Figma (FIG) has long been the designer’s playground — the place where ideas turn into apps, and creativity meets collaboration. From startups sketching their first interface to tech giants refining digital experiences, Figma became the tool everyone wanted in their stack. Yet, even cult favorites aren’t immune to Wall Street’s cold logic. Since its initial public offering (IPO), FIG stock has tumbled, weighed down by doubts over whether hype had outrun the numbers.

But then came Figma's third-quarter report, which crushed expectations. Artificial intelligence (AI) powered tools drew in new users, revenue beat forecasts, and management doubled down on building the long-term platform, even at the cost of short-term margins. Analysts may still be divided, but there’s no denying that Figma’s AI story is getting louder. Now, investors are starting to listen again.

So, with momentum turning and AI fueling fresh growth, did Figma just design its comeback moment?

About Figma Stock

Founded in 2012 and headquartered in San Francisco, California, Figma has grown from a simple design tool into a collaborative, AI-powered creative hub used by millions. Its browser-based platform brings together designers, developers, marketers, and business teams to ideate, prototype, and deliver digital products with ease. With tools like FigJam, Dev Mode, and Figma Make, the company turns creativity into real-time collaboration — seamless, visual, and deeply connected.

Figma’s AI capabilities now help users design, code, and build web apps faster, turning the platform into a one-stop solution for modern digital creation. Its business model centers on teamwork and accessibility. Competing with giants like Adobe (ADBE), Figma stands as one of the most influential forces in the global design and SaaS space. Its market capitalization stands at around $18.5 billion.

Figma’s Wall Street debut on July 31 opened at $85 and soared to $142.92 the very next day. For early investors, it looked like a masterpiece in motion. But the shine didn’t last long. Concerns over its lofty valuation and whispers of a tech bubble sent FIG stock sliding. A lukewarm Q2 report didn’t help steady the lines.

Then came the Q3 report — strong results, upbeat guidance, and a wave of fresh optimism from analysts. FIG stock popped briefly, reminding investors why Figma had captivated the market in the first place.

Still, the chart tells a sobering story. Despite last week’s bounce, Figma shares are down slightly% over the past five days, most recently closing at $44 — well below those euphoric opening highs. It’s a reminder that even the most creative companies cannot always design their way out of market gravity.

In terms of valuation, Figma’s stock carries a premium price tag. Priced at roughly 25 times forward revenue, FIG trades well above the sector average — a valuation that once made sense amid peak IPO excitement but now feels a bit stretched. Investor sentiment has cooled since its early trading days, yet the lofty multiples suggest the market still expects Figma to deliver standout growth ahead.

A Snapshot of Figma’s Strong Q3 Results

The cloud-based design platform released its Q3 results on Nov. 5, and the numbers spoke of both ambition and growing pains. Revenue surged 38% year-over-year (YOY) to $274.2 million. Even as growth cooled slightly from the previous quarter’s 41% increase YOY, it topped Wall Street’s expectations and marked yet another quarter of strong demand. Non-GAAP EPS jumped 150% annually to $0.10, another pleasant surprise.

But beneath that bright headline, the details got a little sketchier. Operating margins grew by 700 basis points sequentially, but contracted by 1,200 basis points to 12%. Meanwhile, gross margins fell to 86% from 92% a year ago. The culprit was a sharp surge in costs that tells the story of a company in deep build mode.

Figma’s operating expenses soared 483% to $1.3 billion, with R&D spending alone ballooning to $681 million and SG&A costs climbing to $645 million. Simply put, Figma is pouring resources into innovation and product growth, spending nearly $5 for every $1 earned. Yet, management insists this is the price of scale. On the earnings call, they described Q3 as “the best quarter in Figma’s history,” noting its annualized revenue run rate (ARR) crossed the $1 billion mark.

The momentum seems real. Backlog jumped 15% sequentially to $517 million, with nearly all of it set to convert within the next 12 months. Customer expansion remains robust. 12,910 clients now spend over $10,000 annually, and 1,262 customers exceed the $100,000 ARR mark. Many use three or more Figma products — a sign of growing stickiness.

Much of this momentum is being fueled by Figma Make, the firm's new AI-driven, prompt-based design assistant. Launched earlier this year, Make has quickly become a favorite among top-tier customers, with 30% of $100,000-plus clients using it weekly. The company rolled out over 50 new features this quarter, pushing adoption and driving net retention to 131%.

Management was especially upbeat about the growing excitement among Figma’s users, who are rapidly embracing the platform’s new AI-driven tools and features. Figma went full throttle on AI this quarter. It rolled out tools like Copy Design, Make Kits, and the remote MCP Server to power AI-native workflows. The company also teamed up with OpenAI to launch the Figma App for ChatGPT — letting users turn chats into flowcharts or diagrams in FigJam. And with its Weavy acquisition — now rebranded as Figma Weave — it’s diving deep into AI-driven image, video, and motion design creation.

Looking ahead, Figma’s playbook for the next quarter still seems pretty ambitious. Management issued guidance that exceeded Wall Street’s estimates, driven by its confidence in product innovation and the growing influence of AI across its platform. The team believes that AI will continue to attract more users into the ecosystem, ultimately leading to stronger revenue momentum.

That said, the growth curve is expected to moderate slightly. For Q4, management is projecting revenue between $292 million and $294 million — roughly 35% YOY growth. It is solid, although slightly below the 38% to 41% pace the firm kept up in the last two quarters.

Zooming out to fiscal 2025, management expects revenue to land between $1.044 billion and $1.046 billion, marking about 40% annual growth at the midpoint. Non-GAAP operating income is pegged between $112 million and $117 million, a steady progress as Figma continues to scale with purpose.

