Johnson Controls International plc (JCI) is a global leader in building products, systems and smart-building solutions. Headquartered in Cork, Ireland, it develops, manufactures, installs and services a wide range of heating, ventilation and air-conditioning (HVAC), refrigeration, fire- and security-protection, building management and controls, and integrated infrastructure products as well as energy-efficiency and smart building services for commercial, industrial, institutional, government and data-center customers. Johnson Controls carries a market cap of around $75.2 billion.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Johnson Controls fits this criterion perfectly. Johnson Controls is distinguished by its long history of innovation in building systems and its ability to deliver comprehensive solutions for both new constructions and retrofitted structures.

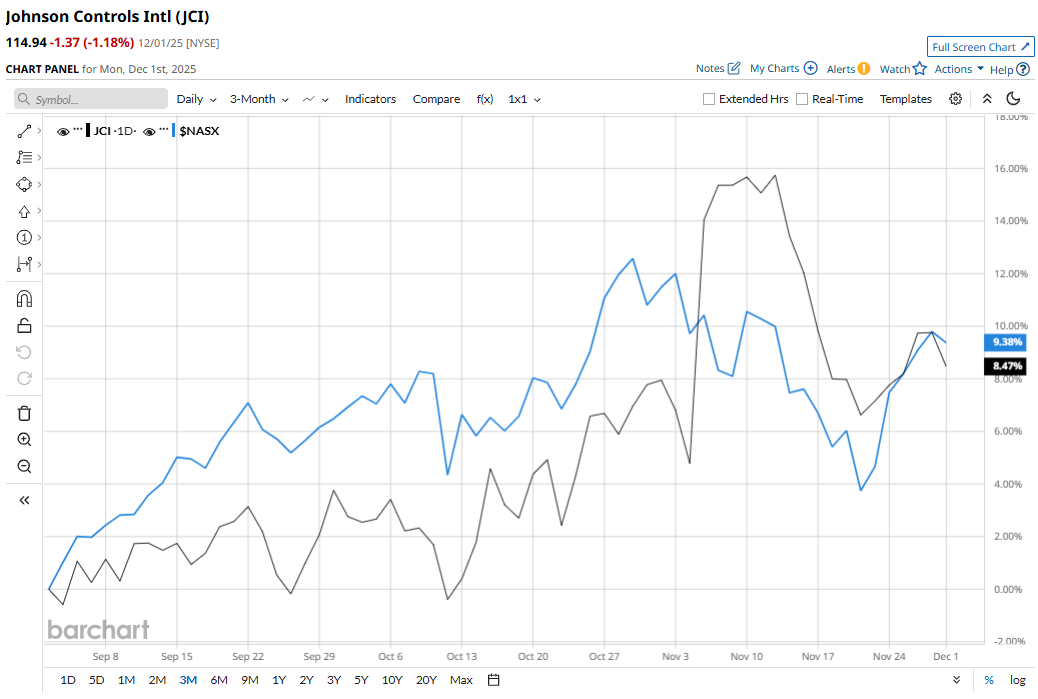

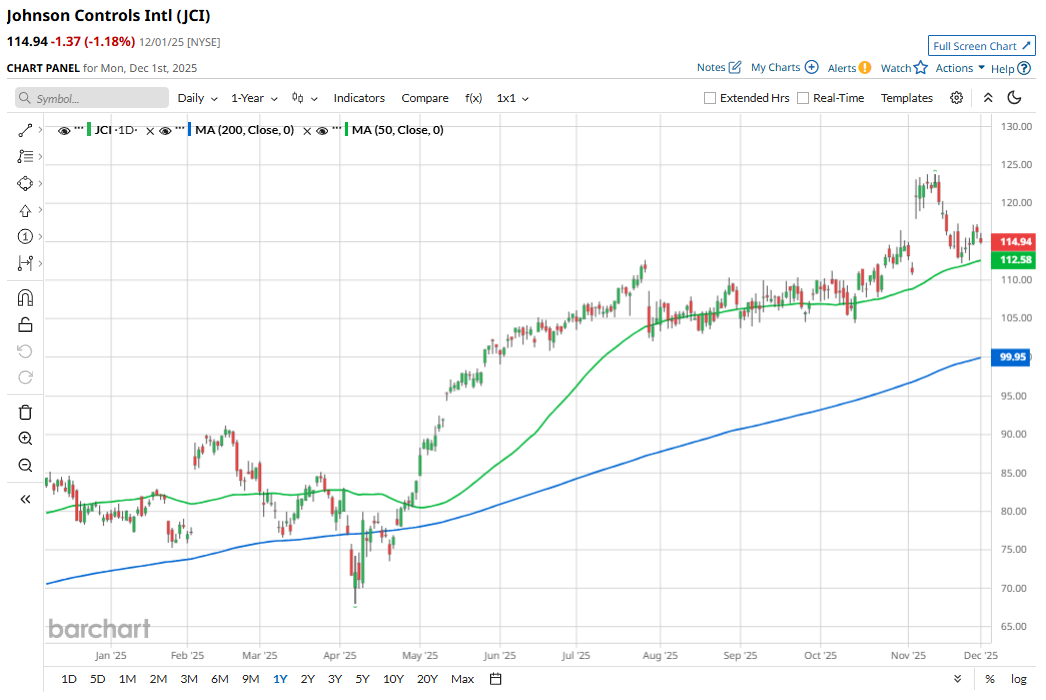

The building solutions provider has declined 7.1% from its 52-week high of $123.78, achieved on Nov. 12. Shares of JCI are up 7.5% over the past three months, lagging behind the broader Nasdaq Composite’s ($NASX) 8.5% rise over the same time frame.

Longer term, JCI is up 45.6% on a YTD basis, outpacing NASX’s 20.5% gains. Also, shares of Johnson Controls have risen 37.1% over the past 52 weeks, outperforming NASX’s 21.1% gains over the same time frame.

JCI has been trading above its 200-day moving average since late April and has remained mostly above its 50-day moving average during the period despite some fluctuations.

JCI’s stock rally in 2025 reflects strong operating results, robust demand, and growing investor confidence. The company has consistently beaten earnings expectations. At the same time, JCI is capitalizing on surging demand for data-center infrastructure and energy-efficient smart building and cooling solutions, especially driven by increased AI/data-center builds globally.

In comparison, the stock’s rival, Carrier Global Corporation (CARR), has underperformed JCI, with a 20.5% decline on a YTD basis and a 29.9% drop over the past 52 weeks.

Despite the stock’s outperformance, analysts remain cautiously optimistic about its prospects. Among the 20 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and the mean price target of $130.31 indicates an upside of 13.4%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart