Last week, Palantir Technologies (PLTR) delivered Q3 numbers that left Wall Street stunned, but investors still punished the stock. The data analytics and artificial intelligence software company posted what Wedbush analyst Dan Ives called eye-popping growth in Q3 that crushed Street estimates.

Yet shares tumbled the following day, sparking worries about an AI bubble and adding to nervousness in the tech sector. Despite the selloff, Ives remains bullish, predicting tech stocks will climb another 8% to 10% through year-end as the AI revolution gains momentum.

The contradictory market reaction highlights the tension gripping tech investors right now. Palantir's U.S. commercial business is booming, prompting Ives to liken Palantir to early-stage giants like Salesforce (CRM) and Amazon (AMZN) Web Services.

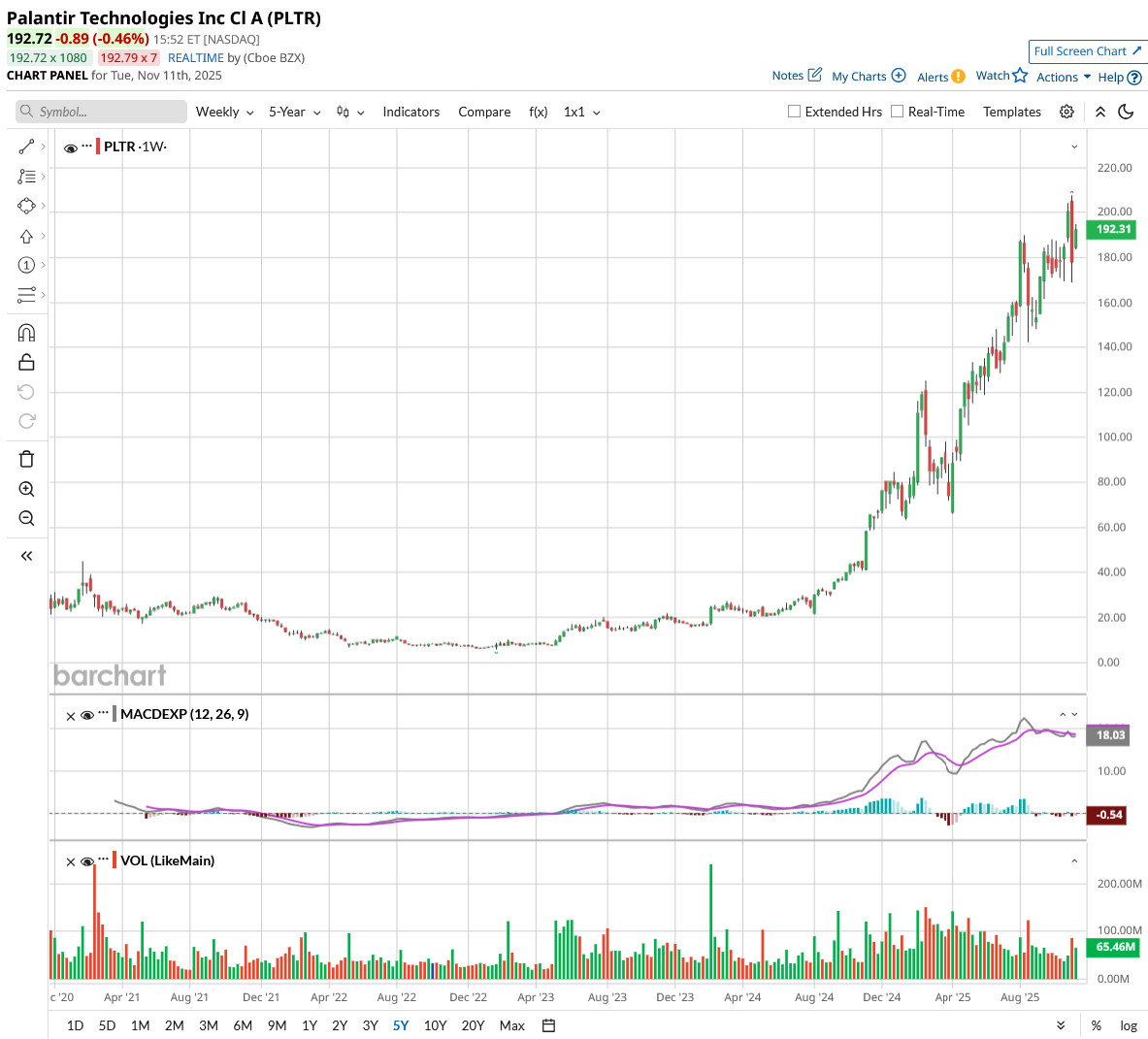

He even dubbed Palantir “the Messi of AI” and boldly predicted the company would reach a $1 trillion valuation within three years. That forecast implies 120% upside from its current $460 billion market cap, which already represents a 2,900% gain since January 2023.

Let’s see if you should buy PLTR stock at the current valuation.

Is Palantir Stock a Good Buy Right Now?

Palantir's third-quarter earnings call revealed a company firing on all cylinders, with CEO Alex Karp delivering one of his most forceful defenses yet of the company's stratospheric valuation.

The data analytics firm posted a Rule of 40 score of 114%, marking its highest ever and representing a 20-point jump from the previous quarter. This metric combines revenue growth and profit margins, and Palantir's performance stands virtually unmatched in the history of enterprise software.

Palantir’s growth acceleration stems largely from its Artificial Intelligence Platform, or AIP, which is driving unprecedented adoption rates among commercial customers. What's striking is how quickly customers are scaling their engagements.

One medical device manufacturer expanded its contract eightfold just five months after signing, with the CEO personally driving an enterprise-wide transformation. This pattern is repeating across industries, with C-suite executives taking direct ownership of AI implementations rather than delegating to lower levels.