Meanwhile, analysts tracking Figma anticipate the company’s GAAP net loss per share to be around $2.32 in fiscal 2025, a 38% YOY improvement. Losses are then expected to shrink by another 69% annually to $0.71 per share in fiscal 2026, signaling a steady path toward profitability.

What Do Analysts Expect for Figma Stock?

Figma’s Q3 story has drawn a mixed view on Wall Street, but the spotlight remains bright. After-hours trading on Nov. 6 saw the stock jump 4%, powered by Goldman Sachs lifting its target to $54 from $50 while keeping a “Neutral” rating. The bank praised Figma’s strong quarter and promising fundamentals but called the valuation “relatively full,” preferring a clearer risk-reward setup.

Morgan Stanley, meanwhile, took a measured view, trimming its target to $65 from $70 and maintaining an “Equal Weight” rating. Analysts acknowledged solid post-IPO performance and improving returns on recent investments, although they trimmed estimates in line with peer valuations.

JPMorgan also kept a “Neutral” rating while lowering its target to $60 from $65. The firm described Figma’s Q3 as “healthy,” with upbeat guidance for Q4.

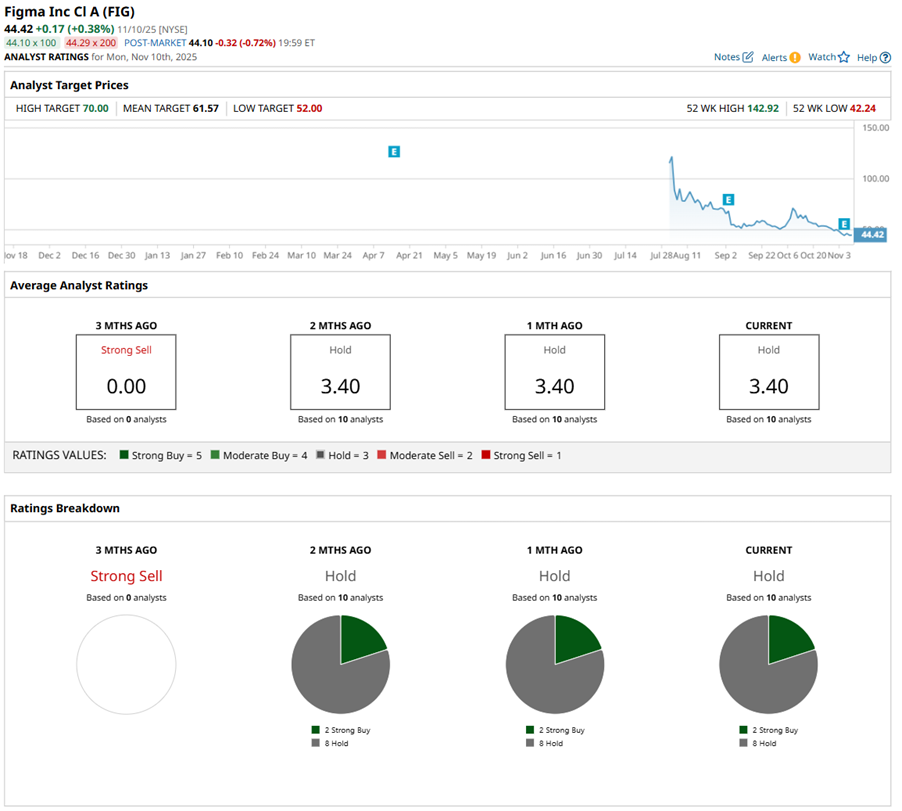

Wall Street’s verdict on Figma feels a lot like the company's design ethos — clean, balanced, and cautiously composed. Analysts agree Figma is executing well, proving its AI-powered vision is not just hype. Still, they are not ready to hit the “Buy” button just yet. FIG stock has a consensus “Hold” rating overall. Out of the 10 analysts offering recommendations for the stock, two suggest a “Strong Buy,” and the remaining eight play it safe with a “Hold” rating.

The average analyst price target of $60.86 indicates 38% potential upside from current price levels. However, the Street-high price target of $70 suggests that the stock could rally as much as 59%.

Final Thoughts on Figma

Figma’s story is a mix of innovation and investor caution. The company is still in its early market chapters, and while public data remains limited, its Q3 results show clear operational strength. AI continues to be the driving force — powering user growth, enhancing workflows, and giving the platform fresh commercial momentum. Management’s pricing strategy is expected to provide a mid-to-high single-digit tailwind to revenue, which could boost near-term sales as customers hurry to renew before the new rates kick in.

Yet, the shine comes with shadows. Stock-based compensation soared to $1.1 billion in Q3 — a 13x jump — while shares outstanding nearly doubled, diluting existing holders. Combined with its lofty valuation and moderating growth, that's enough to make even bullish investors pause. The upcoming lock-up expiry in early 2026 could also weigh on sentiment as insiders gain the option to sell.

Still, Figma’s vision and execution can’t be dismissed. AI is deepening its moat, collaboration remains its superpower, and if growth steadies, Figma might just redraw its investment story again.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- United Airlines (UAL): Hidden Behind the Shutdown Deal is a Secret Informational Arbitrage Opportunity

- Penn Entertainment Is Breaking up With ESPN in Sports Betting Deal. Should You Sell PENN Stock Here?

- Loop Capital Says This Semiconductor Stock Is Poised for Big Gains Ahead in 2026

- Should You Buy the Dip in Intellia Therapeutics Stock?