FOX has been on fire lately. In the past six months alone, the company’s stock price has rocketed 42%, reaching $47.34 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy FOX, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why we avoid FOXA and a stock we'd rather own.

Why Do We Think FOX Will Underperform?

Founded in 1915, Fox (NASDAQ:FOXA) is a diversified media company, operating prominent cable news, television broadcasting, and digital media platforms.

1. Long-Term Revenue Growth Disappoints

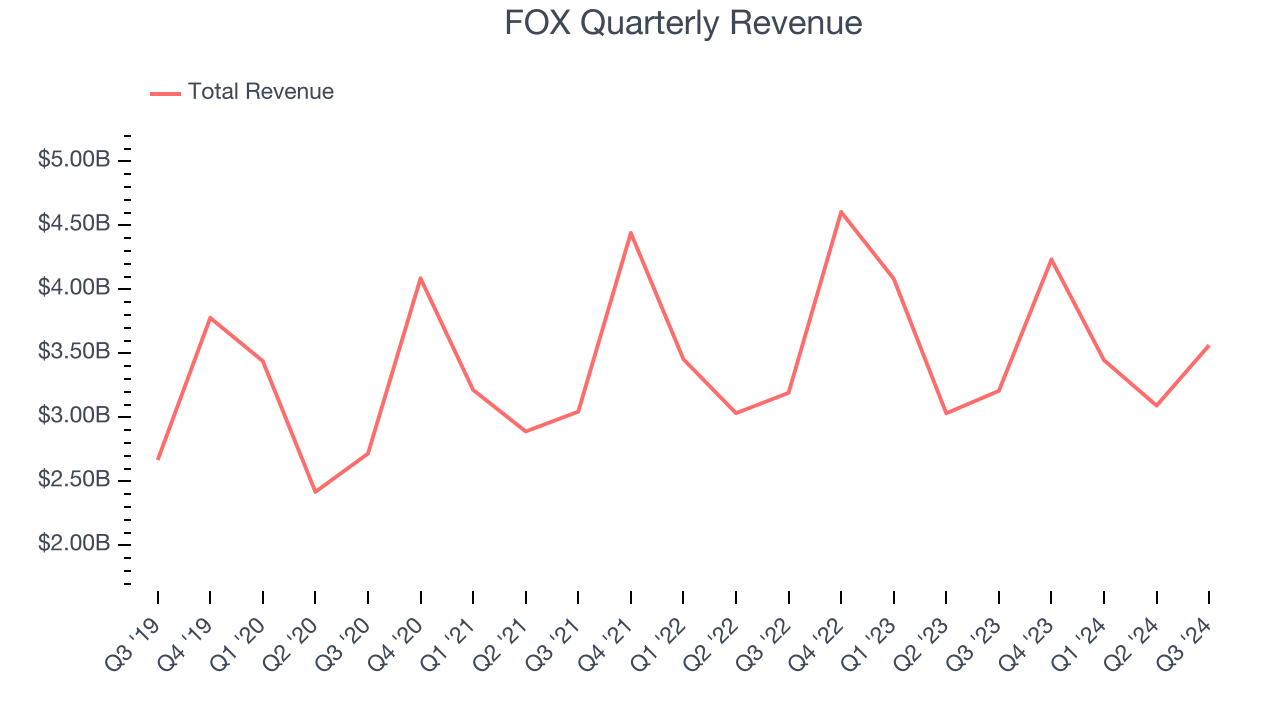

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, FOX’s 4.5% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector.

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

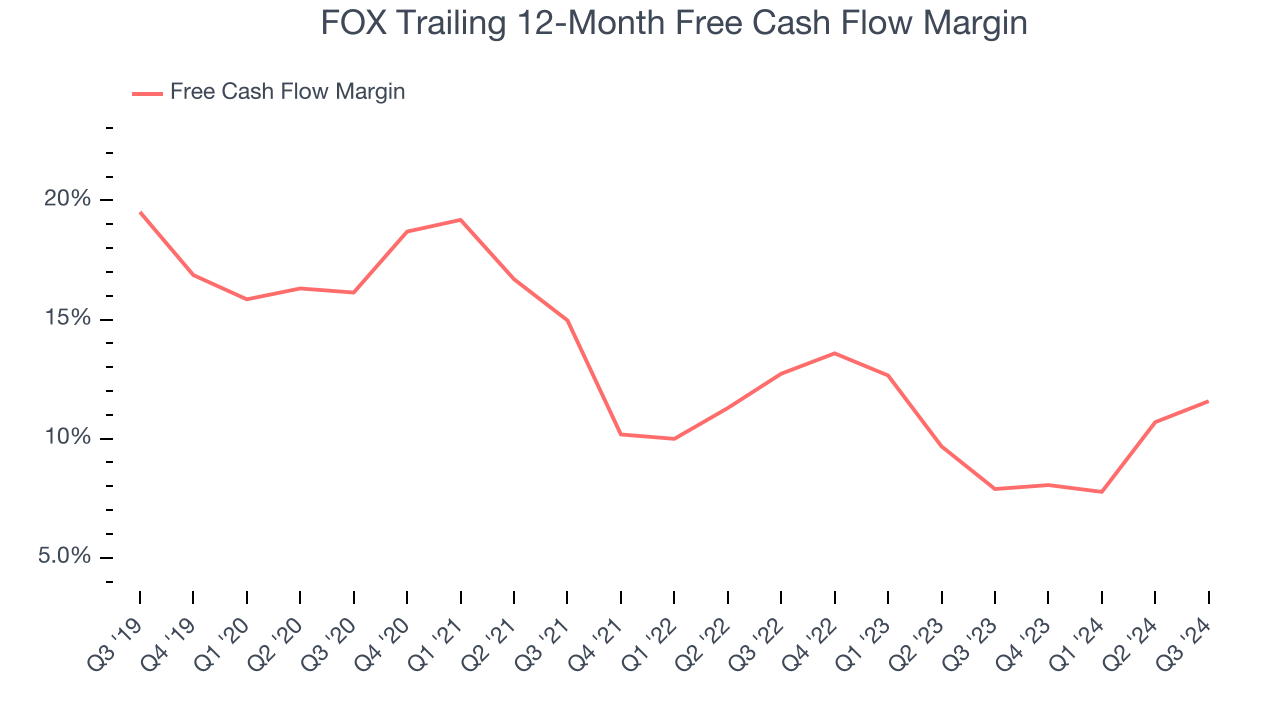

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

FOX has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.7%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires FOX to make large cash investments in working capital and capital expenditures.

3. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect FOX’s revenue to drop by 3.3%, a decrease from its flat sales for the past two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of FOX, we’ll be cheering from the sidelines. Following the recent surge, the stock trades at 13.2× forward EV-to-EBITDA (or $47.34 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now. We’d recommend looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than FOX

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.