The artificial intelligence (AI) boom is changing everything, and Palantir Technologies (PLTR) is right at the center of it. Once known for its government data work, it is now a major force in enterprise AI, helping companies automate, predict, and scale faster. With shorter deal cycles and rising adoption, Palantir is becoming the go-to name in intelligent enterprise software.

Its third-quarter earnings report on Nov. 3 was another knockout performance, showcasing surging revenue, expanding profitability, and record deal bookings. Yet, despite the stellar numbers, Palantir’s shares took a surprising turn south. High expectations and a sky-high valuation left little room for error, and investors reacted quickly. Shares have tumbled nearly 15% since the report, as traders took profits and analysts voiced concerns about its premium multiples.

Adding to the drama, The Big Short legend Michael Burry’s Scion Asset Management disclosed put options on 5 million Palantir shares – a move that rattled sentiment, as puts signal a bet on a stock’s decline. Although PLTR stock surged to $207.52 after a record-breaking run, it slipped shortly after, now down 12.2% from the peak.

Now, with PLTR cooling off after its fiery run, is this dip a red flag, or is November 2025 a golden opportunity for investors to buy the AI powerhouse?

About Palantir Stock

Founded in 2003 with support from the CIA’s In-Q-Tel, Palantir Technologies has transformed from a counterterrorism startup into a powerhouse of AI and data analytics. Based in Denver, its platforms – Gotham, Foundry, Apollo, and Artificial Intelligence Platform (AIP) – help organizations turn data into strategy across defense, healthcare, and finance. Now valued at $453 billion, Palantir stands tall in the large-cap arena, shaping the future of national security and enterprise AI alike.

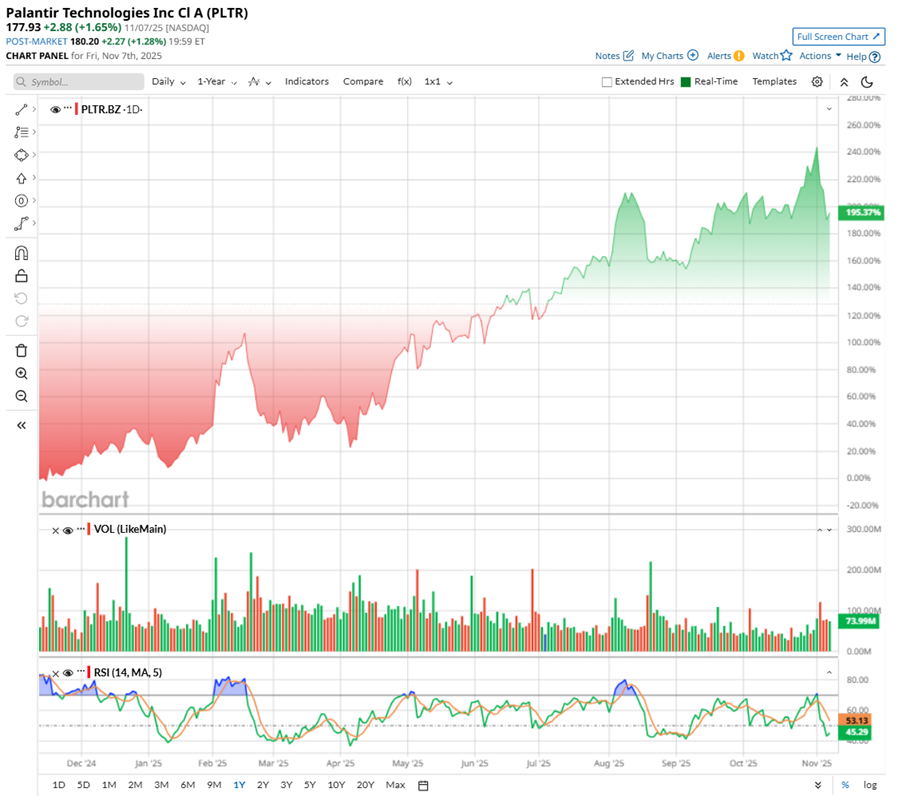

Palantir’s shares have been on a stunning climb – soaring roughly 204% over the past year as investors double down on its growing presence in AI, defense, and enterprise software. Year-to-date (YTD), gains stand near 141%. On Nov. 3, momentum carried the stock to a new 52-week high of $207.52 after Palantir’s Q3 report, before settling slightly lower at $207.18.

