According to research, global IT giants face potential cybercrime costs exceeding $15 trillion by 2030. This implies sustained tailwinds for companies providing protection against cyberattacks.

Rubrik (RBRK), which helps companies achieve business resilience against cyberattacks, is therefore an attractive growth investment.

The company has already demonstrated healthy growth in a big addressable market, and as margins expand coupled with growth in cash flows, value creation seems likely. Amidst healthy growth, RBRK stock has trended higher by 16.4% for the year.

About RBRK Stock

Headquartered in Palo Alto, Rubrik is a provider of data security solutions to businesses globally. The company’s cloud platform delivers cloud resilience and identity resilience to deliver continuous business operations.

Rubrik has been on a healthy growth trajectory, with subscription ARR growing to $1.25 billion as of Q2 2026. With organic and acquisition-driven growth, the positive business momentum is likely to sustain.

It's, however, worth noting that RBRK stock has remained sideways in the last six months. Amidst positive business developments, this correction period seems like a good entry opportunity.

Strategic Partnership to Boost Growth

On Nov. 10, Rubrik announced a collaboration agreement with Amazon (AMZN) Web Services (AWS). With this collaboration, Rubrik will support the running of data and systems before and after cyber threats.

Similarly, the partnership with Cognizant (CTSH) is to provide business resilience-as-a-service for mutual customers.

These big partnerships are likely to ensure that the company’s ARR growth remains strong. It’s worth noting that as of July 2025, the company had 2,505 customers with ARR of more than $100,000.

Strong Q2 2026 Results and Positive Outlook

For Q2 2026, Rubrik reported healthy revenue growth of 51% on a year-on-year (YoY) basis to $309.9 million. For the same period, the subscription ARR increased by 36% to $1.25 billion. Further, the company’s GAAP gross margin expanded by 640 basis points to 79.5%.

Another important point to note is that Rubrik reported operating and free cash flow of $64.7 million and $57.5 million, respectively, for Q2 2026. In the prior year's comparable quarter, the company had reported cash burn.

Besides delivering healthy numbers, Rubrik has also guided for a strong FY 2026. The company expects subscription ARR to be at $1.4 billion. Additionally, free cash flow is expected at $150 million. With strong top-line growth backed by a growing number of clients, it’s likely that free cash flows will continue to swell.

In June 2025, Rubrik announced the acquisition of Predibase. This is likely to help the company accelerate its agentic AI adoption. As FCF swells, the company has the flexibility to pursue inorganic growth and invest in innovation. Further, as of Q2 2026, Rubrik had $322 million in cash and $1.2 billion in short-term investments. This provides ample flexibility to make aggressive investments.

What Analysts Say About RBRK Stock

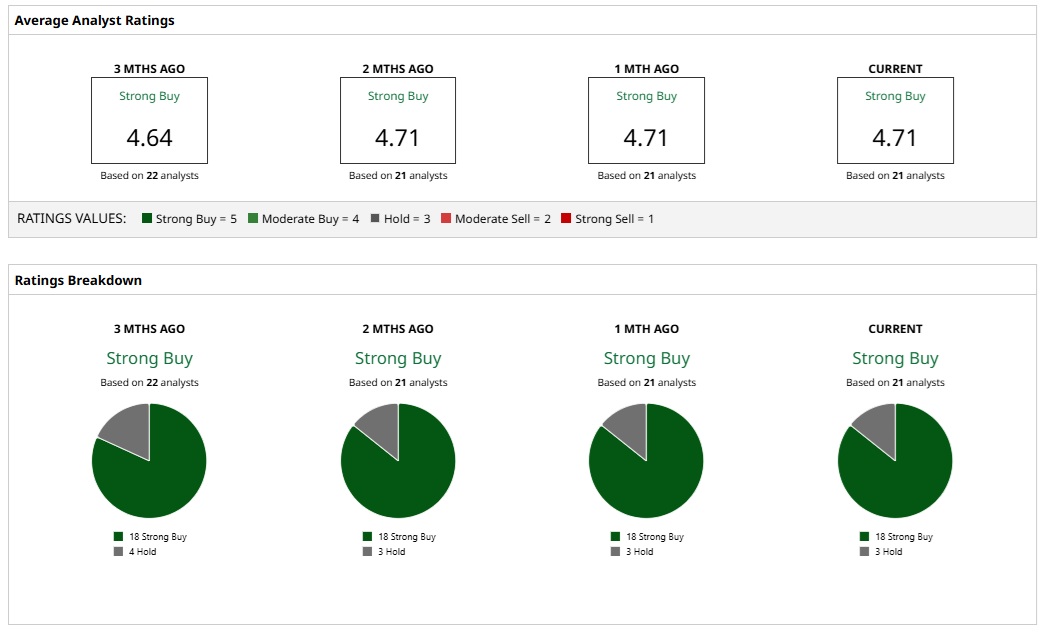

Based on the rating of 21 analysts, RBRK stock is a “Strong Buy.”

An overwhelming majority of 18 analysts opine that the stock is a “Strong Buy” while three analysts have assigned a “Hold” rating.

Further, the mean average price target of $115.37 implies an upside potential of 52%. Considering the most bullish price target of $130, the upside potential is 71%.

After Q2 2026 results, Goldman Sachs reiterated its “Buy” rating and increased the price target to $120. Goldman Sachs' analyst opined that the “underlying business momentum was decidedly positive.”

The bullish analyst outlook and the fact that RBRK stock has traded sideways in the last six months certainly suggest a good accumulation opportunity.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Enovix (ENVX) Offers the Most Daring Contrarians a Quant-Driven Upside Opportunity

- Alphabet Generates Strong FCF and If It Continues GOOGL Stock is 40% Undervalued

- Is Owens & Minor’s New Focus Enough to Lift Its Shares From the Bottom 100?

- SPY’s 50-Day Moving Average Streak is Going Strong. The Rest of the Market is Sending Up Flares.