Walmart (WMT) shares closed up on Monday after the retail behemoth confirmed it will shift its listing from the New York Stock Exchange to the Nasdaq Global Select Market on Dec. 9.

In its press release, the retailer framed the move as part of its “tech-forward approach” and highlighted automation and artificial intelligence (AI) as central to its future strategy.

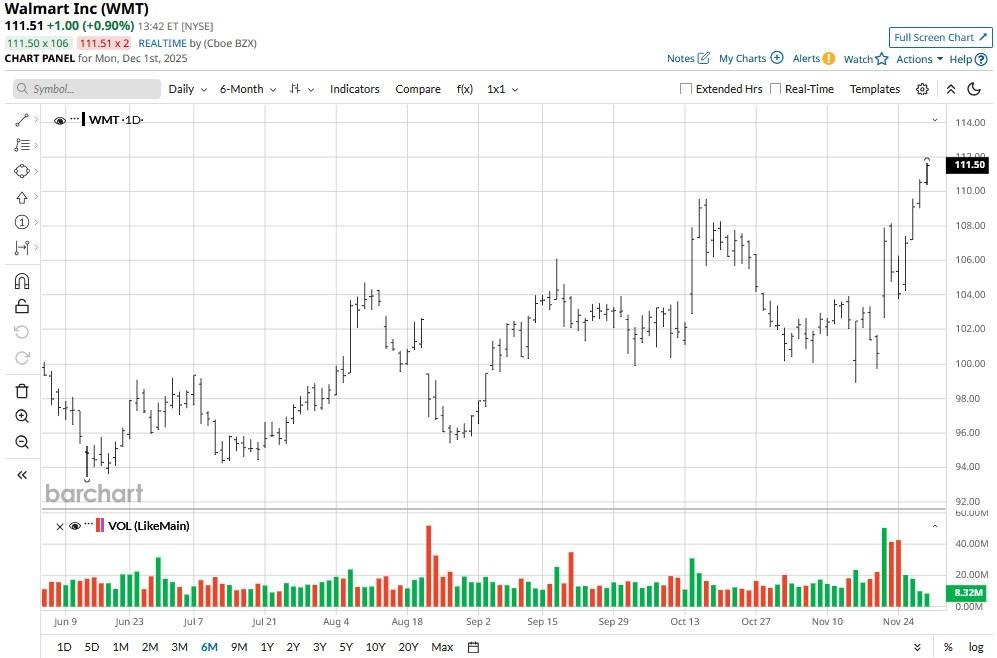

Including today’s gains, Walmart stock is up roughly 40% versus its year-to-date low in early April.

Here’s What Moving to the Nasdaq Means for Walmart Stock

Moving its listing to the Nasdaq will place Walmart alongside the world’s most innovative technology companies, reinforcing its narrative as a retailer embracing automation and AI.

This could broaden the overall WMT investor base, attracting growth-oriented funds that typically focus on Nasdaq names.

The announcement signals Walmart’s ambition to be seen as more than a consumer staple, positioning itself as a hybrid of retail and tech.

For shareholders, the rebranding may translate into stronger demand for WMT stock and improved liquidity over time.

Is it Worth Owning WMT Shares Heading into 2026?

Dana Telsey remains positive on Walmart as a long-term holding heading into the new year.

Speaking with CNBC today, the chief executive of Telsey Advisory dubbed it “always a winner” of the peak retail season, adding WMT continued to drive sales on Black Friday this year as well.

U.S. shoppers spent a record $11.8 billion on the holiday kickoff event, reinforcing that the consumer remains strong, which could push Walmart shares much higher from here in 2026.

WMT has been growing in e-commerce and expanding its footprint in the high-margin advertising business as well, which makes up for another great reason to have it in your investment portfolio.

Meanwhile, a 0.84% dividend yield makes it even more attractive for the income-focused investors

Wall Street Remains Bullish as Ever on Walmart

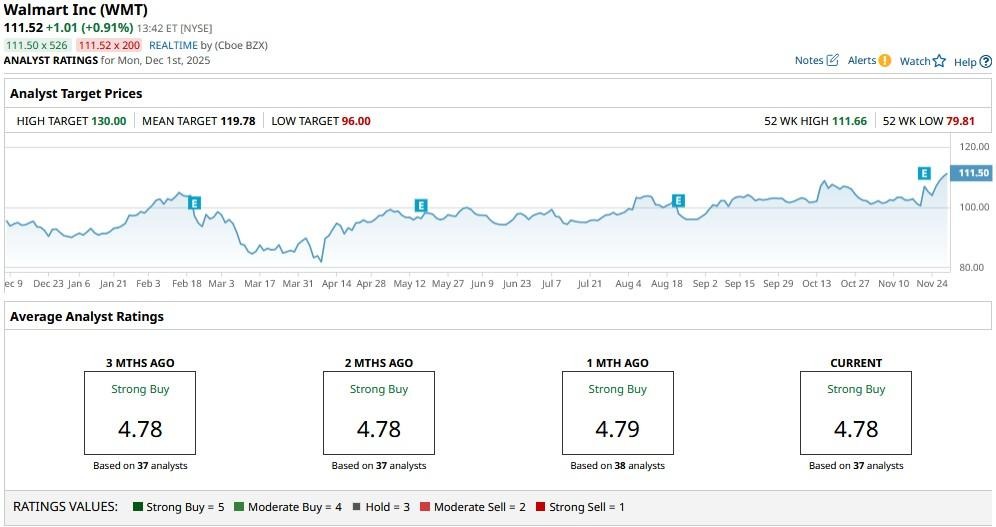

Wall Street analysts also recommend sticking with WMT shares for the next 12 months.

According to Barchart, the consensus rating on Walmart stock currently sits at “Strong Buy” with price targets going as high as $130 indicating potential upside of another 16% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart