Over the last six months, Bath and Body Works’s shares have sunk to $37.61, producing a disappointing 14.1% loss - a stark contrast to the S&P 500’s 11.9% gain. This might have investors contemplating their next move.

Is now the time to buy Bath and Body Works, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the more favorable entry price, we're cautious about Bath and Body Works. Here are two reasons why you should be careful with BBWI and a stock we'd rather own.

Why Is Bath and Body Works Not Exciting?

Spun off from L Brands in 2020, Bath & Body Works (NYSE:BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

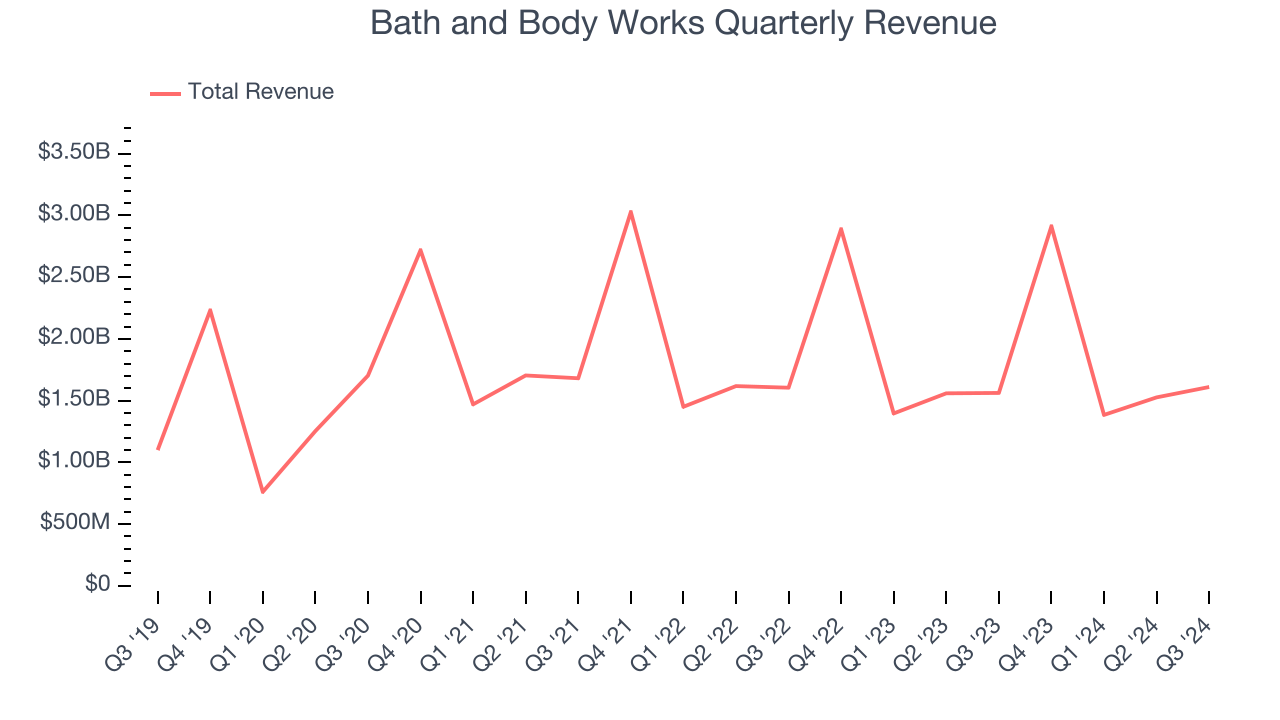

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Bath and Body Works’s sales grew at a tepid 7.5% compounded annual growth rate over the last five years. This was below our standard for the consumer retail sector.

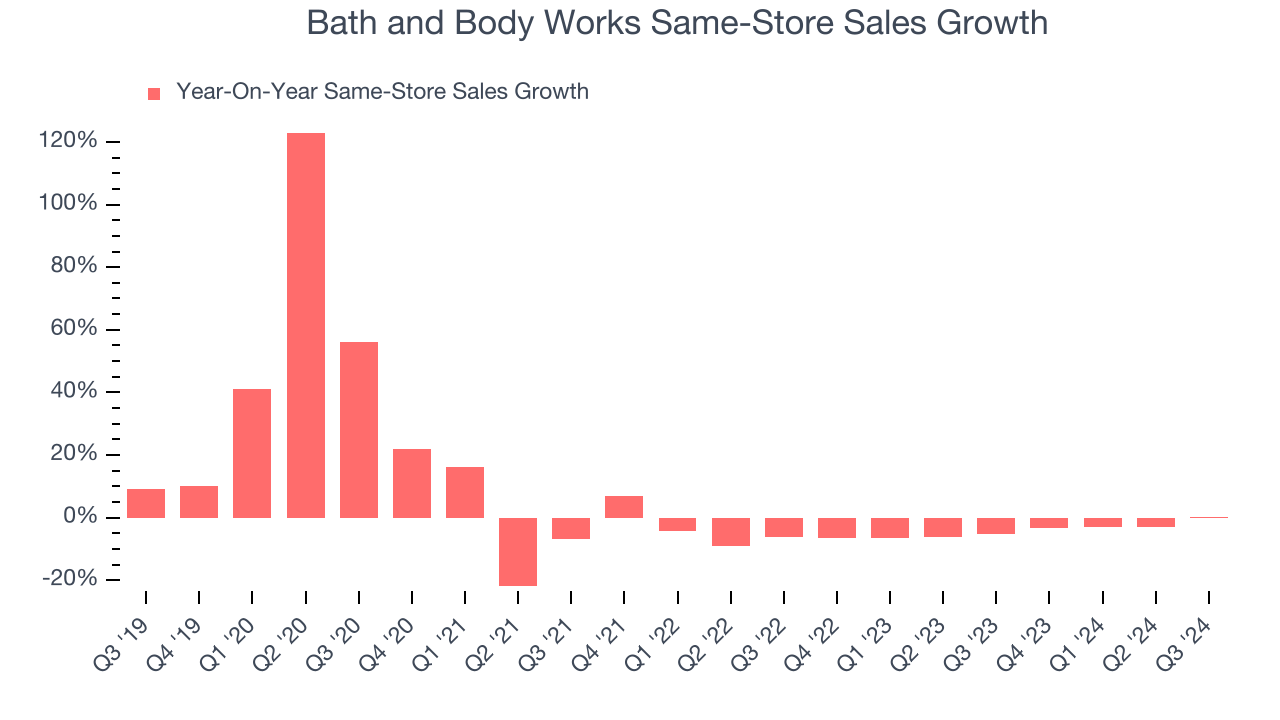

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Bath and Body Works’s demand has been shrinking over the last two years as its same-store sales have averaged 4.2% annual declines.

Final Judgment

Bath and Body Works isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 8.2× forward EV-to-EBITDA (or $37.61 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward Chipotle, which surprisingly still has a long runway for growth.

Stocks We Would Buy Instead of Bath and Body Works

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.