With a market cap of $50.3 billion, Irvine, California-based Edwards Lifesciences Corporation (EW) provides products and technologies aimed at treating advanced cardiovascular diseases. It operates as the world’s leading manufacturer of tissue heart valves and repair products used to replace or repair a patient's diseased or defective heart valve.

Companies worth $10 billion or more are generally referred to as “large-cap stocks.” EW fits right into that category, with its market cap exceeding the threshold, reflecting its substantial size, influence, and dominance in the healthcare sector.

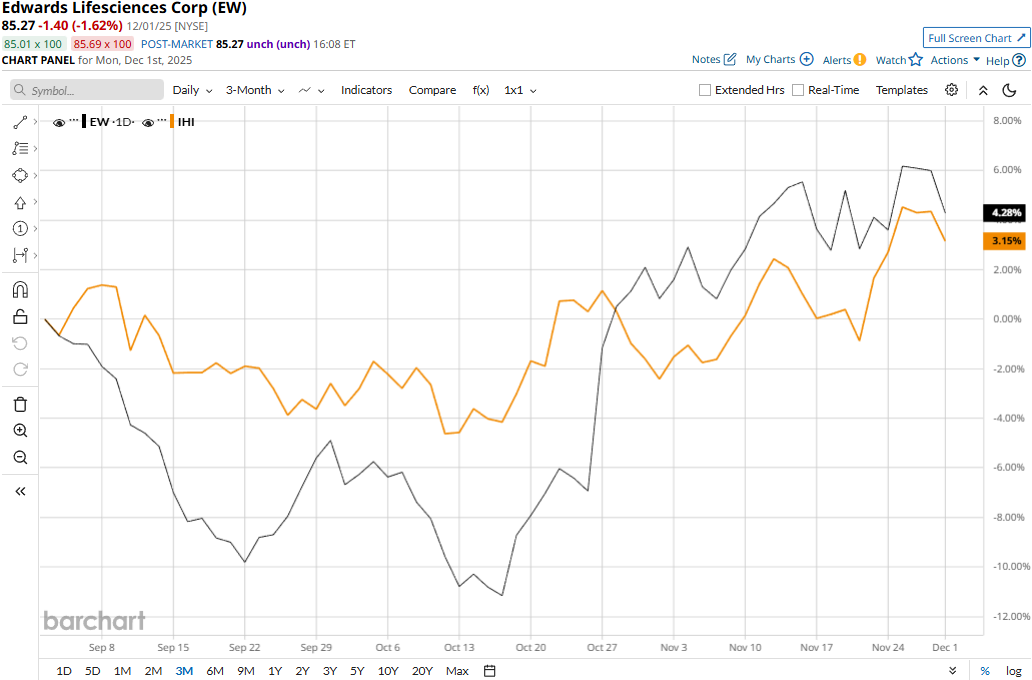

Edwards touched its 52-week high of $87.40 on Nov. 26 and is currently trading 2.4% below that peak. Meanwhile, EW stock prices have gained 4.8% over the past three months, outpacing the iShares U.S. Medical Devices ETF’s (IHI) 2.4% uptick during the same time frame.

Edwards has outperformed over the longer term as well. EW stock prices have soared 15.2% on a YTD basis and 19.5% over the past 52 weeks, compared to IHI’s 9% gains in 2025 and 4.1% uptick over the past year.

EW stock has traded mostly above its 50-day and 200-day moving averages since late April, with some fluctuations, underscoring its bullish trend.

Despite reporting better-than-expected financials, Edwards Lifesciences’ stock prices dropped 1.2% in the trading session following the release of its Q3 results on Oct. 30. Driven by growth across various therapeutic areas - aortic, pulmonic, mitral, and tricuspid, the company’s sales soared 14.7% year-over-year to $1.6 billion, beating the Street’s expectations by 3.3%. Meanwhile, its adjusted EPS of $0.67 surpassed the consensus estimates by 13.6%. Following the initial dip, EW stock observed a notable uptick in the next two trading sessions.

Further, Edwards has also outperformed its peer Stryker Corporation’s (SYK) 3.4% gains on a YTD basis and 5.1% decline over the past 52 weeks.

Among the 31 analysts covering the EW stock, the consensus rating is a “Moderate Buy.” Its mean price target of $93.68 suggests a 9.9% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Options Strategy Turns Your Stock Portfolio Into a Consistent Income Generator

- This ‘Strong Buy’ Dividend Stock Looks Set to Raise Payouts. Should You Buy Shares Now?

- JPMorgan Just Upgraded CleanSpark Stock. Should You Buy Shares Here?

- Dear Walmart Stock Fans, Mark Your Calendars for December 9