Insurance industry-focused software maker Guidewire (NYSE:GWRE) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 26.8% year on year to $262.9 million. Guidance for next quarter’s revenue was optimistic at $285 million at the midpoint, 2% above analysts’ estimates. Its non-GAAP profit of $0.43 per share was 44.9% above analysts’ consensus estimates.

Is now the time to buy Guidewire? Find out by accessing our full research report, it’s free.

Guidewire (GWRE) Q3 CY2024 Highlights:

- Revenue: $262.9 million vs analyst estimates of $254 million (26.8% year-on-year growth, 3.5% beat)

- Adjusted EPS: $0.43 vs analyst estimates of $0.30 (44.9% beat)

- Adjusted Operating Income: $34.71 million vs analyst estimates of $21.11 million (13.2% margin, 64.4% beat)

- The company lifted its revenue guidance for the full year to $1.16 billion at the midpoint from $1.14 billion, a 1.7% increase

- Operating Margin: -1.8%, up from -16.3% in the same quarter last year

- Free Cash Flow was -$67.38 million, down from $189.3 million in the previous quarter

- Annual Recurring Revenue: $874 million at quarter end, up 13.5% year on year (slight miss vs analyst estimates of $$875.3 million)

- Market Capitalization: $17.3 billion

“We continue to see great momentum as P&C insurers look to Guidewire to deliver the platform they trust to innovate and grow efficiently,” said Mike Rosenbaum, chief executive officer, Guidewire.

Company Overview

Founded by two individuals involved in the development of leading procurement software Ariba, Guidewire (NYSE:GWRE) offers insurance companies a software-as-a-service platform to help sell their products and manage their workflows.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Sales Growth

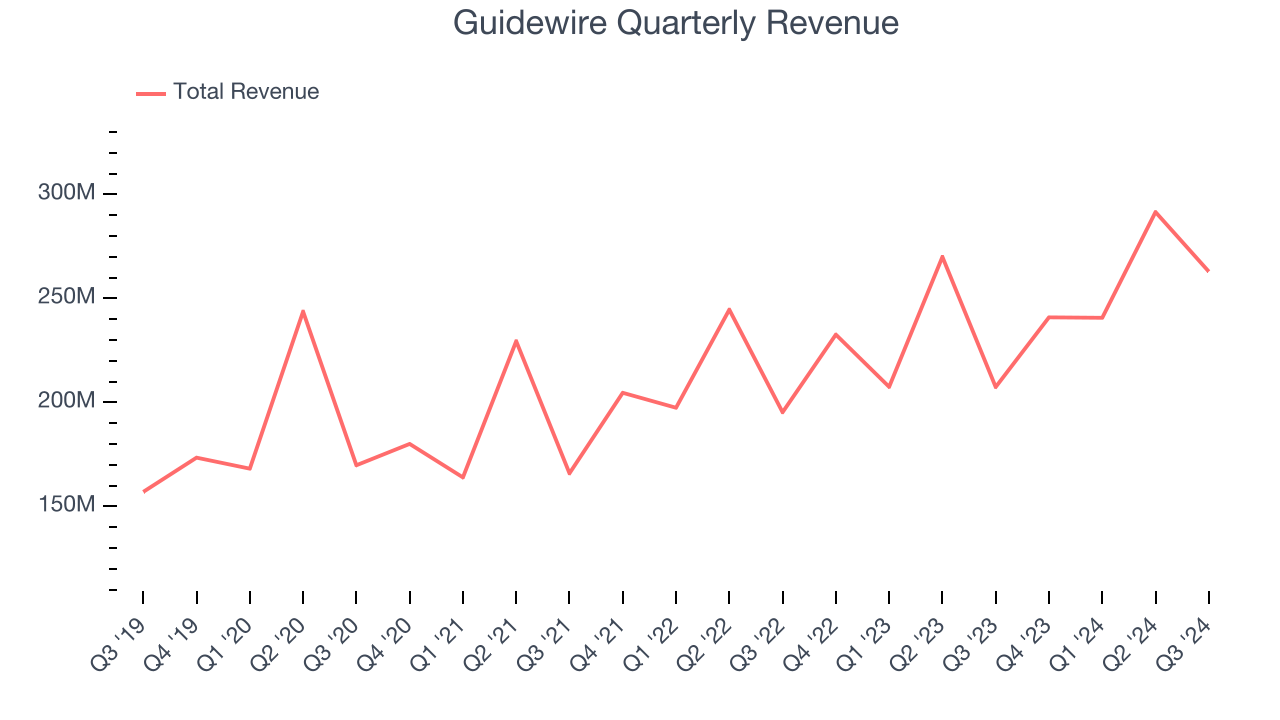

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Guidewire grew its sales at a 11.9% annual rate. Although this growth is solid on an absolute basis, it fell short of our benchmark for the software sector.