But momentum can be tricky. The 14-day RSI was at 71, and fading volume on those green candles hinted that the rally might have run too far too fast. Sure enough, after Palantir’s earnings, profit-taking kicked in – the stock dropped 7.9% on Nov. 4 and has slid roughly 2.9% in the past week.

Palantir’s meteoric rise has dazzled Wall Street, but its valuation is where the real tension lies. The stock now trades at a jaw-dropping 375 times forward earnings, with a price-to-sales ratio soaring above 160x.

Sure, its commercial momentum is building fast, yet government contracts still form its backbone. At these levels, investors are essentially betting on perfection, that Palantir will keep executing flawlessly. Any stumble, though, could send multiples tumbling in a heartbeat.

Palantir’s Shares Dip Despite Stellar Q3 Results

Palantir’s Q3 earnings results were released on Nov. 3, and the company once again flexed its muscle with a mix of soaring growth, expanding margins, and cash flow that could make even the most disciplined CFO grin. What’s striking is how Palantir’s story keeps looping back to the same theme – elite execution. The firm continues to scale its commercial business in the U.S. while holding its fortress in government contracts, cementing its place as an AI powerhouse redefining enterprise intelligence.

Revenue for the quarter came in at a staggering $1.18 billion, up 63% year-over-year (YOY) and 18% sequentially – well ahead of Wall Street’s expectations. That kind of growth doesn’t happen by luck. Demand for Palantir’s AIP and data analytics software is exploding, with the U.S. market alone contributing $883 million, or 75% of total sales. It’s clear that Palantir’s software is quickly becoming a necessity for companies racing to modernize operations, automate workflows, and extract real value from data.

Government contracts, the company’s historical backbone, didn’t miss a beat either. Revenue from that segment surged 55%, while U.S. government sales climbed 52% annually – proof that Palantir remains a trusted partner in national security and intelligence.

Total contract value bookings hit a record $2.8 billion, a 151% jump YOY, marking the company’s best quarter ever for deal signings. With 204 new contracts worth $1 million or more and customer count up 45% to 911, Palantir’s footprint is widening fast. Retention remains stellar, too. The net dollar retention rate hit 134%, meaning existing clients are spending significantly more over time – a clear testament to the stickiness of Palantir’s software.

On the profitability side, the company delivered its highest-ever adjusted operating margin of 51%, showing how its model scales beautifully. Adjusted EPS stood at $0.21, while free cash flow reached $540 million, with a margin of 46%. The $6.4 billion cash cushion now gives Palantir plenty of room to chase bigger AI ambitions.

Perhaps the most jaw-dropping stat was a Rule of 40 score of 114% - one of the highest in the software world, combining growth and profitability in a way few companies can.

With Q4 revenue now guided between $1.327 billion and $1.331 billion by the management, and full-year revenue projected between $4.396 billion and $4.4 billion, the momentum isn’t slowing. U.S. commercial growth alone is expected to soar at least 104%. Adjusted operating income is expected to be between $2.151 billion and $2.155 billion, while FCF is estimated to be between $1.9 billion and $2.1 billion.

Meanwhile, analysts monitoring Palantir expect the company’s fiscal 2025 EPS to be around $0.52, up 550% annually, and rise by another 51.92% to $0.79 in fiscal 2026.

What Do Analysts Expect for Palantir Stock?

After Palantir’s Q3 report, the Street was split – while some were impressed by the numbers, some were cautious about the price tag. The company’s beat-and-raise quarter was everything bulls wanted to see, yet the stock’s muted after-hours reaction told a subtler story. Investors have come to expect brilliance from Palantir, and its valuation bar is now sky-high.

Analysts, while applauding the execution, couldn’t resist poking at the math.

Wedbush’s Daniel Ives could not hide his enthusiasm. Calling the results a “major validation moment for AI demand,” Ives said any short-term weakness should be seen as a buying opportunity. “This is not as good as it gets,” he wrote on X, implying the AI party has only just begun.

Over at William Blair, Louie DiPalma’s team kept a “Market Perform” rating. The brokerage firm noted that FCF guidance rose by only $100 million versus the usual $200 million bump, which may have cooled investor excitement. Still, their internal trackers pointed to over $300 million in annual recurring revenue bookings – the highest in Palantir’s history. Despite minor ripples from the Department of Government Efficiency and the government shutdown, Palantir’s U.S. government operations remain steady, fueled by powerful AI-driven momentum across both public and commercial sectors.

RBC Capital Markets stuck with its “Underperform” rating but nudged its target up to $50 from $45, citing U.S.-heavy growth, limited international traction, and uncertainty over long-term AIP demand, despite strong profitability and multi-year contracts driving near-term momentum.

