) unit reported revenues of $297.7 million but an adjusted EBITDA loss of $76.6 million.

Notably, the company recognized an adjusted EPS loss of $0.22 per share, compared to a loss of $0.25 the same time last year, substantially missing estimates and reflecting an impairment charge within the interactive segment. Additionally, management emphasized a strategic refocus with the early termination of its marketing agreement with ESPN and a planned rebrand of its U.S. online sportsbook offering to theScore Bet.

Penn further updated its 2025 capital expenditure forecast to $685 million, down from prior guidance of $730 million. The firm also projects net cash interest expense of about $160 million for the year.

Management reiterated its expectation that the interactive segment will break even or better in 2026, signaling a clear strategic pivot to cost discipline and monetization rather than purely volume growth.

Analysts expect loss per share to improve 80% YOY to a loss of $0.32 in fiscal 2025, before further improving by 375% to EPS of $0.88 in fiscal 2026.

What Do Analysts Expect for Penn Entertainment Stock?

Earlier this month, Needham downgraded PENN stock to “Hold” from “Buy” following the company’s decision to end its partnership with ESPN and pivot toward a new interactive strategy centered on iGaming and omnichannel integration in the United States.

On the other hand, however, Stifel recently upgraded PENN stock from “Hold” to “Buy,” and raised the price target to $21 from $19. The firm cited optimism following the company’s ESPN Bet exit and its shift toward an iCasino-focused digital strategy. Analysts believe this pivot supports its “value-unlock” thesis, as Penn Entertainment’s brick-and-mortar fundamentals remain stable and continue to show resilience amid sector softness.

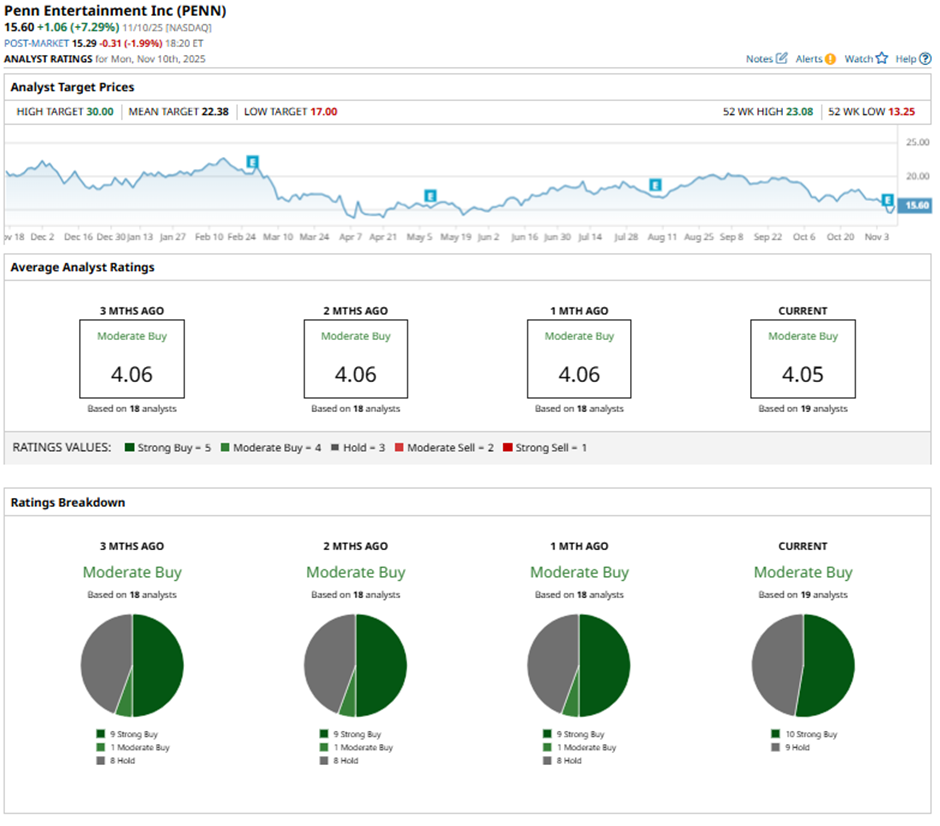

PENN stock has a consensus rating of “Moderate Buy" overall. Of the 19 analysts covering the stock, 10 advise a “Strong Buy,” while nine suggest a “Hold.”

While PENN’s average analyst price target of $22.07 indicates a 44% potential upside ahead, the Street-high target of $30 signals that shares could rise as much as 96% from current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- United Airlines (UAL): Hidden Behind the Shutdown Deal is a Secret Informational Arbitrage Opportunity

- Penn Entertainment Is Breaking up With ESPN in Sports Betting Deal. Should You Sell PENN Stock Here?

- Loop Capital Says This Semiconductor Stock Is Poised for Big Gains Ahead in 2026

- Should You Buy the Dip in Intellia Therapeutics Stock?