Palantir deploys Forward Deployed Engineers who embed with customers to solve specific high-value problems, building custom solutions using Palantir's Ontology framework. This creates direct alignment between Palantir's success and customer value creation, rather than selling commodity software with large sales teams. Karp emphasized this point repeatedly, noting the company is achieving 77% overall growth with a shrinking sales force.

The U.S. commercial business more than doubled year-over-year (YoY) and ended Q3 with $1.3 billion in total contract value, a sixfold increase on a dollar-weighted basis from a year ago. Palantir serves 530 U.S. commercial customers, an increase of 65% YoY, and closed 83 deals worth over $1 million in Q3. Revenue from the government segment rose 52% as the U.S. Army issued a directive consolidating all data operations onto Palantir's Vantage platform.

The company's technology investments, including AI-powered developer tools that enable two engineers to accomplish work that would typically require an army of consultants over two years, are amplifying productivity both internally and for customers alike.

With an operating margin of 51%, Palantir’s free cash flow in the last 12 months surpassed $2 billion for the first time ever. Management has raised its full-year revenue guidance to $4.4 billion, representing a 53% increase, while U.S. commercial growth is forecast at 104%.

What Is the PLTR Stock Price Target?

Analysts tracking PLTR stock forecast revenue to increase from $2.87 billion in 2024 to $15.62 billion in 2029. In this period, free cash flow is projected to expand from $1.25 billion to $7 billion. If the stock is priced at 100x forward FCF, which is quite expensive, it could gain 52% over the next three years.

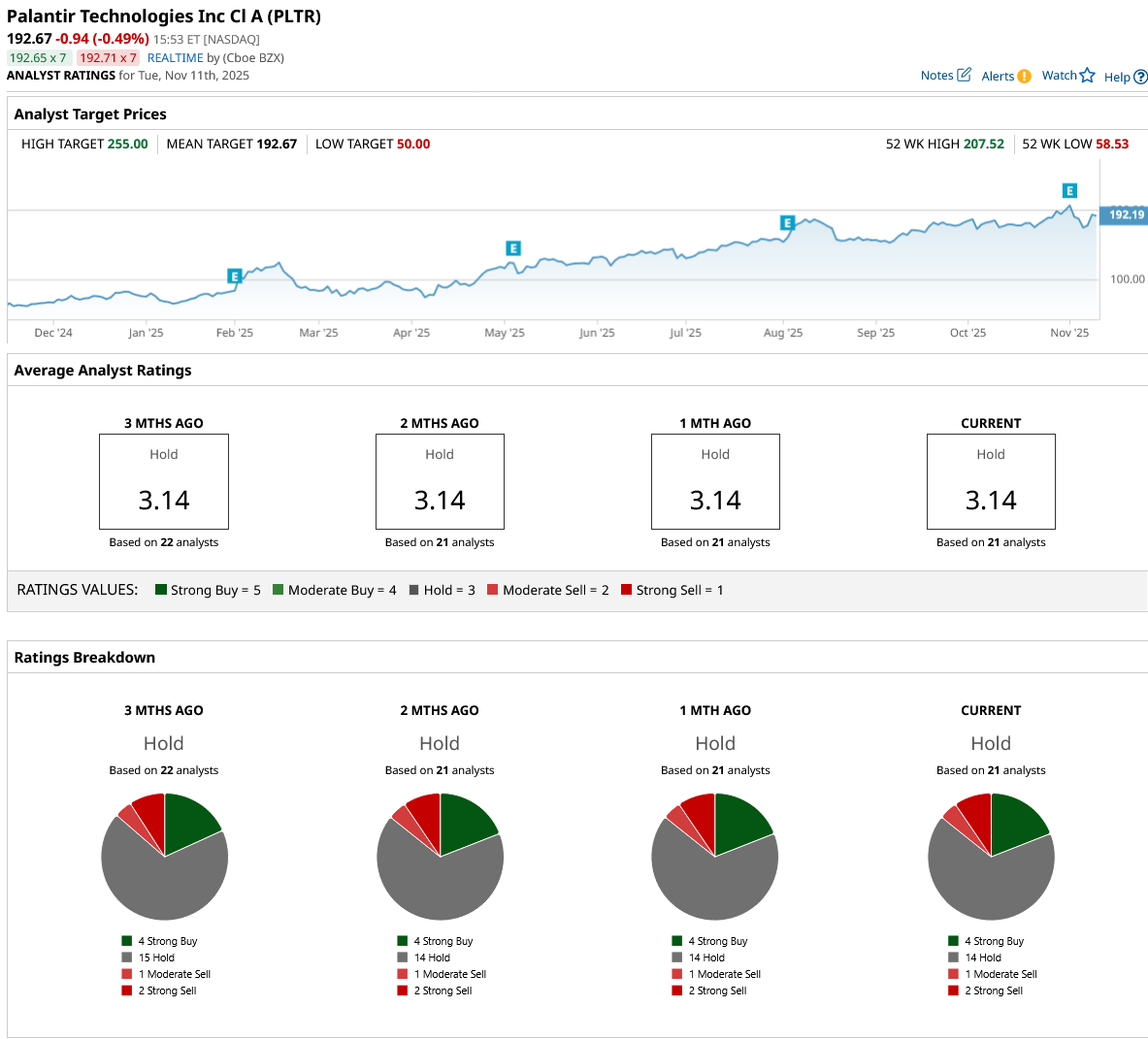

Out of the 21 analysts covering PLTR stock, four recommend “Strong Buy,” 14 recommend “Hold,” one recommends “Moderate Sell,” and two recommend “Strong Sell.” The average stock price target is $192.67, almost exactly at the current trading price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.