With a market cap of $23.6 billion, PulteGroup, Inc. (PHM) is a leading U.S. homebuilder that designs and constructs a wide range of residential properties, including single-family homes, townhomes, condominiums, and duplexes under multiple brand names. Through its Homebuilding and Financial Services segments, it also offers mortgage financing, title insurance, and closing services to support homebuyers nationwide.

Shares of the Atlanta, Georgia-based company have underperformed the broader market over the past 52 weeks. PHM stock has dropped 9.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.1%. Moreover, shares of PulteGroup are up 11.3% on a YTD basis, compared to SPX’s 16.4% increase.

Focusing more closely, shares of the homebuilder have lagged behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 9.2% return over the past 52 weeks.

Despite better-than-expected Q3 2025 EPS of $2.96 and revenue of $4.4 billion, PulteGroup’s shares remained unchanged on Oct. 21 as investors focused on the 16% year-over-year profit drop and 6% decline in net new orders to 6,638 homes. Margins were pressured by buyer incentives used to offset affordability challenges from high inflation and mortgage rates. Additionally, management’s warning that tariffs could add about $1,500 per home starting in 2026 fueled concerns.

For the current fiscal year, ending in December 2025, analysts expect PHM’s EPS to decline 14.5% year-over-year to $11.35. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

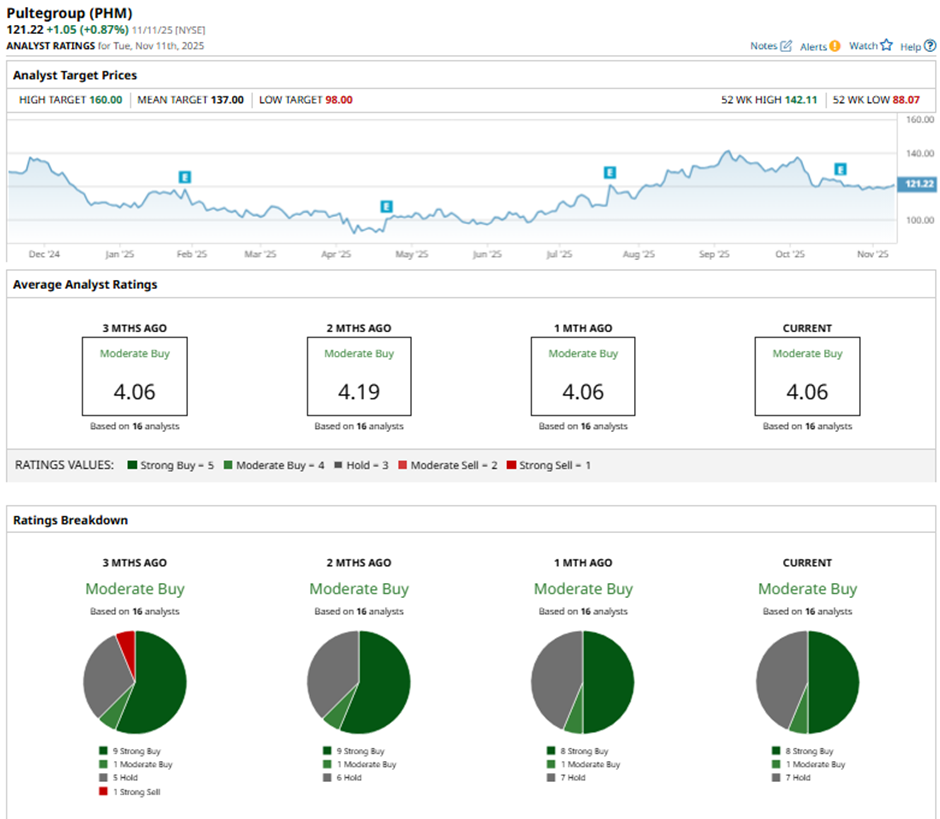

Among the 16 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

This configuration is slightly less bullish than three months ago, with nine “Strong Buy“ ratings on the stock.

On Oct. 23, Oppenheimer analyst Tyler Batory reiterated a “Buy“ rating on PulteGroup and maintained a price target of $140.

The mean price target of $137 represents a 13% premium to PHM’s current price levels. The Street-high price target of $160 suggests a nearly 32% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- I’m Preparing for a ‘Bang’ When the Nasdaq Crashes. Here’s How I’m Trading the QQQ ETF First.

- Bullish Tilt: Palantir Option Strategy Geared for Upside Gains

- S&P Futures Climb as U.S. Government Shutdown Nears End, Fed Speak on Tap

- This Buy-Rated Stock Just Raised Its Dividend 14%. Should You Buy Shares Here?