Valued at a market cap of $22.5 billion, CMS Energy Corporation (CMS) is a utility company that provides electricity and natural gas to millions of customers. The Jackson, Michigan-based company focuses on delivering reliable, affordable energy while advancing sustainability through investments in renewable power, grid modernization, and emissions reduction initiatives.

This utility company has lagged behind the broader market over the past 52 weeks. Shares of CMS have gained 9.2% over this time frame, while the broader S&P 500 Index ($SPX) has soared 12.6%. Moreover, on a YTD basis, the stock is up 10.9%, compared to SPX’s 14.6% return.

Narrowing the focus, CMS has also underperformed the Utilities Select Sector SPDR Fund’s (XLU) 13.2% uptick over the past 52 weeks and 17.2% YTD rise.

Shares of CMS rose 1.3% on Oct. 30 after the company reported better-than-expected Q3 results. Its operating revenue climbed 15.9% year-over-year to $2 billion, surpassing consensus estimates by 11%. Moreover, its adjusted EPS came in at $0.93, up 10.7% from the year-ago quarter and 8.1% ahead of analyst estimates. CMS also raised its fiscal 2025 adjusted EPS guidance to a range of $3.56 to $3.60, signaling sustained momentum and further bolstering investor confidence.

For the current fiscal year, ending in December, analysts expect CMS Energy’s EPS to grow 7.5% year over year to $3.59. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

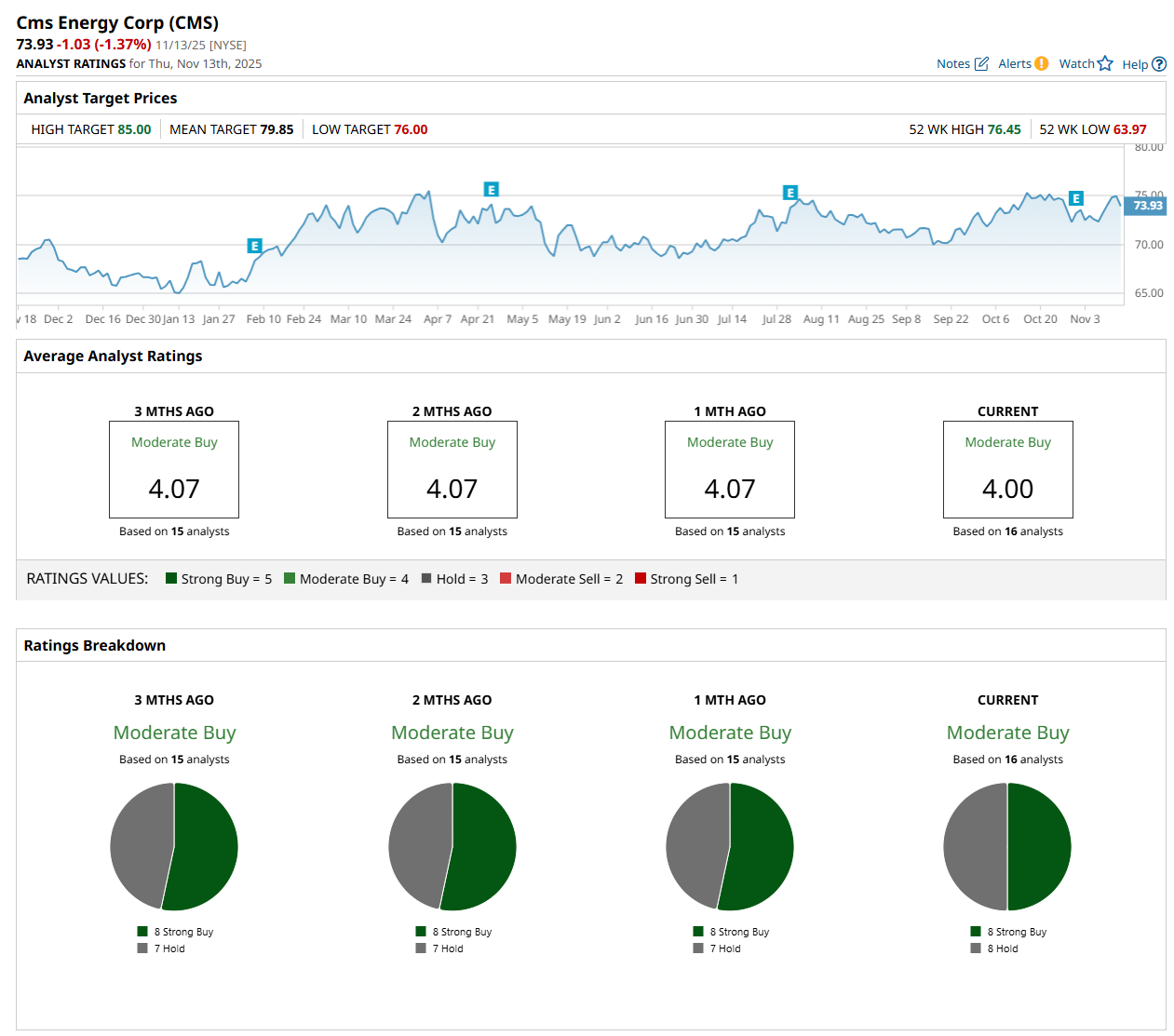

Among the 16 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy” and eight "Hold” ratings.

This configuration has remained fairly stable over the past three months.

On Oct. 31, The Bank of Nova Scotia (BNS) analyst Andrew Weisel maintained a “Buy” rating on CMS and set a price target of $81, indicating a 9.6% potential upside from the current levels.

The mean price target of $79.85 represents an 8% premium from CMS Energy’s current price levels, while the Street-high price target of $85 suggests a 15% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?

- 1 Outperforming Growth Stock to Buy as the Government Shutdown Ends

- Stock Index Futures Plunge on Fed Rate-Cut Doubts and Valuation Concerns