This quarter, Guidewire reported robust year-on-year revenue growth of 26.8%, and its $262.9 million of revenue topped Wall Street estimates by 3.5%. Company management is currently guiding for a 18.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.2% over the next 12 months, an acceleration versus the last three years. This projection is noteworthy and indicates its newer products and services will catalyze better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

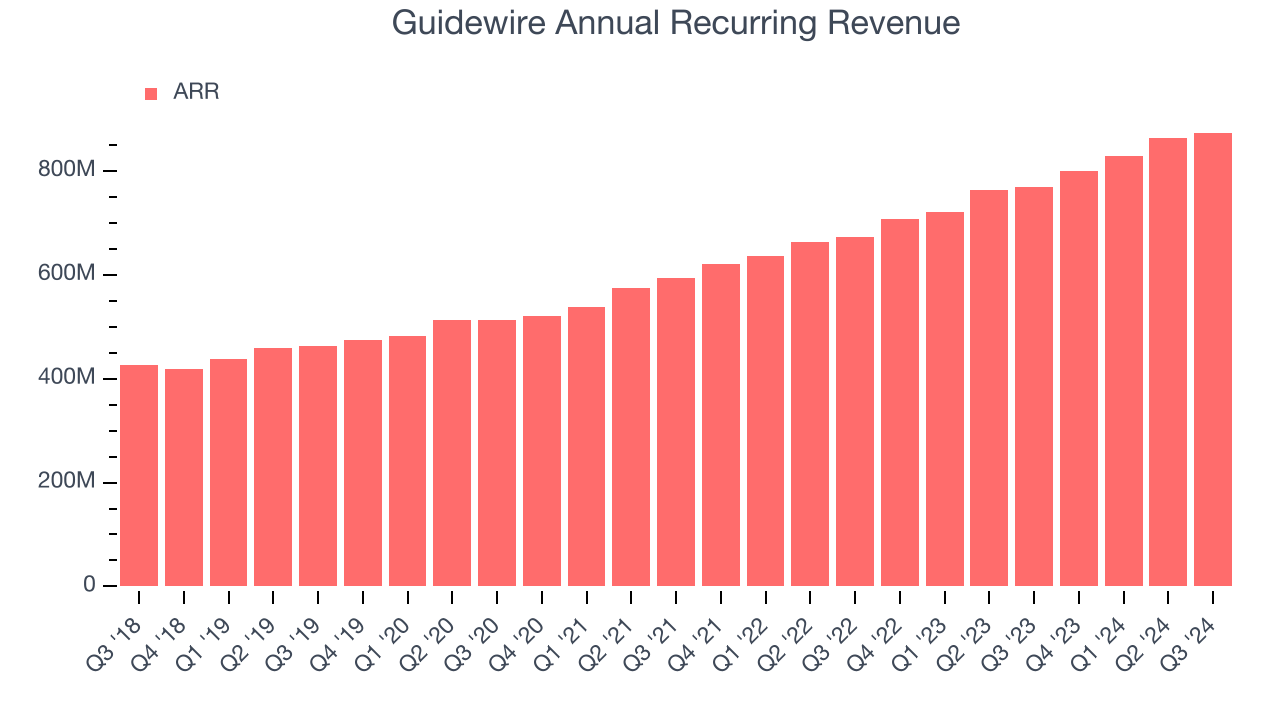

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Guidewire’s ARR punched in at $874 million in Q3, and over the last four quarters, its growth slightly outpaced the sector as it averaged 13.6% year-on-year increases. This performance aligned with its total sales growth and shows the company is securing longer-term commitments. Its growth also contributes positively to Guidewire’s revenue predictability, a trait long-term investors typically prefer.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Guidewire’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Key Takeaways from Guidewire’s Q3 Results

ARR, a key topline indicator, missed slightly. However, revenue in the quarter managed to beat. Revenue guidance for next quarter also came in higher than Wall Street’s estimates. Overall, this quarter was mixed. The areas below expectations seem to be driving the move, and shares traded down 2.6% to $201.36 immediately after reporting.

Big picture, is Guidewire a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.