Over the last six months, Angi’s shares have sunk to $1.84, producing a disappointing 18.6% loss - a stark contrast to the S&P 500’s 13.5% gain. This might have investors contemplating their next move.

Is there a buying opportunity in Angi, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Despite the more favorable entry price, we're swiping left on Angi for now. Here are three reasons why ANGI doesn't excite us and a stock we'd rather own.

Why Is Angi Not Exciting?

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

1. Revenue Spiraling Downwards

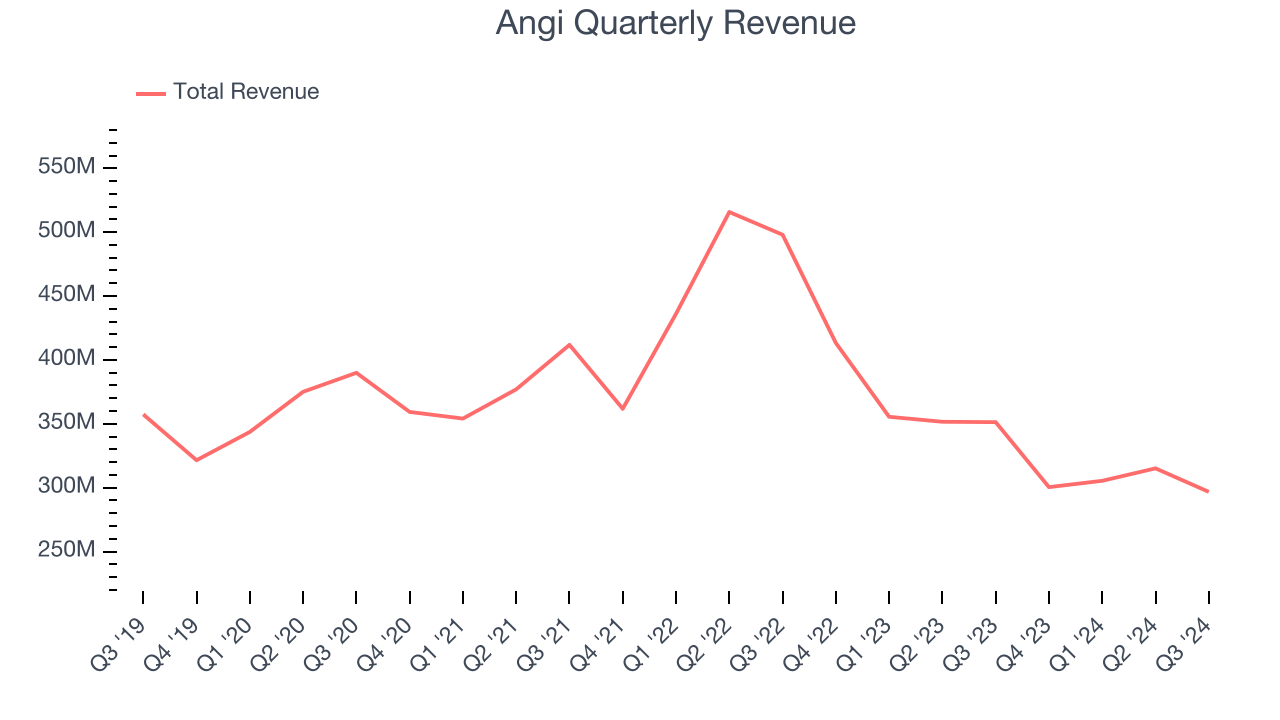

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Angi’s demand was weak and its revenue declined by 6.8% per year. This fell short of our benchmarks and is a sign of lacking business quality.

2. Declining Service Requests Reflect Product Weakness

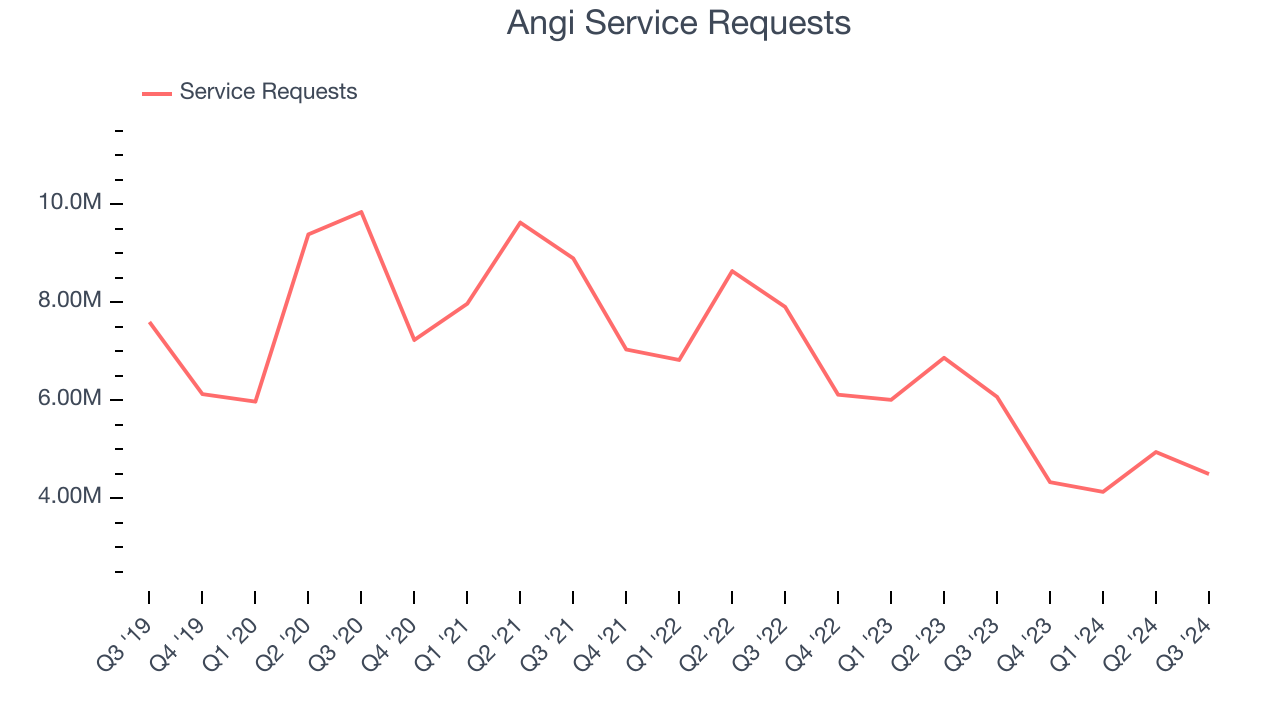

As a gig economy marketplace, Angi generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Angi struggled to engage its service requests over the last two years as they have declined by 22.9% annually to 4.49 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Angi wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

3. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Angi’s revenue to drop by 3.3%. While this projection is better than its three-year trend, it's hard to get excited about a company that is struggling with demand.

Final Judgment

Angi’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 6.4× forward EV-to-EBITDA (or $1.84 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Like More Than Angi

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.