Meanwhile, Cantor Fitzgerald’s Thomas Blakey reiterated a “Neutral” rating but raised its target from $155 to $198, praising Palantir’s flawless execution, FDE-driven business model, and AI dominance while admitting valuation remains its only restraint.

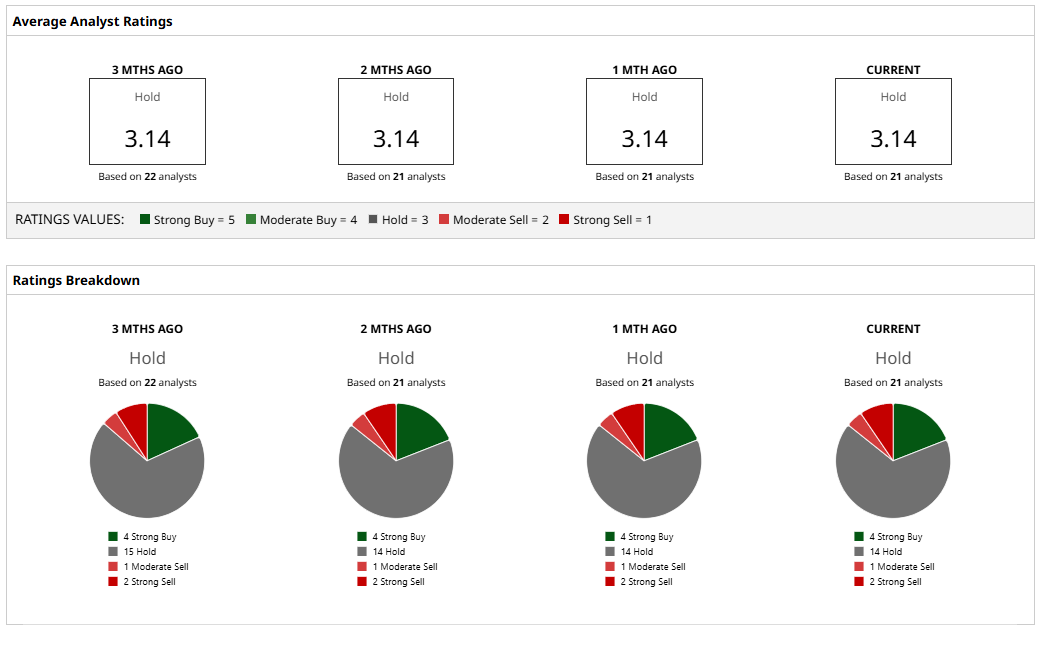

So, while Wall Street remains split on Palantir’s true worth, the verdict feels more like cautious applause than wild cheers. The stock currently carries a consensus “Hold” rating – respected but not yet celebrated. Out of 21 analysts tracking the stock, only four are firmly in the bullish camp with a “Strong Buy.” A majority of 14 analysts, to be exact, prefer to stay on the sidelines with a “Hold,” while one leans mildly bearish with a “Moderate Sell,” and two remain outright skeptics, calling it a “Strong Sell.”

With PLTR slipping recently, the average analyst price target of $192.67 suggests the stock has rebound potential of 4%. The Street-high target of $255 suggests that the stock can still rise by as much as 38% from current levels.

Final Thoughts on Palantir

Palantir’s numbers remain undeniably impressive – from its record-breaking backlog to its accelerating U.S. commercial growth – yet its valuation sits in rarefied air. The stock seems priced for perfection, leaving little margin for error. Even with exceptional profitability, such lofty multiples can’t expand indefinitely, acting as a ceiling on future gains and prompting caution among seasoned investors.

Then came Michael Burry’s move – put options on Palantir shares – signaling a cautious stance that perhaps the AI trade is overheating. And he is not alone. Market watchers have started spotting echoes of the dot-com bubble – circular financing loops between tech players, sky-high data center costs, and questions over whether revenue can ever catch up with infrastructure spending.

Plus, as Palantir leans more into private-sector expansion, cyclical risks like a potential recession or cooling AI enthusiasm could test its resilience.

Still, corrections are natural in every market cycle. Timing them, however, is a gamble few win consistently. While the “AI bubble” narrative continues to hover, today’s AI leaders differ vastly from the dot-com era – they are profitable, cash-rich, and backed by real-world demand. For investors, the question is not whether Palantir will keep growing – it is whether its stock can keep up with the legend it’s already becoming.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?

- Is It Too Late to Buy Palantir Stock in November 2025?