Strategy (MSTR), formerly MicroStrategy, stock has taken investors on a volatile ride, plummeting 40% over the past six months as Bitcoin's (BTCUSD) price swings and concerns about the company's aggressive fundraising strategy weigh on shares.

The software company, which transformed itself into the world's largest corporate holder of Bitcoin, saw its stock hit a seven-month low this week after the cryptocurrency briefly dipped below $100,000.

What was once a winning bet during the crypto boom has turned sour as investors question whether Chairman Michael Saylor's strategy of continuously buying more Bitcoin makes sense at current prices.

Strategy's preferred stock sale has sparked worries about shareholder dilution, while the premium investors once paid for MSTR shares over its Bitcoin holdings has shrunk dramatically.

Let’s see if you should buy, sell, or hold MSTR stock right now.

Is MSTR Stock Still a Good Buy?

Michael Saylor's bold Bitcoin strategy faces its toughest test yet as investor enthusiasm cools and the company scrambles to maintain momentum. Over the last five years, Strategy has evolved from a modest software company into the world's largest corporate holder of Bitcoin.

Strategy recently announced it is raising the dividend on its preferred shares to 10.5% in November. The move comes as the company attempts to revive sluggish demand for these securities, which have become its primary source of funding for purchasing more Bitcoin.

MSTR stock has plunged roughly 45% from its November peak, as the premium it once enjoyed over its Bitcoin holdings has shrunk dramatically. Its market multiple to the net asset value has narrowed to 1.06x from 2.7x last year and is hovering near its 20-month low. This decline makes the issuance of new common shares dilutive to existing shareholders, forcing the company to consider alternative funding options.

While BTC recently hit a record high, it is down 20% from record levels. In Q3 of 2025, Strategy reported a net income of $2.8 billion tied to unrealized gains on its crypto stockpile, which is valued at $70 billion. A few days back, Strategy added 487 Bitcoin using “just” $50 million from preferred stock sales, a far cry from the multi-billion-dollar buying sprees that once moved markets.

Notably, Strategy will no longer issue common shares below 2.5 times its net asset value except to cover interest and dividend payments, which total $689 million annually. Yet with its premium hovering just above 1.0 times, that threshold seems restrictive.

Strategy is now exploring international markets and considering ETFs backed by its preferred shares. It also plans to launch its first euro-denominated preferred share, expecting $715 million in proceeds.

What Is the MSTR Stock Price Target?

Investors should gain exposure to MSTR stock in November 2025 if they are bullish on Bitcoin. BTC prices rose more than 7x between January 2023 and October 2025. During this period, MSTR stock increased by 30 times.

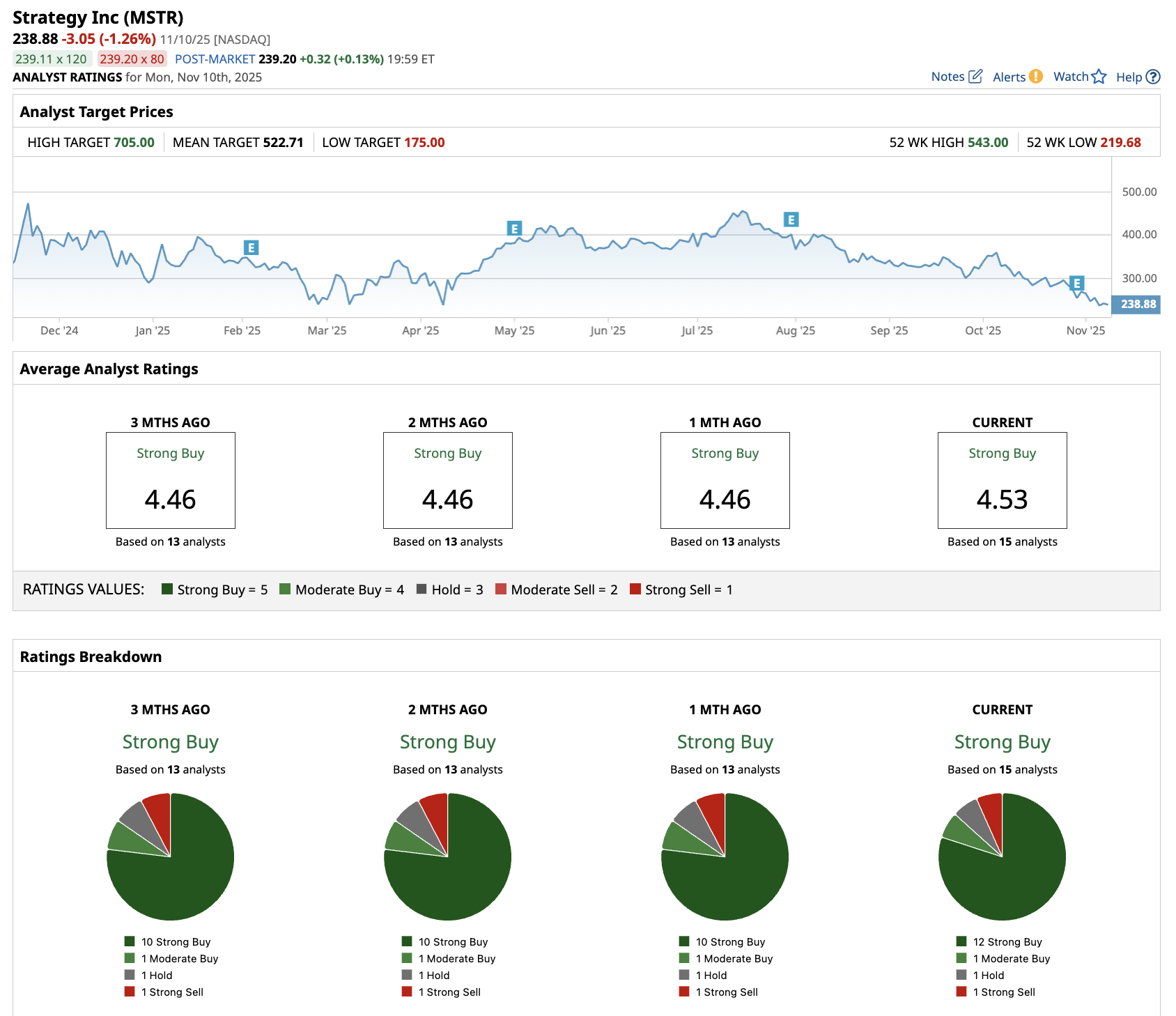

Out of the 15 analysts covering MSTR stock, 12 recommend “Strong Buy,” one recommends “Moderate Buy,” one recommends “Hold,” and one recommends “Strong Sell.” The average MSTR stock price target is about $523, indicating an upside potential of over 120% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla Just Lost Its Cybertruck Leader. Should You Buy, Sell, or Hold TSLA Stock?

- Palantir Achieved ‘Eye-Popping Growth’ and Is a Buy Through Year-End, According to Wedbush

- Down 40% in the Past 6 Months, Should You Buy, Sell, or Hold MicroStrategy Stock in November 2025?

- Opendoor Is Betting That It Can Become an AI Company. Does That Make OPEN Stock a Buy, or Should You Stay on the Sidelines Here?